We are not certified professionals. For more information about us please read our Disclaimer.

Getting Ready to Skip Town

One of our major concerns when starting our early retirement was health insurance. I won’t get into the debate right now about why US medical insurance and healthcare are so expensive, or whether or not the US provides the best healthcare. Suffice it to say, we all need to take care of our health, and there are times when we will need to see a specialist or get more complicated care. Like the bunion surgery I had on my left foot in June of 2018. And like the surprise hysterectomy Ali had in September of 2018, just one month before we left our condo in Seattle. I know, TMI. But remember here at AOC, it’s just us, and we like to share our stories!

Thankfully, I scheduled my foot surgery as soon as I retired, and we scheduled it to take place while Ali still had her job and I was on her employer’s insurance. We also scheduled our major checkup’s before Ali left her job, hence the shocking discovery that Ali needed her surgery. Once Ali left her job we went on COBRA through her employer until the end of the year. It was expensive to pay for COBRA for 3 months but we still had a few followup appointments for both of our surgeries, including getting 2 screws removed from my foot! COBRA also made a big difference in costs for final dental cleanings and checkups, and for the filling the dentist recommended for Ali just before we left Seattle. So much fun!

We are grateful that we still had Ali’s employer provided insurance during both of our surgeries. Otherwise, I might still be limping around with a bum foot, and Ali might still be dealing with some crazy fibroids. Or maybe we would have had the surgeries and then been responsible for paying more than $50,000 in combined medical costs. That would have seriously impacted our finances and our success with early retirement. Instead we were only responsible for covering our co-pays and deductibles and now we are feeling great!

Why Do We Need Insurance?

From my perspective, there are 2 big reasons to have any kind of insurance to cover things like your home, car, and medical issues. Especially while we were living in the US.

1. It helps cover the cost of a claim or procedure, like a tree falling on your house or a medically necessary surgery. These kinds of incidents are really expensive to cover out of pocket in the US!

2. It protects your assets from being irreparably depleted if you have a really expensive accident, or if someone makes a claim against you resulting in your liability for costs to cover someone else or their property due to your role in an incident or accident.

Insurance is really valuable as wealth or asset protection when you get right down to it. And yes, I think it is very important to have a stash of cash to cover your deductibles and out of pocket costs — see our blog post on emergency funds, “Pools of Possibilities.”

Asking Who, What, When, and Where – for Insurance

As of January 2019, we have no access to employer provided health insurance. And we are traveling full-time. But we think it’s very important to have medical insurance, especially for emergencies. So at the end of 2018 we did a lot of research on insurance options for our new life on the road.

Who

Ali is about to turn 45 in May of 2019. And I am 55 years old now. So we need coverage for our 2 female selves in our 2 different age categories.

What

Turns out insurance companies generally break our bodies into 3 different parts. Teeth are one kind of insurance, eyes are another, and then there’s everything else. Through our previous employers we each had 3 kinds of insurance dealing with those 3 different aspects of our health, which I think is odd. With that in mind we did research on à la carte insurance options for: medical insurance, dental insurance, and vision insurance.

When

Do we only need insurance during emergencies or do we also need wellness and preventative care? Our options for our bodies generally include either catastrophic emergency coverage, or comprehensive coverage with preventative care. Since we’ve both had our clocks cleaned and we’ve had everything possible checked and rechecked in 2018, we decided to go with only emergency coverage in 2019. We will pay out of pocket for checkups and vaccinations and that sort of thing.

Where

As full-time nomads we needed to decide where on the globe we need coverage. In 2019, we assume we will spend around 5 months in Asia, 3 months in Europe, 2 months in Central/South America, and only 44 days in the US. That means we need some kind of medical coverage that basically covers the whole world.

The Hunt for Our 2019 Medical Insurance

In November of 2018 we started looking for global medical insurance that would cover 2 females with very strong emergency healthcare around the world including in the US.

Affordable Care Act

We started by looking at the ACA for our coverage in the US. We found a high deductible plan that we really liked for about $3,000 in premiums a year as residents of Washington State. This would have been our plan with a system to manufacture our income level to remain below the 4x poverty rate reflecting about $64,000 a year. That would have been doable. However, those plans do not cover us in other countries outside of the US. We could get an ACA insurance plan and add traveler’s insurance to transport us back to the US for treatment. But why pay for 12 months of ACA coverage when we’ll only be in the US for 44 days?

Global Medical Insurance

We focused on researching the private health insurance market for expats and full-time travelers, and there are tons of options in that arena. We decided to narrow our options to plans that would cover our emergency medical needs above a $10,000 deductible. We settled on that number as the “pain point” in our budget where we would have to dip into other funds to cover unexpected expenses. And because that’s about what we would have paid for an ACA policy with premiums plus deductibles.

Here’s some of what we learned about our options for these types of global medical insurance plans:

- World coverage, excluding the US, is very reasonably priced.

- World coverage + the US is similar in price to the ACA plan we liked, around $3,500 per year.

- Most World + US plans discount your deductible if you seek treatment outside the US.

- There can be a one year waiting period to qualify for coverage of preventative add-on options.

- The private market can impose exclusions for preexisting conditions.

- There are even more fun options and plans available if you can use a residence outside of the US – we are still listing as Washington State in the US for now so those options are not available to us currently.

There are of course a lot of REALLY comprehensive medical insurance plans that are priced very differently from what we looked at and mentioned above. And there are also lots of other plans for people at different ages priced differently from what we mentioned above. We only looked into plans for our ages and our own healthy bodies.

IMG’s Global Medical Insurance

Ali had fun with this intensive research project and subsequent email exchanges with the shortlist of 5 different insurance companies. After two weeks of reading policy information and filling out medical history forms, we settled on IMG’s Global Medical Insurance at the Gold level for the 2 of us. Our premiums are about $3,500 for the year with a family deductible of $5,000. We also ended up with some preexisting conditions exclusions. And we don’t have access to full preventative care options until our second year with IMG.

I was happy that my age (55) did not increase our premiums much. We are paying very close to what high deductible plans cost in the US through the ACA for our planned income level. That was a bit of a shock. We are thinking a lot about the idea of dropping full coverage in the US in 2020, since that would substantially lower our insurance costs. We would also like to consider options that would involve using a residence address outside of the US since that opens the door to so many other plans.

What about Vision and Dental?

We both have less than perfect vision. Especially Ali with her heavy prescriptions and extreme astigmatisms in both eyes. Before we left Seattle, Ali and I both had comprehensive eye exams under our old insurance plans. We bought new prescription glasses and prescription sunglasses. We both also went to the dentist and had our teeth cleaned at the end of the year while we were still under COBRA insurance. Ali also had insurance help with a filling in November of 2018.

We have done a lot of research on medical tourism options in places like Southeast Asia and South America. We have decided to pay out of pocket for things like dental cleanings, eye exams, and new glasses for each of us while visiting other countries.

Since these types of care are so much more affordable in other countries like Thailand and Mexico, the idea of medical tourism is attractive. And paying out of pocket does not sound like a budget breaker. We have done enough research on the options out there, and we know our eyes and teeth well enough to plan ahead. That’s one of the reasons our medical budget is set at around 15% of our total budget for 2019. For more detail see our post on “The AOC Budget and Our Daily Living Expenses.”

Making Appointments In Chiang Mai, Thailand

Since we read so many great stories about travelers receiving excellent medical and dental care in Thailand and specifically in Chiang Mai, we planned a longer stay in Chiang Mai to make room for a few of those types of things. We figured we would go see some places in person and feel free to get some stuff done if we felt good about our options. And that’s the main reason I am so glad we planned to stay 22 days in Chiang Mai on our first visit!

I also listened to a podcast interview with Kristy and Bryce of Millennial Revolution where they talked about medical insurance and how to find reliable dental clinics around the world. Check our that interview on The Bigger Pockets Podcast.

The day after we settled into our Airbnb, I did a search on dentaldepartures.com and found a well-rated dental clinic (Kitcha Dental Clinic) very close by our apartment. I was able to ask questions, get price quotes, and make appointments for the 2 of us all by email. After that I picked a healthcare clinic close by (CM Mediclinic) and again, I was able to ask questions, get price quotes, and make appointments for the 2 of us on the following Tuesday all by email. EASY!

Vaccinations

We got a whole ton of required and recommended vaccinations back in the US before we left on our full-time travels. Ali had 11 shots between September and November, and I had 13 since I needed one additional vaccination because I’m over 50 years old. Our vaccinations in the US were almost completely covered by our insurance. But some of the vaccinations are in cycles that have to be spread out with a few months between shots, including Hepatitis A and Hepatitis B. Hep B requires 3 doses so we got the first 2 doses in Seattle, but we had to wait until March of 2019 for dose 3. And Hep A requires 2 doses so we got the first dose in Seattle in September 2018, but we had to wait until March of 2019 for dose 2.

On the day of our appointment we took a short 10 minute Grab ride to the CM Mediclinic. It’s in a cute neighborhood, bookended by apartments and little restaurants. Their hygiene rules require that your outside shoes stay outside and you wear the slippers they provide when inside. As directed, we took our shoes off outside and stepped into a small, clean, and welcoming waiting room and put on the clinic’s slippers. We filled out a basic patient form with a bit of medical and contact information that they will keep on file. The front desk staff included a Thai woman and British expat man and everyone spoke perfect English. While we were filling out our forms we noticed one of the staff got up and placed a different pair of slippers by the front door, and then a minute later the clinic doctor came in and put those on.

There was another man in the waiting room and it was clearly not his first visit. He chatted with the staff, went away and had some kind of quick and simple test done, paid in cash, and left pretty quickly while we were still chatting with the staff and looking around. Then a nurse came to get us and brought us both back to the vaccination area for our shots. Ali asked to look at the boxes and bottles for our vaccinations for a little extra comfort and was reassured. And before we knew it we were all done! It was fast and as painless as vaccination shots can be.

While we were there we also asked about getting annual checkups and blood work so we would have that information to refer to later. From what we could tell, they do the basic checkups and draw blood at the clinic we visited. And they told us about the specialists and labs in other locations around the city they use as well. If we had followed through we would have had our blood work results available online within 2 business days. Then we would have been able to follow up with the doctor and go over the results via email, or come back in to talk in person if we preferred. And then we could schedule any followup or specialist appointments as needed.

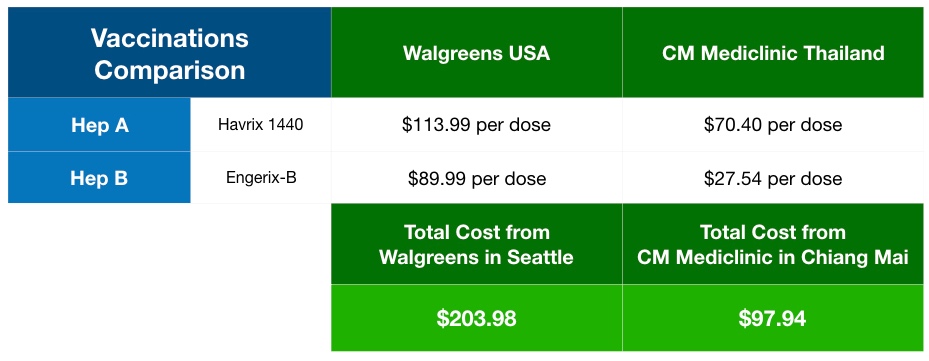

The Money Crush on Vaccinations

Below is a comparison of what the vaccinations we received cost us in Thailand, with what they would have cost back in the US if we paid out of pocket. Basically, we got a 50% discount in Thailand. Not bad. And of course we paid with our travel rewards credit card instead of cash. POINTS!

Going to the Dentist – Oh My!!!

I think most people would agree that getting a couple of vaccination shots in a foreign country sounds easier than going to the dentist in a foreign country. Right? Well if you are Ali (the scaredy cat) that is very true! She barely made a peep and blinked at the health clinic when we got our shots, and she has been known to squeal and get worked up when getting shots in the past so I was impressed. But the dentist is a whole other ball game. Ali is fairly terrified of dentists. So I’ll give you the numbers and then Ali will describe her experience in detail at the end of this post.

We had a great dentist in Seattle, and we loved that team partly because of the amazing convenience of having a dentist one block from our condo, but we did in fact absolutely LOVE that one particular dentist, Dr Brian. If we still lived there I’m pretty sure we’d be happy to pay out of pocket to keep seeing that dentist since we both liked and trusted him so much.

When we started this post, we requested cost information from our old Seattle dentist office, full costs with no help from insurance. What we heard back is included below. To make things a little less specific and give a bigger picture I also did some research on health.costhelper.com, because figuring out actual dental costs in the US is complicated since there are a range of services and packages and costs vary based on location.

Back in Seattle, we were getting “a complete cleaning appointment” most of the time. That includes getting your teeth cleaned by a hygienist and then also a quick exam from the actual dentist. And I think during every other cleaning we would also add x-rays during the same cleaning visit. Since we only wanted to get a standard cleaning on our first dental visit in Chiang Mai, with no x-rays, that’s what I’m outlining below.

The Money Crush on Dental Work

Here in Chiang Mai, Ali and I each got our teeth cleaned for $35 each. Then there was an unplanned event – Ali got super excited by that excellent experience and decided to also get a porcelain crown for $663. Amazing. It’s a little hard to say exactly what we saved compared to what we might have paid in Seattle since costs in the US are in ranges and she didn’t have an exam and estimate done by a dentist in Seattle for the exact tooth in question. But the bottom line is, we clearly saved a bunch of money by getting this crown and our cleanings in Chiang Mai. And we didn’t have to pay any insurance premiums to get these prices. And more importantly, Ali has never been so happy after getting dental work before in her entire life. It’s almost weird how happy she is. This must be the compounding effect of a good dentist, plus a painless dental experience, plus saving money!!!

Ali’s Dental Visit Story

I really hate going to the dentist. The dentist I had when I was a little kid was intimidating. Dr Molly did a great job of teaching me to fear all dental work, including a simple cleaning. During every visit there I would start to cry pretty quickly because something hurt or I was afraid, and then she would grab my shoulders and shake me and tell me not to cry. So I would cry more and on it went. On my last visit there she gave me so much nitrous to knock me out that my family had trouble waking me and had to carry me out of there. I never had to go back to her after that.

So yeah, I’m an adult who’s terrified of dentists. Great. When I’m due for a simple dental cleaning I’d honestly rather go for a mammogram, followed by a pelvic exam with a pap smear, followed by a poke in the eye and a kick in the shins.

I have probably had about 20 or so dentists between Dr Molly who was my first dentist in Livermore California where I grew up, some dentists in Sacramento where I spent most of my 20s, and my last dentist in Seattle where I lived until I was 44. I blame Dr Molly for this habit I got into, of deciding dentists are too rough or not nice enough after one or two visits.

Except for our last dentist in Seattle. He is the only dentist I have ever trusted and stuck with for years. Dr Brian is fabulous! But since I’m laying it all out here, I was not a fan of the dental hygienist we had in Seattle. She insisted on loud, non-stop chatter while poking around in my mouth. That was pretty annoying, but she also seemed kind of distracted and careless when doing her job. I thought it was oddly painful when she cleaned my teeth, and since my teeth and gums were supposedly in good shape when I walked in I was always upset that it seemed like she caused more bleeding from my gums with her sharp tools than she should have. Frankly, it hurt like hell to let her clean my teeth. The only good thing I got out of my experience with that last dental hygienist in Seattle was using nitrous for cleanings. I wish I had tried that earlier, since it made me feel like I just had a good Scotch and was able to relax in the chair while she poked the hell out of me.

Fast forward to Chiang Mai, Thailand

Friendly bear

The main lobby

All smiles out front

The front desk staff greeted us very warmly when we arrived. The office seemed new, clean, comfortable, and very welcoming. They all spoke varying amounts of English, and more than enough English to check us in and work with us on filling out our forms. We noticed one woman among the front desk staff who seemed like to be more of a manager and basically had perfect English, so pretty soon I was directing most of my comments and questions to her.

Alison looking mellow

Ali looking nervous

The staff created detailed files for each of us. And they took our blood pressure. That’s the first time I’ve ever had my blood pressure taken at a dentist appointment. (Maybe that should be more standard for dental appointments in the US?) We asked for wifi passwords and they printed out usernames and passwords for each of us. And then a dental assistant came and got each of us before I had time to play on the internet.

The exam room I was taken to for my cleaning looked very nice and very modern. All of the equipment looked high tech, brand new, and perfectly clean. I was immediately impressed. Then Dr Kitcha came in. Yep. My dentist was Dr Kitcha himself, the top dude at Kitcha Dental Clinic. He asked me if I wanted nitrous to relax and I declined. I was nervous and I really wanted to really pay attention during this experience.

Then I realized the dentist was doing the cleaning himself, and that shocked me. Back in the US hygienists have done my cleanings, saving the more intensive dental work like fillings and crowns for the dentist. I felt kinda special having such an experienced and well-rated dentist cleaning my teeth. (Why don’t dentists usually do cleanings in the US? Because that would make the process too expensive. Hmm.)

It also seemed like the tools were different, or at least the way he used them seemed really different. I asked Alison if I was making things up and she said she felt the same way (and she had a different dentist do her cleaning). Back in the US what I remember experiencing was a a majority of poking and scraping at my teeth with sharp metal tools, sometimes with a brief amount of ultrasonic cleaning. But here in Chiang Mai they used the ultrasonic tool for the majority of the work. I didn’t get poked by a sharp metal tool even once. Ultrasonic cleaning removes deposits of plaque more effectively than scraping with metal tools. It results in a deeper cleaning, and it causes less discomfort. So why haven’t I ever had that kind of dental cleaning experience before now? Doesn’t matter! I honestly walked out of there feeling like that was the best dental cleaning I’ve ever had! My coffee and mustard loving teeth looked kind of amazing (that will be very temporary).

Before the cleaning started

Yes I am still taking photos in here

And it was over really quickly. I was back in the lobby feeling weirdly happy so I went back to chatting with the front desk team again. I mentioned that my previous dental team back in Seattle had recommended getting three crowns in the next couple of years because I have three teeth that are mostly fillings, one molar and two incisors. Fillings are not as strong as real teeth and they are not meant to last forever. My previous dental team reminded me that I should be proactive about getting these 3 crowns since they could crack and need crowns, or if I’m really unlucky they might break and need awful root canals and then crowns.

Moments later I was back in the exam room with Dr Kitcha. He immediately showed me those 3 same teeth (makes sense that a dentist could identify them immediately). He quickly focused on the one molar and talked a lot about that one since he thought that one was the most in need because it’s the oldest, the biggest, and the most worn down of the 3. I sat there listening to him describe how old and worn it was, that it wasn’t urgent but it would be wise to get a crown fairly soon and avoid waiting for it to break. I was happy that he said so many of the same things I had heard from my previous dental team. So I scheduled an appointment to fix that the following week!

For me getting a crown on a back molar is much scarier than just getting my teeth cleaned. So this time I had the nitrous. And this time I noticed there was a bigger team in the room. There was the dentist, plus his main assistant, and then another person who seemed to be managing the nitrous and also helping them with the different tools and the overall process. And since I was having some real work done this time the dentist gave me the dreaded local anesthetic shots to block pain. Everyone hates those! There were three shots and the first two hurt, but the third shot did not hurt at all. Must have been that amazing glass of Aberlour 18 year old Scotch (I wish!). I guess the first two injections did the job and the nitrous was clearly very relaxing.

Speaking of relaxing, that reminds me of another thing that was really different at this Chiang Mai dental office compared to my previous dental work in Seattle. During my previous dental visits in the US there was always a silly little blue paper bib on me that caught at least some of whatever was being sprayed and splashed around. But I still had some goo on my shirt and on my face at the end of every vist, which always added to the general crappy feeling I walked away with. At this Chiang Mai dental office they put a large and thick purple cloth towel type of thing on my chest when I got in the chair, and then when it was time for action they unfolded it and this thing covered most of my head and face too. There was just a square cut out around my mouth for them to work in. As I write this I think how very odd that sounds. But I found it super reassuring! Goodbye to the usual situation where I had a way-too-bright-light shining in my eyes and a full view of multiple hands and tools coming at my face non-stop (I hated that). This time I had a pretty purple cloth on my face and chest, no bright light in my eyes, and I didn’t need to see the octopus effect of multiple heads and faces and hands and tools swarming over me. I didn’t close my eyes, I just enjoyed the small window and simpler experience. Plus, there was nothing splattered on my face or hair or clothes when it was over. I had this same experience for my cleaning and my crown appointments. And it was awesome!

So that’s it! I had three appointments in total. First a cleaning, and then a 2nd appointment to get a temporary crown, and then a 3rd appointment to get my new perfect porcelain crown fitted. During and after all of those appointments I had zero pain. I was 100% thrilled with the whole experience. I can’t believe I just said that about dental work. But it’s one of many reasons I want to return to Chiang Mai.

Maybe I can’t say I hate going to the dentist anymore???????

Hi Alison,

Very informative post. Also like your new roles as World Healthcare Investigators, can we request countries?

That said I probably need to do one about the UK vs USA..

Like you say it matters a lot where you expat from and plan to get returned to in order to get the best deal, the Swedish folks are very lucky since their country even pays for it’s citizens’ flight home.

Ours is reasonably cheap due to the UK free medical insurance where we would be shipped back to but that would unfortunately mean we’d need to live there 6 months out of every year to get permanent residence…hmm..not too sure about that part.

Everything we’ve read about Mexico points to there as the best option we’ve seen, maybe the WHI team could get some crowns done there? Also hope your foot is better now…but screws? Yikes.

It’s also critical to read.every.single.damn.sentence of the small print in your policy otherwise you’re heading to GoFundMe like these poor unfortunate folks when the insurance kicks out your claim on a silly technicality.

https://thethaiger.com/news/south/paralyzed-american-teacher-heads-home-to-us-after-gofundme-raises-76000

https://thethaiger.com/news/chiang-mai/uk-backpacker-needs-1-5-million-baht-for-hospital-bills-and-to-fly-home

Hope Vietnam is working out well, say hi to Ali from us!

DN

LikeLiked by 1 person

Hey DN,

We will for sure be looking for other locations to get another crown. I think the next cleaning and crown will happen in Mexico or at least that part of the world at the end of this year. And we promise to report back.

You all are lucky to have dual citizenship so that you can have more options. We do not want to be limited to medical care only in the US. Especially now with that #45 guy looking to axe the ACA all together. Medical tourism is looking more and more interesting for us, and we will definitely keep exploring our options in other countries!

And no worries – the foot is doing great. A little stiff but I can hike on it just fine (whew!). I think it’s 90% for our march around parts of Vietnam. By August It will be 95% for sure, so look out Ben Nevis here we come.

Have a good time at the Great Wall – total bucket list place.

Tell Deb CHEERS from us!

~Alison

LikeLike

[…] Expat Medical Insurance and Medical Tourism All Options […]

LikeLiked by 1 person

LOVE IT! Thank you so much for sharing. I’m also planning to get IMG’s expat insurance. It’s great to know you looked into it as well and awesome to read about your experiences with medical tourism and the costs involved. You’re making me feel a lot better about my plan! Great job putting your plans into action – it looks like it’s all working out well 🙂 .

LikeLiked by 1 person

Fabulous! We are looking forward to hearing more about your plans and where you are headed!

LikeLike

Really we need medical insurance. Thanks for sharing your knowledge about the insurance. Appreciate your work.

LikeLiked by 1 person

Thank you Robert! Medical insurance is one of our biggest projects to continue researching and learning more about. Feel free to send us an email if you want to chat more about this tricky topic. We are always looking to swap ideas and information! 🙂

LikeLike

Thank you so much for sharing your stories in such a depth. This might have prevented us to get too excited and only getting Travel Insurance (through companies like World Nomads as an example). And a special kudo to APurpleLife who pointed me to your article.

We do have a couple follow up questions when it actually come to the differences between Travel and World Insurance.

1) Do you exclusively use exclusively the later or did you also purchase the former?

2) Do you have coverage for the item below through IMG? If not, is that something that you’ve purchased separately? Or is this something that you already got coverage (through your credit card for instance)?

– Trip Interruption (for the even where a close family member just passed away and you need to head back home)

– Emergency Evacuation (to get your to the closest hospital if you go hiking in a remote place for instance)

– Practice of extreme sports (to cover for the practice of Scuba Diving, Snowboarding, Jet skiing and all that fun stuff)

– Personal effects being lost/stolen (to cover in case we lose our pricey laptop of other valuables)

Happy Travels!

Mr. Nomad Numbers

LikeLiked by 1 person

Hey Mr. Nomad Numbers! Thanks so much for checking out our blog. We are really glad you found it helpful.

We categorize travel insurance as a supplement for covering “shorter trips” in addition to our main medical insurance. For 2019, we do not have any travel insurance. So to answer your #1 question, we only have world medical insurance and no travel insurance at this time.

We declined to have ACA medical insurance for 2019 since we will not be in the US much this year and it would not help us while we are outside of the US. Instead we went with world medical insurance in the form of a high deductible catastrophic plan that covers us worldwide (including the US).

Trip Interruption: No our IMG plan does not cover that. We could add travel insurance for that but we have decided to deal with that scenario out of pocket if something happens to a family member (fingers crossed that does not happen!). Our Chase Sapphire Reserve card would be the first call we made if something did happen to one of our family members to request help and reimbursement. They offer a great trip interruption plan but it would likely not cover us if whatever trip we are on at the moment qualifies as “exceeding more than 60 days.”

Emergency Evacuation: Yes our IMG plan does cover us for emergency evacuation to a hospital, as well as covering local ambulance and interfacility ambulance rides if needed.

Adventure Sports: Our IMG plan has the option of an additional “sports rider” which we do not have personally since we prefer to stroll rather than any extreme adventuring. Travel Insurance can also provide coverage for adventure sports related accidents.

Personal effects being lost/stolen: We honestly don’t know much about that scenario. I know our Chase Sapphire Reserve card would cover us for that type of thing if our bags were lost by an airline, or if we purchased a laptop recently using that card. Travel insurance could do the same type of thing if an airline loses your baggage. But for lost items we basically just consider ourselves as “self insured” and would plan to pay out of pocket to replace our gear.

If you have figured out anything else please share! We are always trying to learn more.

Safe and happy travels to you both!

Ali & Alison

LikeLike

Thank you Ali & Alison for getting back to me so quickly.

From your answer, I decided to start digging into the details of the Global Medical Insurance by downloading their brochure are reading through it. If you don’t mind, I have some follow up questions for you two (that other readers by benefit from as well)

– You said you declined ACA medical insurance for 2019 but you plan to stay 44 days in the US, which is under the 35 days to qualify as “living abroad” (https://www.gocurrycracker.com/obamacare-expats-and-visits-home/) and then not having the pay the $700 penalty. Unless this number of days has changed for 2019, are you included this fee in your healthcare budget?

– Why did you decided to pick the Gold plan (over Bronze, Silver or Platinium). I can see that Sport Rider (something I am considering subscribing) is only available for Gold & above. The rest seems to be pretty hard to decipher even by going line by line on the brochure. Why are the insurance company making things hard to understand???!!! 🙂

– How long did the application process take? (from submitting the online application to being approve for coverage). Asking since we need coverage for 6/4 which is less than 2 weeks from now 🙂

– Do you know if you get a discount by paying the annual coverage upfront (for the entire year) versus paying monthly?

– You said: “Most World + US plans discount your deductible if you seek treatment outside the US.”. I read on the brochure that “IMG offers a Medical Concierge program, an unparalleled service that saves you on out-of-pocket medical expenses. We also offer a cash incentive and to waive 50% of your deductible for choosing to receive treatment from some of the best medical facilities outside the U.S.”. Does this means that I can slash by deductible by half on the plan I choose as long as I don’t see treatment in the US?

– What were the other insurance companies you compared to IMG?

Thanks again for your help!

LikeLiked by 1 person

Yes lets keep the chat going!

Regarding the ACA penalty — that requirement for days in the US as quoted in that 2016 article no longer applies. In 2019 there is no longer any tax penalty for not having ACA coverage, regardless of the number of days spent in the US. Here’s a link for the latest info:

https://www.healthcare.gov/health-coverage-exemptions/exemptions-from-the-fee/

Regarding our decision to get the Gold Plan — I spent a lot of time going through the fine print of the plans with the IMG rep I was working with. But here’s the simplest answers I can give…

Platinum: We chose not to consider the Platinum plan since we are currently healthy and that plan is loaded with additional coverage we don’t need such as high level prescription coverage, maternity coverage, and extra preventative care coverage that would be more useful for people over 70 for example.

Bronze and Silver: These plans seemed inadequate for us because they are too limited (for you with the sports rider they don’t even allow that addition). The main reason we didn’t want to consider those lower level plans is the coverage dollar limits. The best example of the dollar limits is in the Outpatient category where you can see both the Bronze and Silver have a $300 maximum per visit for lab tests, and a $250 maximum per visit for diagnostic x-rays. We don’t want to pay these premiums and deductibles and then have to deal with dollar limits like that.

Gold Plan: This really was the best option for us. Really it seemed like the only logical option for us. We chose a $2,500 deductible per person which gave us a total cost of $3,611 for the year for coverage for both of us.

Regarding the amount of time for the application process — I spent a month asking questions and comparing options and reading all of the fine print. And then we had our decision and we were ready to apply. But – the effective date for coverage must be within 30 days after signature on your application. I’ll admit that freaked us out. But it was good to have the time to finish all of the application information, including our medical histories. Pulling all of that together was a bit time consuming for us. I submitted our applications on December 5, 2018. And I got an approval notification on December 14, 2018. It is a bit stressful to have to limit your application date and coverage dates to being within 30 days of each other. So if you need to get coverage by June 4 you probably need to hustle and get that application going ASAP.

Regarding a discount — I am pretty sure they did offer a small discount for annual payments vs monthly payments. But we weren’t as focused on that since we timed our annual insurance payment to coincide with a new credit card with a minimum spend requirement for awesome travel rewards. We were more focused on the need for the big spend rather than paying attention to the discount.

Regarding the Concierge and Treatment outside the US — Yes they really incentivize using the concierge system for treatment in the US, or opting for treatment outside the US. This might be a turnoff for some people but we think those options are really appealing. We are really looking forward to setting up some medical appointments at the end of this year when we plan to be in Central and South America. And we promise to use the concierge if we do need treatment in the US when we are back in June and October!

Regarding comparisons — I did research and comparisons on ACA coverage, travel insurance, and world medical insurance. The companies I researched are: Aetna, Atlas, Cigna, IMG, Travelex, World Nomads, and Kaiser through the ACA.

Let us know what you decide!!!

~Ali & Alison

LikeLiked by 1 person

Hi Ali & Alison,

Thanks for clarifying the ACA penalty.

I start to understand why it took you guys 2 months to decide which company and coverage to pick as the more I dig to more questions I come up with. So here they are:

During my web searches, I stumble upon some pretty bad review for IMG (especially from the very reputable BBB site: https://www.bbb.org/us/in/indianapolis/profile/travel-insurance/international-medical-group-inc-0382-17001341/customer-reviews). I’,m assuming you saw similar review too. What convince you to still go with IMG? Do you think these reviews are from people that have purchased insurance without doing their due diligence and did not know what they were getting coverage for?

World Nomads seems to have better review but it is my understanding that they only provide travel insurance (and no medical insurance). Would you mind sharing how you ranked all the insurance to decided on IMG (or at least your top 3) you reviewed?

Last but not least, how did you decided on which deductible amount to choose? Did you try to estimate what the average “emergency” cost for the country (or region) you will be traveling to would cost in order to decide on your deductible amount? Looking at the 10K deductible on the gold plan, it will pay for itself (meaning you would have save about $5,000) after 5 years of coverage.

Mr. Nomad Numbers, still digging into policies & brochures 🙂

LikeLiked by 2 people

Hey there Mr NN!

Yes I’ve read tons of reviews about IMG and they were mostly from people who filed claims and then were frustrated when there was resistance back from IMG on paying out reimbursements. I would expect the same if we file a claim with this or any insurance company, with the claim process being lengthy and frustrating. It makes sense that reviews for insurance are often focused on problems rather than successes. A lot of the positive reviews I read with IMG were for short term gap insurance from people who said they were glad they didn’t need whatever plan they signed up for. I didn’t get as far with reading reviews of World Nomads since they are travel insurance and we decided after the initial reviews of our options that we don’t want travel insurance. We like to call ourselves self insurance for our gear and bags!

IMG did seem like the best option for global medical insurance for us. Our IMG application process and paperwork was very detailed and that made it crystal clear to us that they want to determine upfront what they can call preexisting. I did see a couple of good reviews from people getting the type of comprehensive medical insurance we got, using it, and being satisfied with the outcome though so that was reassuring for me.

Ultimately, IMG is an American insurance company. So like all of the rest, IMG is not perfect and they are in the business of trying not to pay out on claims. Our application process and paperwork made it crystal clear to us that they wanted to determine upfront what they can call preexisting for us, and our approval paperwork outlines what those things are. Our goal with the deductible was simply to pick a sweet spot that works with our comfort level for out of pocket spending with a deductible that’s high but premiums that we are comfortable with as well. Sounds like you are doing the same thing now. We were comfortable with the $5k level as a couple ($2.5k per person) for this year at least. For now I assume we will stick with this type of insurance at least for a few years. Eventually (in a few months or so) we will be using our plan for regular preventative care appointments for checkups and bloodwork and I will definitely post about how that goes. And of course we hope never to need the bigger emergency related coverage our plan provides!

So we will see how it goes with IMG and we will be sure to post whatever we learn from actual use with this plan. Once you finish the decision making process I am really looking forward to hearing what you decide. It would be fun to share our IMG experiences with each other as we all continue our travels!

~Ali

LikeLiked by 1 person

[…] Alison & Ali’s Post on Expat Medical Insurance & Dental Work in Thailand […]

LikeLiked by 1 person

Thanks for sharing!

LikeLike

Insurance helps cover the cost of a claim or procedure, like a tree falling on your house or medically necessary surgery. These kinds of incidents are really expensive to cover out of pocket in the US!

LikeLiked by 1 person

I like to call any kind of insurance wealth protection for sure. I also look at the where the pain point would be for out of pocket expenses before insurance kicks in when choosing a deductible amount. It works for us but not for everyone.

LikeLiked by 1 person

[…] If you are interested to know more about this topic, we recommend reading the Expat Medical Insurance and Medical Tourism blog post from our friends at All Options Considered that provides an excellent take on how to get […]

LikeLiked by 1 person

Thanks for linking us in your post!!!

LikeLike

[…] out our Chiang Mai medical tourism experience blog post for more […]

LikeLiked by 1 person

[…] do have a global medical insurance plan with IMG. We have a $5000 deductible so we consider that to be catastrophic coverage for emergencies. My […]

LikeLike

I know I’m commenting on an older post. I actually read it a while ago and revisiting now. I’m finally starting the research process for our global health insurance. I just wanted to thank you as your post, as well as the conversation between you and NN, has been very helpful. Keep up the good work, safe travels, and thanks again.

LikeLiked by 1 person

Thank you Skip. We recently renewed for the exact same IMG Gold plan for a second year and have been doing more research about how it works so feel free to comment or send a private message if you want to chat about anything.

LikeLike

[…] other thing to keep in mind is that our global healthcare insurance is not as great in the US compared to other countries since medical costs are so much higher in the […]

LikeLike

[…] Care Act: We have a global medical plan since we are full time travelers. Since we aren’t looking to join the ACA in the next two years, […]

LikeLike

[…] anywhere in the world. They were recommended to me by the lovely and genius 2 year veteran nomads All Options Considered and I’ve been having very helpful chats with IMG’s customer support team. Here are the […]

LikeLiked by 1 person