Ask Yourself – Can We Go It Alone?

We have been managing our own investments and money for a while now. It has definitely taken us some time (years) to build the confidence we needed to go it alone. The process became much easier for us once we found all the amazing information online from the FIRE community. And we have learned a lot from other authors, bloggers, and podcasters in the financial independence/retire early movement. The overwhelming message that we have gotten is — we can do this on our own. No matter what the money question is, with some accurate information, personal focus and structure, we can manage our money ourselves just fine. And so can YOU!

Know Your Own Mind Ahead of Time

Establishing structure and personal accountability is an important element of managing your own money. It’s critical to take the time to figure out what’s important to you on as many money topics as you can think of. And writing it all down is invaluable.

As one example, I found something called an Investor Policy Statement on the PhysicianOnFIRE website. We love the idea of having a tool people can use to document their goals, values, and decisions for how YOU want to work with YOUR money.

Who Should You Listen To? YOU!

We believe in setting financial goals so people can avoid blindly heading down a financial path that may not work for you specifically. We wanted a tool of our own where we could express our goals for family charitable giving, how we want to use credit cards, and the possibility of a future home purchase. Other people might want a tool to document how they will save money to help pay for a child’s college fund, or pay for property in a different country. Having a place to document your personal stance or philosophy for everything relating to your money is important, especially when there’s an end result with a plan for when and how to budget, save, invest, give, and spend.

The other important job these kinds of personal money documents have is to remind you of what you plan to do when certain situations, opportunities, or challenges arise. This type of plan can help curb your unhelpful human reactions so you can avoid a hasty move that would be contrary to your original goals and stated strategies if the market does something unexpected. It can also help keep you on track if you get into a conversation with a friend about the “amazing” whole life insurance policy they just bought and waved in your face. You can listen to anyone, feel confident that you have already identified your goals, and move on knowing what’s best for you.

Everyone Should Have A PMS!

When we do our research, we always try to adapt what we find and make it a perfect fit for us. So when we made our own document we had to give it a name that we love. Welcome to our Personal Money Statement! This is where we write down all of our money objectives, not just the ones about investing. And as a bonus now we can say we have a PMS! You can call yours anything you want but we are gleefully reclaiming this acronym. We have our PMS and we are proud of it!

Our First Personal Money Retreat

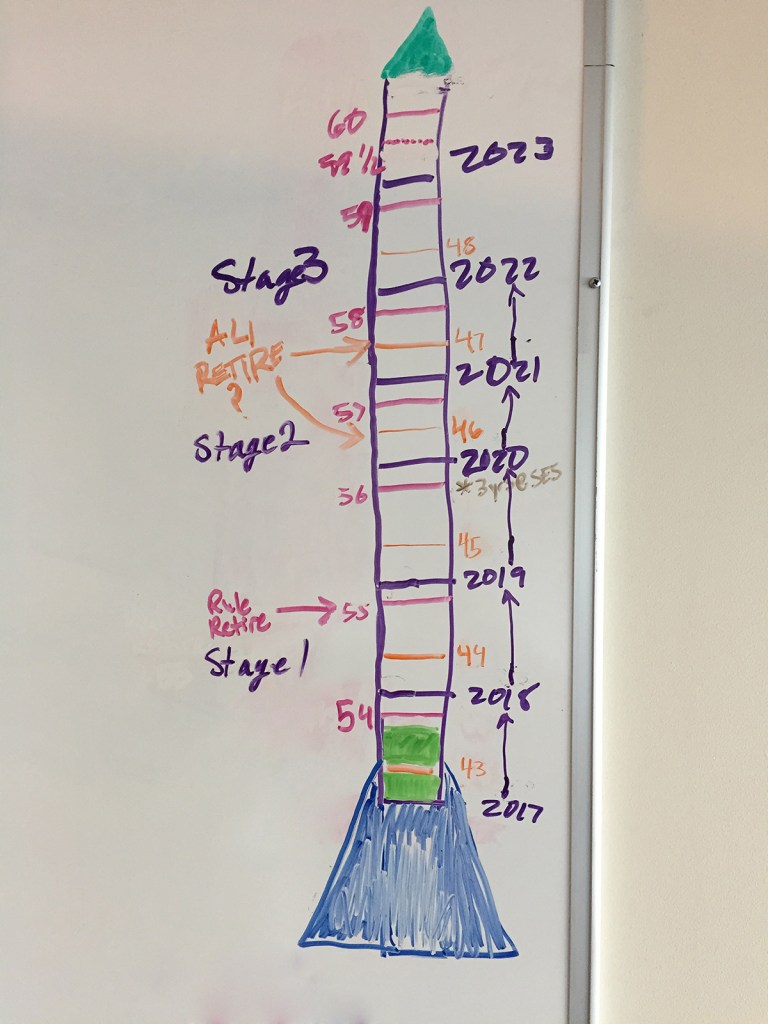

When Ali and I figured out that we had hit our FIRE number in June of 2017, we found that pretty shocking. For more details on our process for asking how much money we need in retirement to support the life we envision for ourselves, see our blog post “What’s Our Number?”

We decided we needed to get away and take a deep dive into how we wanted to turn our lives upside down and retire. We love the idea of setting aside uninterrupted time every few months to have major money conversations as a couple. So Ali and I decided to have our first AOC Money Retreat that September over a long weekend. We chose a little vacation community out on the Washington coast called Seabrook. We had been there once before with friends so we knew the community and amenities well. There was space to walk on the beach, enjoy bonfires, cook for ourselves, or go out to eat, all within walking distance of our little one bedroom cottage. Most importantly, that location helped us get away from all the influences of our daily surroundings at home. We didn’t want the pace of Seattle or the draw of work, family, or friends to interrupt or influence our conversations.

It was during our AOC Seabrook Summit that we identified the major elements of our PMS by taking some time to dream big and then ask some tough questions of ourselves. We started by asking each other to describe our hopes and dreams. One of my hopes is to spend lots of time with my mom in her later years, just as Ali wants more time with her family. At that point we were contemplating a FIRE goal in 2021, and we both described our “Perfect 2021” as a time to see more of the world at a much slower pace than we were used to on regular vacations from work.

The toughest questions we asked each other that weekend were… Did we want to continue living in Seattle? Did we want to keep our wonderful condo as a home base? Then we broadened our thinking… Did we want to travel around the US in an Airstream trailer? Or travel around the world as nomads? If the whole world is available where do we want to live? We also asked each other how we wanted to generate our income, and tons of other things. The list of questions was long and ranging.

I have to say that was one of the best getaway weekends we have EVER taken. It was a liberating moment for us to see how much choice and control we had over our future. Nothing was off limits. In the end we found our focus and started to build our list and set our priorities. And we identified what would go in our PMS.

Nuts and Bolts

What follows below is our PMS, but with a few specific dollar details left out. There are some statements in our PMS that are duplicates, which is on purpose, as financial concepts can be relevant in multiple sections of your life and your planning document.

Remember this PMS below is very tailored to what we are doing as traveling nomads. Also, the pools of cash that we live on are also available to be drawn from as emergency funds if needed. When you’re ready to build your own PMS it may look nothing like ours, or that of your friends either. This is the beauty of the financial planning process, it works best when it’s completely customized and personalized for YOU.

Disclaimer

It’s important to know that you can start this process on your own at any time. However, we do suggest reviewing big plans or changes with a CPA, CFP, or other professionals you trust. We in no way have all the answers here at AOC, we are not experts, and we are still open to seeking out and paying for objective reviews and advice ourselves. Especially when our plans are due for a big change.

Our Personal Money Statement

Written September 2017, Updated March 2019

Section 1. Goals and General Statements

1a. Personal Goals and Statements

Note: List your goals, dreams, and personal interests here. Your goals should be specific, attainable, and valuable to you.

- We will not carry any credit card debt. We will pay off all credit card balances every month.

- We will create a portfolio to generate income that covers our annual hopes, dreams, and needs. Our baseline is the average of our 2017 and 2018 expenses.

- We will create an annual budget that covers all our needs including health insurance, and that fits within the income mentioned above.

- We will start each year with all the cash that’s needed for that year in a liquid savings account.

- We will not take unnecessary risks with our money and we are willing to forgo outsized gains in favor of longterm growth and near-term income generation. See Section #3.

- Our cash has a job! We will always maintain an emergency fund. See Section #2.

- Our portfolio should be tax efficient. See Sections #3 and #7.

- We will self-manage our portfolio. We will seek advice and checkups as appropriate from a fee-only CFP, CPA, and other professionals.

- We will track our annual living expenses as well as the total return and real return on our portfolio each year. (Note: Real return is nominal return less inflation.) We will actually look at these results and be willing to make adjustments as needed.

1b. Financial Goals and Statements

Note: List your overarching financial goals and your intentions around money here. Describe your comfort level with risk in terms of investing, and the types of financial advisors you are interested in employing. You can also list the investment vehicles you want to use to achieve your goals such as index funds, individual stocks, rental property, or side hustles. It’s your money so it’s your call. Use real numbers and dates as well as “I will” or “we will” statements and hold yourself accountable.

2017 Money Goals

- Alison will retire in October 2018. (Note: this changed in early 2018)

- Ali will retire in 2021. (Note: this changed in early 2018)

- Our net worth is equal to 33x our annual expenses as of June 2017.

- We will continue to make 401k contributions through the end of 2017. Alison will also make the over 50 catch-up contributions in her 401k for 2017.

- We will both max out our Roth IRAs in 2017. Alison will also make the over 50 catch-up contribution in her Roth IRA.

- We will continue to contribute all of our extra income to our taxable investments through 2017.

- We will continue to track our living expenses and resist any lifestyle inflation.

2018 Money Goals

- Alison will retire in April 2018.

- Ali will retire by November 2018 (Note: Ali retired in September 2018).

- We will not front-load our 401k’s in early 2018, because we do not have the cash flow to live on and cover that commitment this year. We will continue to make regular 401k contributions every pay period until we quit our jobs.

- We will both max-out and front load our Roth IRAs in early 2018. Alison will make the over 50 catch-up contribution in her Roth IRA.

- We will set aside enough cash for our 2019 living expenses by the end of December 2018.

- We will sell our Seattle condo by the end of 2018. Those funds will be invested in our taxable account.

- We will sell our car and add those funds to our cash fund for living expenses in 2019.

- We will continue to track our 2018 living expenses and avoid any lifestyle inflation.

- We will sell or give away 90% of our belongings by October 2018.

- We will only rent a 5×10 square foot storage unit, but no bigger. If we can’t fit all of our belongings in that we will let go of everything that doesn’t fit.

2019 Money Goals

- We will set our total investment portfolio, with taxable and tax deferred accounts, to provide an income that is equal to the average of our 2017 and 2018 expenses, by January 2019.

- During 1st quarter 2019 we will set up laddered CDs valued at 60% of our annual living expenses, to help protect us from sequence of return risk in the first few years of our retirement.

- We will continue to track our 2019 living expenses and resist any lifestyle inflation. We will remember we are living as nomads, we are NOT on vacation!

2020 Money Goals

- We will re-evaluate our actual expenses from 2019 and make adjustments for 2020 as needed.

- We will make adjustments to our travel planning methods in 2020, based on lessons learned in 2019, and be more efficient on our travel spending.

- We will take advantage of travel rewards and spend travel points whenever possible.

- We will continue to rent nomadically to keep our average monthly expenses down.

- We will re-evaluate our global health insurance and consider world coverage without the US, with travel insurance supplements for our time in the US.

- We will start Roth conversions within the lower tax brackets so that we can continue to leverage 0% capital gains.

- We will re-evaluate the need to maintain laddered CDs and evaluate the performance of our portfolio and the stock market in 2019.

- We will continue to track our 2020 living expenses and resist any lifestyle inflation.

Section 2. Emergency Fund

Note: An emergency fund is a key part of a financial plan and it deserves its own section. Your emergency fund should be unique and specific to your situation. Our current emergency fund is not very traditional, but it works well for our current home-free nomadic lifestyle. For more information about our current financial plan and emergency fund, see our blog post “Pools of Possibilities.”

- Remember our cash has a job!

- While we are traveling as nomads, we will start each year with 100% of the cash needed to cover all of our budgeted expenses for that year. This money will be held in an interest bearing account.

- We will maintain a series of laddered CDs for the first 3 years of our nomad life, starting in 2019. Those CDs will hold enough funds to supply years 2 and 3 of our nomad life.

- After the end of year 3 of our nomad life we will evaluate the need to continue with laddered CDs depending on the performance of the market and our spending levels.

- We will count our Emergency Fund as part of our fixed asset allocation. See section #8.

Section 3. Market Investment Philosophy

Note: This is where you explain HOW you plan to invest, such as individual stocks, ETFs, real estate, etc. Keep in mind the trends of normal market volatility and how you would plan to react or not react during market fluctuations. Remember to refer back to this section on your investment philosophy for reference whenever you consider making a change to your investments in the future. For more detail on our passive Income Engine plan, see our blog post “Visualizing Your Money.”

- Our investment approach will endeavor to minimize taxes and fees on all investments, generating enough income for our hopes, dreams, and needs every year.

- Our primary investment vehicles will be low cost, low turnover, stock and bond mutual funds or ETFs.

- In general, we favor passively managed investments over actively managed investments.

- See section #8 for allocations.

- Any cash in the portfolio will be held in short term interest bearing vehicles, until it’s used to rebalance the portfolio or moved to cover subsequent years’ expenses.

- We will strive to achieve a real return of at least 6% annually, averaged over the portfolio’s lifetime. The goal is building a portfolio that will support a 50 year retirement.

- We will rebalance the portfolio every year in May and otherwise take a buy and hold stance. (Note: Rebalance every year and pick a special/memorable time of year to do it. I picked May for Ali’s birthday.)

- We will not panic as a result of the ups and downs of the market. And we will especially not panic if there is a major Black Swan event or a prolonged downturn. We will not sell securities due to market corrections. And we will not invest the cash set aside for our living expenses as a reaction to a downturn in the market.

- (Note: This is a good spot to add more ideas throughout the year about changes in the market and how you reacted to them.)

Section 4. Taxes

Note: This section is where you record any special considerations regarding tax optimization. You can include the tax bracket you are in here as well.

- We will work with a CPA as needed for the first few years of our retirement so that we can optimize and tax plan our income and stay within the 12% income tax bracket.

- We will attempt keeping our total taxable income within the 12% income tax bracket to access the 0% capital gains bracket when selling stocks.

- We will make Roth IRA conversions from our rollover IRAs within the 12% bracket to reduce future RMDs and optimize longterm tax-free growth in the Roth IRAs.

Section 5. Asset Allocation

Note: This section describes WHAT you are specifically investing in, on a month to month and year over year basis. It can include both taxable, tax deffered, and any other types of investments you are involved in. You can assign percentages based on your whole net worth or along taxable, tax deffered, or other categories. It’s important to list individual funds or properties by name.

- We will build an overall portfolio with taxable and tax deferred accounts that is allocated to include 75% equity investments and 25% fixed income investments.

- Our cash accounts and any CDs will be included as part of our fixed income.

- Any future home or property we own will not be included in this figure.

- Over time we will increase the equity portion of our portfolio so that we are positioning ourselves towards longterm growth.

- We will hold ETFs that invest in the broad US market, established foreign markets and bond funds.

- We will invest in low cost ETFs over individual stocks until a time when we have more time available for the in-depth research needed to purchase and track individual stocks.

- We will rebalance our portfolio once a year in May. If new money is added to the portfolio, we will make purchases that rebalance the holdings back towards our stated allocation percentage goals. We will only rebalance when the ratio is +/- 5% from our targeted percentages.

- Over time we will research and place the most tax efficient holdings in the most tax efficient accounts. (Note: This is one of our ongoing learning goals.)

Asset Allocation Detail

- Equity (75%)

- Broad Market (50%)

- International Market (25%)

- Bonds and Fixed Income (25%)

- Cash

- CDs

- Money Market

Section 6. Personal Home Ownership or Renting

Note: Anything related to your personal housing goes in this section.

- As of 2019, we have no plans to own another home.

- We intend to travel and live as renters for the foreseeable future.

- We will not purchase any real estate unless there is a market correction that presents a buying opportunity like the one we leveraged in 2009 when we bought our condo. See section #13 regarding “waiting periods.”

- If we decide to buy another home at some point in the future, we will consider purchasing with cash.

Section 7. Spending

Note: This section speaks to your core personal values when it comes to spending and tracking your spending. Don’t use this section to punish yourself for spending choices. Do use this section to describe the types of spending you want to avoid and the types of spending you want to focus on. Remember also to consider all of your basic needs both near and longterm when considering your spending habits.

- We will track our spending every month to ensure appropriate use of our resources.

- We will not use credit to purchase automobiles, appliances, or vacations.

- We will only consider using credit for safe fixed-income investments, convenience, or a mortgage.

- We will only pay for the types of travel experiences that fit in our annual budget.

- We will resist inflating our travel experiences exactly the same way we resist all forms of lifestyle inflation.

Section 8. Debt Repayment

Note: List any and all debt including student loans, car loans, mortgages, home equity loans, personal loans, 401k loans, and credit card debt. Add the balances, interest rates, and payoff dates. Describe your plan to pay off each loan and the timeline you expect that will take.

- We have paid off all loans and hold no debt.

- We are committed to paying off each credit card to a zero balance every month.

Section 9. Giving and Lending

Note: Anything related to the choices you make around giving or lending to yourself and to others can be included in this section. These should be money choices made freely and be tied to your personal values. Remember to consider all of your basic needs both near and longterm first when making plans to help others financially.

Family Giving

- We will always be available to help Alison’s mother manage her finances.

- For now we will continue to provide some financial assistance to Ali’s mother by paying monthly utilities and phone service. And we will always do so in a way that does not jeopardize our own longterm financial security or our mental health.

- Regular giving occasions include birthdays, graduation, and Christmas.

- Regarding Ali’s mom we will pay monthly phone and utilities but assume no other giving.

- With our death our goal is to leave some money to our nieces and nephews and chosen family.

Charitable Giving

- We keep a line in our budget for giving a minimum of 10% of our income to some type of charitable organization(s).

- For our first year post-FIRE we were initially a little nervous so we gave ourselves permission to cut back on charitable giving, but halfway through the year we realized we didn’t need to worry. We created a new plan for charitable giving when we became nomads, focused on the communities we visit during our travels.

- Should we settle down in one community again in the future we would add new charitable giving efforts to our plan to give back to our new community.

- For now we do not plan to use a donor-advised fund (DAF). We appreciate the benefits of using a DAF but we aren’t focused on tax deductions from our giving. We want the freedom to give money to communities in need including indigenous communities inside the USA, as well as indigenous communities and individuals outside of the USA where a DAF would not be useful or allowed.

- We maintain a list of our previous annual charitable and political donations and intend to continue giving to our favorite nonprofits no matter where we are located.

- With our death our goal is to leave some money to our favorite charities.

Section 10. Drawdown Plan

Note: This section describes HOW you plan to move funds down from your larger portfolio to cover your actual living expenses. If your retirement plans are not within the next 5 years, you can fill this section out later when retirement is near term. If you are planning to retire within the next 5 years fill this section out with your drawdown plans for covering your living expenses. It is useful to describe your drawdown plans in phases. We have completed this section with 3 phases each lasting for 3 years.

Phase 1, Years 1-3 (2019-2021)

- While we are traveling as nomads, we will start each year with 100% of the cash needed to cover all our budgeted expenses. For 2019 these funds were accumulated through W2 savings during 2018, selling home furnishings and selling our car. This money will be held in an interest bearing account.

- We will maintain a series of laddered CDs for the first 3 years, starting in 2019, that hold enough funds to supply year 2 and 3 of our nomad life.

- We will start Roth conversions in 2020 up to the top of the 12% tax bracket and in such a way we can still leverage a 0% capital gains tax.

Phase 2, Years 4-6 (2022-2024)

- After 3 years of nomad life, we will evaluate the need to continue with laddered CDs

- In general, we will live off the dividend income, capital gains and original cost basis of the taxable account until Alison turns 59.5. At that time we will reassess our strategy regarding the need to start drawing from Alisons IRA or Roth.

- We will continue Roth conversions up to the top of the 12% tax bracket and in such a way we can still leverage a 0% capital gains tax.

PHASE 3, YEARS 7-9 (2025-2027)

This is more than 5 years out so we will start filling this in around 2020/2021.

Section 11. Insurance

Note: Insurance is meant to protect our health, family, and property. It’s also meant to protect our larger assets or investments should we have a big claim or lawsuit filed against you. Whether you choose to pay for any type of insurance is highly subjective and should be specific to your personal needs.

Life Insurance

We do not want any kind of life insurance as we have no mortgage, no W2 income to replace, and no children to support.

Death Insurance

We have cremation services in place for each of us.

Health Insurance

- We will always carry at least catastrophic health insurance. We have IMG Global Medical Insurance for 2019.

- We will look to add more comprehensive preventative health insurance as it might be appropriate in the future.

- American medical insurance is unattractive at this time so we will do research on medical tourism options and consider them for preventative health needs and general medical and dental care.

- We will NOT buy longterm care insurance since we believe we have enough saved to cover those kinds of costs if they are needed.

Home Insurance

- If we decide to buy a home, land, apartment, or condo, we will have appropriate insurance.

- We will maintain renter’s insurance for our storage unit while we have a storage unit.

Car Insurance

- We have no cars but we will have the appropriate auto insurance if we ever own a car, RV, or trailer in the future.

Section 12. Life Planning

Note: Wills and Trusts are meant to protect our family and our intentions after we die. They are also meant to protect our wishes should a family member choose to challenge our wishes after we die. Whether you choose to go with a simple Will or a more complicated Trust can depend on the size and complexity of your wealth and assets, as well as the size and complexity of your family. You should also pay close attention to the laws, protections, and limitations relating to Wills and Trusts as well as marriage and partnerships in the State you live in.

- We will continue to update our existing wills, health care directives, and powers of attorney.

- We will keep our beneficiary forms updated on all bank accounts, IRAs, and Roth IRAs.

- We will continue to communicate with our family members about the location and contents of our legal documents. We currently have a copy of our Will at Ali’s sister’s house and backup files at Alison’s sister’s house.

Section 13. Changes

Note: It’s important to consider future changes to this plan. We have made plenty of changes to our own Personal Money Statement over the last 5 years. In fact we plan to edit our Personal Money Statement at least once a year with updates. Regular review of the commitments outlined in this section will help you avoid changes without thoroughly thinking them through.

- Any change to any portion of our plan will require a 3 month waiting period.

- Development of any new investments, or new funds allowing us to make new investments, will require a 3 month waiting period prior to transferring funds.

Section 14. Signatures

Note: When you get to this part – the end – make sure you sign and date it!!!

Now it’s Your Turn – Get Yourself some PMS!

The PMS document will keep you focused on your goals when new situations, opportunities, or challenges arise. For example, you can refer back to your PMS if it’s time to hire or replace an advisor, or if the market does something unexpected and you need help curbing your human reactions and avoiding hasty moves that are contrary to your original goals and stated strategies. It can also help keep you on track if you get into a conversation with a friend about the “amazing” whole life insurance policy they just bought. You can listen to anyone, feel confident that you know what your goals are, and make the choices that are best for you. PDF and Word versions of our PMS document template are included below for your use. If you have any questions please let us know!

Keep your PMS as a Living Document

At the end of our Seabrook Summit we had a pretty serious plan for early retirement and completely changing our lives. Back in our condo in Seattle we had a huge white board on the wall, which came in handy during some epic games of Pictionary with our friends. We also used our white board for brainstorming and we used it a lot for our early retirement plans. We couldn’t take that white board with us as full-time nomads, but our PMS is always with us! Our PMS is still a very important living document. Our lives keep changing, but our PMS keeps us rooted.

We are not certified professionals. For more information about us please read our Disclaimer.

Thanks for the shout out! Crazy to know I’ve had (a) PMS all this time and never realized it.

Cheers!

-PoF

LikeLike

I have been using your Investor Policy Statement for years now, and Ali and I love making updates to the file. It was exciting to modify and revise your excellent document into our Personal Money Statement. We love our PMS 🙂 I have also built one for my mom. We are encouraging our friends to fill one out for themselves as well since we all find it to be VERY helpful. Thank you so much for the inspiration!

~Alison

LikeLike

I have just found your site and I’m thoroughly impressed with the format of the PMS. I found myself thinking “WE could totally tackle this!” I’m inspired by your weekend away to really dive in to some of the financial conversations that are critical for a couple. My husband and I are trying very hard to make the most of our financial situation now that our daughter has graduated from college, and we find that we are not always on the same page with regards to how we approach money. Did you set guidelines/norms before your discussion? (Money talk can be very emotional for me.) Thank you for sharing your experiences and strategies. Now, I’m off to read your previous postings and catch up with all I’ve been missing!

LikeLike

We loved our Summit Weekend. Since Ali and I usually do well with our money conversations, we had not set guidelines. But if that’s a challenge for you guys I think thats a really good idea to have guide lines. Maybe turn it into a game! But I get how easy it is to take some of these topics personally and get emotional. I guess the thing we do is keep saying “all options considered” so we keep the conversation going. Nothing is too crazy. Then we circle back and look at it all again. The other thing we love to do are our “walk and talks.” We come up with all kinds of fun ideas when we are walking along a beach or through the woods. It creates a space for open conversations and new ideas to flow when you aren’t confined in a room. Oh, and don’t for get a white board or big post-it notes. Love having our ideas on the wall so when we walk by we can ponder them more. Glad you found us and good luck!!!!!!!!

LikeLike

[…] do if you won the Lotto?” We had fun playing that game to make sure there were no rules when we brainstormed our dream life after retirement. Once we decided to sell our condo we wanted to map out as many new ideas as possible for where we […]

LikeLike

[…] to retire it was my job to find a way to build a budget. After doing some life planning at our Seabrook Summit we decided to stick with a budget that represented an average of what we had spent living in our […]

LikeLike

[…] 2020, we will not panic!! Especially me – I promise not to panic. We will be going back into our fabulous Personal Money Statement (PMS) in the first quarter, so we can make a few updates and also make sure we keep a clear head about […]

LikeLike

[…] a little earlier than expected because of the COVID-19 pandemic. Like right now. Last time we had a major life changing planning summit was our Seabrook Summit which is basically when we decided to retire early. Instead of planning 1 […]

LikeLike

[…] Well, if you are a nomad like us, once you have determined you are in a safe location where you can stay for a while and you have a safe way to get food and any other supplies you need, it’s time for a little self comforting. For me that means revisiting our Personal Money Statement (PMS). […]

LikeLike

[…] net worth and help you along the way to the next step, which is making a Personal Money Statement (check out our PMS blog post, haha). Your PMS document will help you plan for reaching your hopes and dreams. I encourage people […]

LikeLike

[…] Related post: Outline Your Goals in a Personal Money Statement […]

LikeLike

[…] past a certified financial planner and designed our new life after FIRE. We built our original Personal Money Statement and then Alison retired in April of 2018 and Ali gave notice 3 months […]

LikeLiked by 1 person

[…] past a certified financial planner and designed our new life after FIRE. We built our original Personal Money Statement and then Alison retired in April of 2018 and Ali gave notice 3 months […]

LikeLike

[…] least 5% off from our allocation target in order for us to do anything. Having that 5% rule in our Personal Money Statement helps us remember that rebalancing is about correcting our equity to bond ratio, it’s not just an […]

LikeLike

Thank you for this!

I just completed my own, which was aided greatly by your format. In it I included in my “life planning” section details about how I will continue educating my teen about finances, investing, and all aspects of the FI philosophy.

I’ve also considered how part of my investing (and withdrawal) goals are designed so that I may be a custodian of a portfolio for my child’s benefit and their future family. My goal isn’t to spend it all, and I want to find the balance between frugality and enjoying an abundance of “slow” travel. So I’m doing the “if I’m hit by a bus” planning that will be outlining my philosophy and wishes for my sister to caretake my portfolio for my teen depending on what age and life stage they are at in the future – my sister is already the beneficiary on all accounts but I’d like a template or decision tree to aid her in making decisions, especially as I’m presently thinking that I would have her quietly hold my portfolio until my teen is 30 years old. Nothing that’s set in stone, but philosophy for her to consult. I want to use my experiences with money as a teaching tool for my teen, but I don’t want it to potentially derail their own independence or work if they were to suddenly come into this at a young age in my “hit by a bus” scenario! Thankfully they’ve already made a decision to invest some of their own money in VTI this year and are very level headed when it comes to money – they thought Game Stop was ridiculous and are firmly on Team Index Funds. Thank you thank you for another fantastic and thought provoking post.

LikeLiked by 1 person

This is PERFECT! We love that you are making a NOW plan and one for “just in case”. How nice that you have a sister to work with you on this as well. Sounds like you all are doing a great job with your own money and plans while teaching the next generation. Congrats!

LikeLike

[…] a personal plan for all of the emotional aspects of completely changing our lives. Building our Personal Money Statement helped a lot but we didn’t do that until we were at the end of our FIRE journey, and that […]

LikeLike

[…] you’re thinking about what your allocation should be, pause to fill out a Personal Money Statement (PMS) or any other style of document that lets you outline your unique plans and put target dates on […]

LikeLike

[…] far we have been following the plan we created in our Personal Money Statement (PMS), and we check it often to make sure our plan still works for us today. We mitigate SORR through […]

LikeLike

[…] or which accounts certain assets should be held in, the answer is… It depends. It depends on your personal investment strategy. It depends on the kinds of accounts you’ve been able to open and contribute to over time. It […]

LikeLike

[…] built our giving plan inside our Personal Money Statement so our PMS document could serve as a roadmap for all of our plans and goals. We planned to give to […]

LikeLike

[…] have a PMS (Personal Money Statement) — thanks to Ali and Alison!!! In my PMS, I decided and wrote out how I’ll make money […]

LikeLike

[…] year. But we feel organized and prepared for whatever may come this year so we’ll stick to our PMS, keep learning, continue to pay attention to tax changes on the horizon, and try to control our […]

LikeLike

[…] as a hedge against inflation. Jane is prepared to stick to the goals and strategies she set in her Personal Money Statement (PMS) when the next Black Swan event […]

LikeLike

[…] in 2017 when we had our pre-retirement getaway weekend (our Seabrook Summit) we did a bunch of research on travel trailers since we were considering living in a trailer full […]

LikeLike

[…] our Personal Money Statement (PMS) we wrote that we’ll strive to achieve a nominal 6% return annually using ETF’s. We […]

LikeLike

[…] setting a timeline for quitting our jobs. We also waited until we had a written plan, our own Personal Money Statement, to help us make thoughtful decisions about our spending and intentional choices about our drawdown […]

LikeLike

[…] and Joan have started building a written personal finance plan that includes reducing their cost of living after retirement by either moving to a more affordable […]

LikeLike

[…] of the more important sections we added to our personal money statement for this part of our lives is about co-living. Two years after quitting our jobs and traveling full […]

LikeLike

[…] process was working for them or voicing their concerns about how to make it work for them. We knew our first post about this process didn’t answer the types of questions we were getting and that got us talking about a new post for […]

LikeLike