While we were still working our W-2 jobs I asked the experts questions like “Should I invest more in my 401k, or my Traditional IRA, or my Roth? Should I focus more on one account over another?” And the response was always “Well it depends on what your tax bracket will be in the future after you retire.” Then I would ask, “Well what will my tax bracket be after I retire?” And the response was, “Well it depends on how much money is in your various accounts in the future.” A vicious cycle of, “Well it depends.”

Now that we have retired I have been thinking about Required Minimum Distributions (RMDs) from IRAs that must start when you hit age 70.5, and the potential dreaded “RMD Cliff.” The supposed negative impact of RMDs on your future tax bracket is a really important topic, and I’m tired of hearing, “Look out, it’s going to be scary in a few decades. Just wait and see how scary it will be.” Getting an answer like “It depends” is not good enough anymore. I want specifics! So I decided to build a spreadsheet that would help shed a little light on our potential RMD Cliff.

The Future is Here — I Want Specifics!

Back at the end of 2018 we rolled our 401k’s into our Traditional IRAs. And now we don’t have W-2 income or side hustle income. So, it’s time to circle back and optimize our portfolio for investment growth to take advantage of tax saving strategies and handle our regular cash flow needs. The long-term tax implications of RMDs from our IRAs have graduated to a critical topic that requires some real answers. I want to see how RMDs would impact our total lifetime tax obligation, and find out how to avoid the RMD Cliff that would bump our income into a higher tax bracket. The real question is — would IRA to Roth conversions really reduce our lifetime tax obligations, and help our portfolio live longer?

Since I’ve become obsessed with RMDs I’ve had a great time building a spreadsheet with my own progressive tax bracket calculator so I can dynamically graph our portfolio balances and the shifts between taxable, tax-deffered, and tax-free accounts as I calculate Roth conversions. I’m totally nerding-out on Roth conversions!

DISCLAIMER: Please do your own research and seek professional advice when making financial decisions. Remember, our situation is different from yours, our financial choices may not apply to you and your goals, and my DIY approach may not be a fit for your situation. Plus, we are not experts, we are just us!

Why Make Roth Conversions in the First Place?

One of the ways we worked towards reaching FIRE was by power saving into our 401k’s and Traditional IRAs. Maxing out our contributions to those accounts reduced our taxable income while we were employed, and will now allow for powerful tax-deffered growth over the long term since we can leave that money to grow untaxed until Required Minimum Distributions (RMDs) are imposed at 70.5 years of age.

Note: There are income phase-out thresholds for contributing to a Traditional IRA, so check out the IRS website for up-to-date information.

While we were employed we were also super savers in our taxable brokerage account, since that was one investment vehicle with no limit to the amount of money we could invest each year. Now that we are in our first year after retirement we are living off of passive income, cash, and equities percolating in that taxable brokerage account as a bridge to hold us over until we start taking social security and distributions from IRAs and/or Roth’s. That’s the good news!

The bad news is the amount of IRA RMDs we’ll have to take at 70.5 years of age is set by the IRS, not based on our personal choices, and can create an undesirable shift in our taxes later in life.

Here’s more good news: We can manage the amount of RMDs we have to take by converting our IRAs to Roth’s way before RMDs hit. By shifting the balance of IRAs to Roth’s in a strategic, tax-optimized manner, we can reduce our lifetime tax bill. That sounds like a good game of Money Crush to me, so I was excited to test Roth Conversions on our portfolio!

Part 1 – Taxes

Our After Retirement Tax Strategy

Post FIRE, the game we are playing now is to pay the least amount of taxes possible for the rest of our lives. In our case, we want to keep our taxes below the 12% tax bracket limit forever.

We were power saving in our 401k’s and Traditional IRAs until I was 54 and Ali was 44. If we leave those accounts alone until I have to start taking RMDs, that will push our income with social security, qualified dividends, and capital gains into the 22% tax bracket. Then when we add Ali’s RMDs and social security and we’d get pushed into the 24% tax bracket. That’s the perfect tax storm, the RMD cliff! How can we avoid that?

Eliminating our tax deferred IRA balances and shifting that money into tax free Roths should greatly reduce our future lifetime tax burden. Theoretically.

A Roth conversion can be done at any time given some specific rules. For instance, The conversions are taxed at your ordinary income tax rate and are penalty free if the funds move directly from IRAs to Roths. Since there’s nothing telling me we have to wait to do these conversions, I decided to test the idea of starting Roth conversions now in 2019, and continuing them until our IRAs are empty.

A Lifetime of Taxes

I want to understand how all our kinds of income will impact our tax brackets and our lifetime tax bill. This is a BIG puzzle to solve! Since we plan to access different kinds of accounts in our portfolio sequentially, the easiest way to see the shifts is to break our portfolio down into individual years and look at the kinds of income being generated in a given year, while keeping an eye on our overall portfolio performance. By calculating each year’s estimated tax obligation over the life of our portfolio, we can see a realistic estimate for our lifetime tax totals and compare portfolio options with and without Roth conversions.

To simplify, we need a detailed understanding of two things:

- The kinds of income we will be generating and specific tax brackets for each.

- The type of account each income stream comes from.

Note: Tax laws can change at any time and will most likely change in the future. So we are going with what we know today. When the laws change, we will redo these tests.

Income Types and Tax Brackets

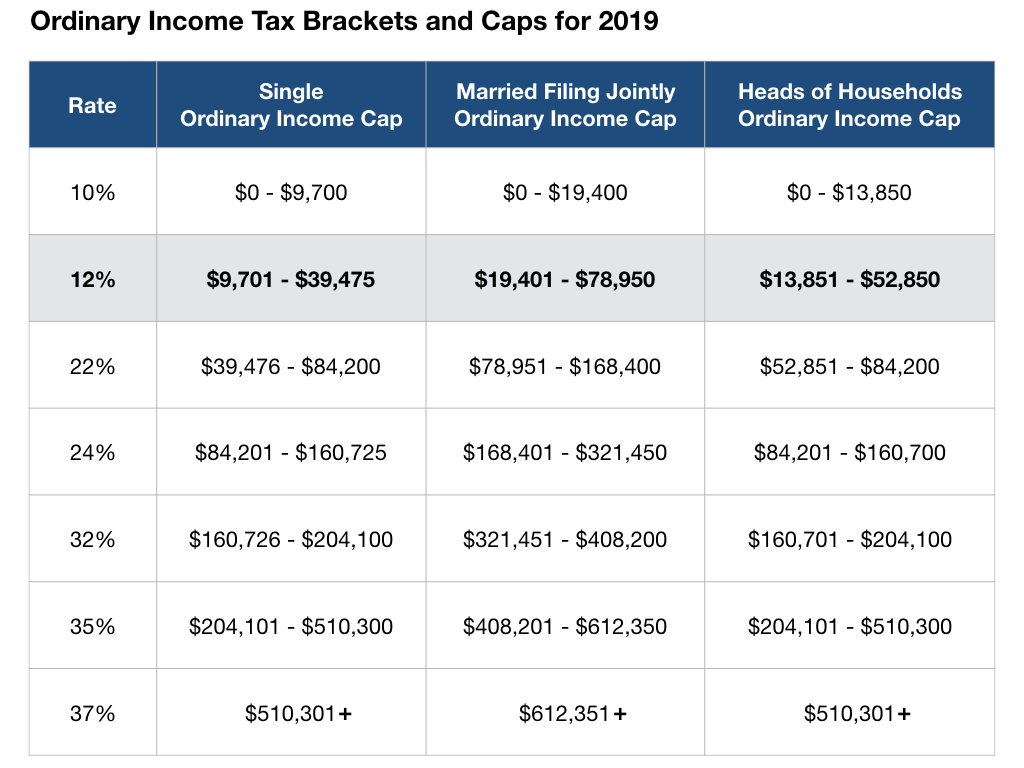

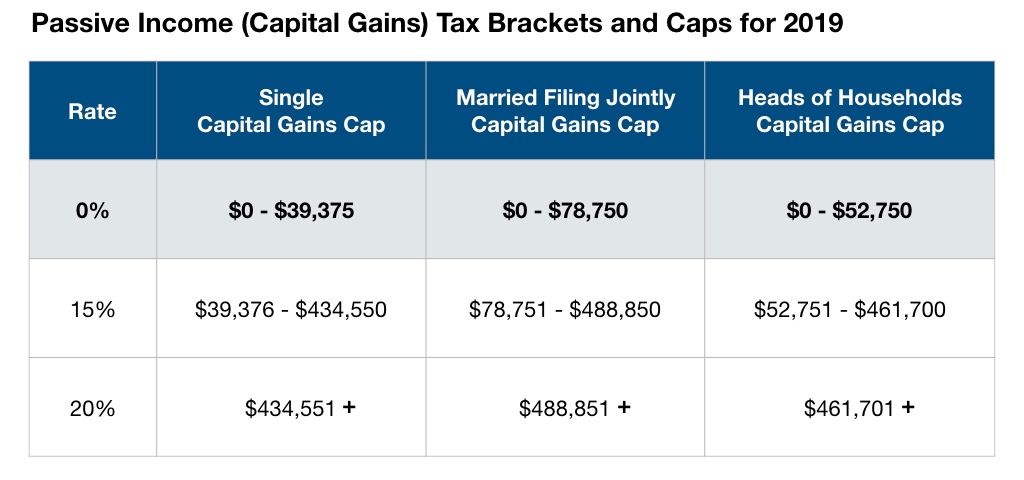

Income can be generally dumped into 2 buckets. Ordinary Income you have earned by doing a job or from an asset held for a short period of time. Or Passive Income earned from assets or equities held for a long period of time. Passive Income is commonly called Capital Gains income. The IRS classifies these two kinds of income differently, and subsequently taxes them VERY differently. The IRS’s income classifications and progressive tax brackets are included below.

Ordinary income Types

- W-2 income or wages, tips and bonuses

- Interest

- Non-Qualifying Dividends (from equities held less than 60 days)

- Short term capital gains (from the sale of an equity held less than 365 days)

- Roth conversions (funds moving between an IRA and a Roth) *

- IRA RMDs *

- Social Security (taxable up to 85% of the original amount) *

- Pensions *

Note: Each of these income types with an asterisk (*) might have additional caveats associated with them, social security and pensions for instance. For now and for this post we will add them up at 100% of their original value.

Passive Income (Capital Gains) Types

- Qualified Dividends (from equities held longer than 60 days)

- Long Term Capital Gains (from the sale of an equity held longer than 365 days)

- Rental Income

- Royalties

- Income from passive business activities

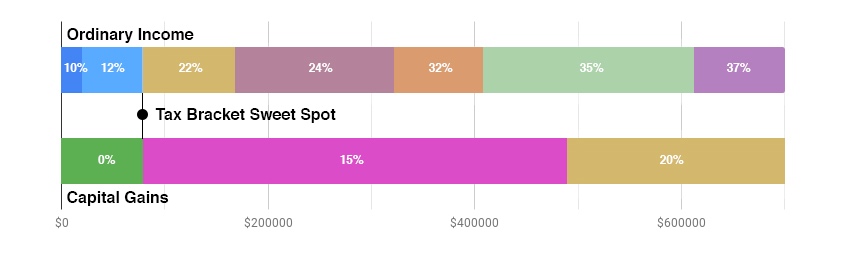

The Tax Bracket Sweet Spots

The graphic below includes the 2019 tax brackets for ordinary and capital gains income. Note that the top of the 12% ordinary income tax bracket ($78,950), coincides closely with the top of the 0% capital gains tax bracket ($78,751). For folks like us who are living on budgets within the 12% ordinary income tax bracket there are some great tax savings to be had if you can control the kinds of income you will need and claim in a given year. For example, if we keep our ordinary income below the top of the 12% tax bracket until we hit that cap, then switch to capital gains in the 15% bracket, that additional capital gains income would be taxed at 15% as capital gains, instead of 22% if it were ordinary income.

How Tax Brackets Work Together

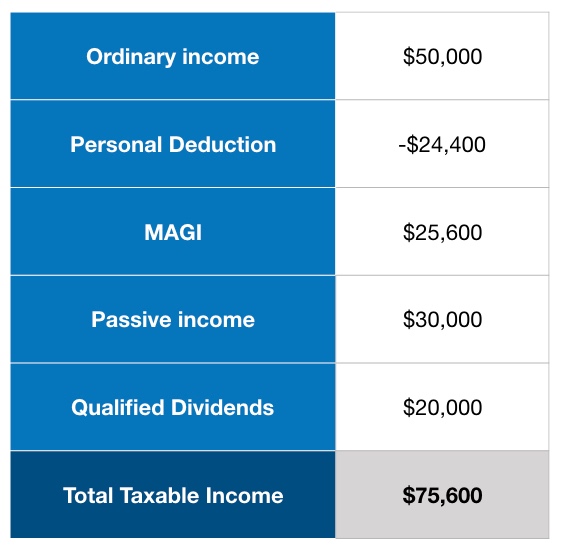

Our taxes for 2019 are not going to be at all like our taxes in previous years, so figuring out our Post-FIRE taxes is like working on a new puzzle. The first step in deciding whether to do Roth conversions was estimating our ordinary income, which has to stay well below the $78,750 cap for the 12% tax bracket. Then I subtracted our corresponding personal deduction of $24,400 since we are Married Filing Jointly, which gives us our Modified Adjusted Gross Income (MAGI) number. Finally, I added all of our passive income sources in the form of capital gains and qualifying dividends to our MAGI, and that gives us our Total Taxable Income.

Why am I focusing on the 12% tax bracket? As long as our total income is well under the top of that bracket, we can fill the gap with passive income in the form of 0% capital gains. Why do we love that passive income category? Because we pay 0% taxes on that income! Another great option is to fill the gap with bigger Roth conversions and only pay 12% on the conversion amount. The choice is ours.

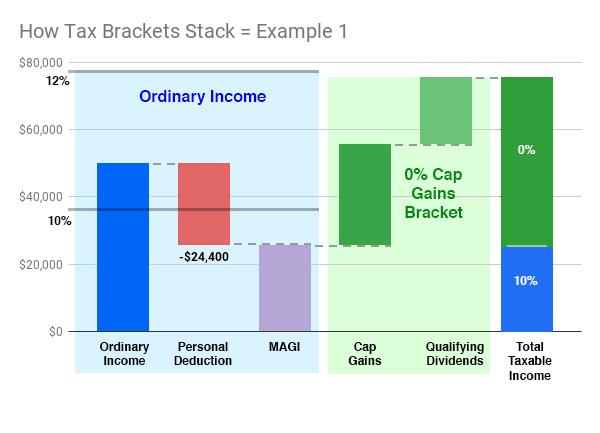

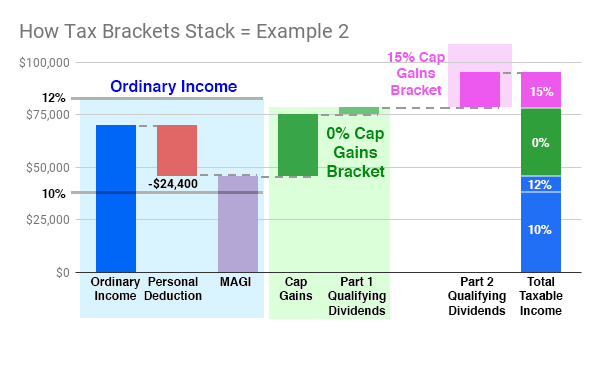

Below I have 2 examples showing how the tax brackets and deductions all fit together.

Example 1. Ordinary Income of $50k

With $50k of ordinary income and a personal deduction of $24,400, we have a MAGI of $25,600. Then adding the passive income, there’s an additional $30k of capital gains and another $20k of qualified dividends. In this example, we only owe taxes on the $25,600 MAGI amount because our total ordinary income is well below the top of the 12% tax bracket AND the addition of passive income is below $78,750. Miraculously, we pay zero tax on the capital gains/passive income in this example!

Example 2. Ordinary Income of $70k

In this example we increased our ordinary income to $70,000 and kept everything else the same. We still have the personal deduction of $24,400, but now our MAGI is $45,600, which is within the 12% tax bracket. We add the passive income of $30,000 in capital gains plus another $20,000 of qualified dividends. With the higher MAGI our passive income is pushed up in the 15% capital gains bracket. So we owe a combination of taxes on a combination of incomes across a combination of brackets. Confused?

Income Engine Account Types

The 3 account types to work with when building your retirement income engine are Taxable, Tax-Deferred, and Tax-Free.

1. Taxable Accounts

These are after-tax dollars either from earned income such as W-2 employment, or reinvestments from dividends, capital gains, and original cost basis from a taxable account. In our case we have a brokerage account and bank accounts. Taxes are due in the year the transaction occurred.

Tax obligations for this account:

- CD interest is taxed at ordinary income rates.

- Dividends-held less than 60 days are taxed at ordinary income rates.

- Dividends-held more than 60 days are taxed at capital gains rates.

- Capital gains-held less than 365 days are taxed at ordinary income rates.

- Capital gains-held more than 365 days are taxed at capital gains rates.

- Original cost basis is not taxed since that was originally “after tax money.”

2. Tax-Deferred Accounts

These are pre-tax dollars earned during W-2 employment usually contributed to 401k’s, or tax deductible contributions to Traditional IRAs. In our case we only have Rollover IRAs since we merged our 401k’s with our Traditional IRA accounts after retirement. Taxes are due at the time of withdrawals and additional penalties may also be apply depending on your age at the time of the withdrawal.

Tax obligations for this account:

- Unlimited ability to buy and sell securities at any time, as long as we don’t make withdrawals.

- Funds converted from IRAs to Roth’s are taxed at ordinary income rates.

- Withdrawals while we are under age 59.5 are taxed at ordinary income rates, plus an additional 10% penalty.

- Withdrawals when we are between 59.5 and 70.5 years of age are taxed at ordinary income rates.

- Once we are 70.5 years old the IRS will force RMD withdrawals in amounts they designate based on the IRS life expectancy table, which are taxed at ordinary income rates. It’s also interesting to note that if you don’t take the RMDs as required there are penalties up to 50% of the amount of the RMD each year. Ouch!

3. Tax-Free Accounts

These are usually after-tax dollars from earned income sources such as W-2 employment. The best thing about these accounts, Roths in our case, is that you never owe taxes on growth or withdrawals, as long as you are over age 59.5 and have had your Roth for more than 5 years. And best of all, there are no RMDs!

Tax obligations for this account:

- Unlimited ability to buy and sell securities at any time, as long as you don’t make withdrawals.

- If you’re over age 59.5 and you’ve met the 5-year Roth holding requirement, your withdrawals are tax- and penalty-free.

- If you’re under age 59.5, there are ways to make penalty free withdrawals assuming you meet the requirements set forth by the IRS. Please do your research before making early Roth withdrawals.

Note: We find using the IRS website for information about early withdrawals to be a challenge. Since we have all of our investments at Schwab we did some research about Roth withdrawals on Schwab’s website and actually found it very helpful!

Part 2 – RMDs

Should we Convert our IRAs to Roths?

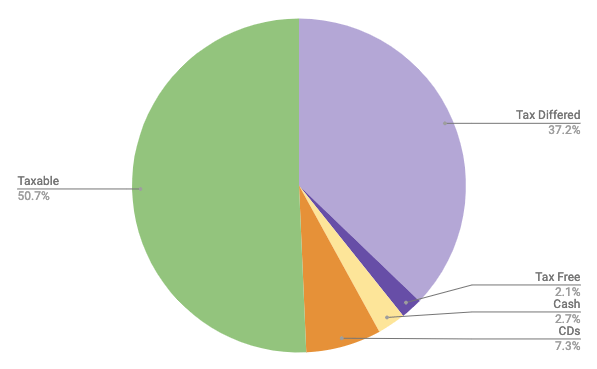

To decide if Roth conversions would help us earn money or save on taxes I looked at several aspects of our total portfolio’s performance. We currently have 5 investment accounts including a joint taxable brokerage account, plus we each have one Rollover IRA, and we each have one Roth IRA.

The questions I’m testing through the following graphics are listed below.

- Portfolio Ending Balance: How does the overall portfolio perform across all 5 accounts as far out as 2075, when Ali turns 100 and kicks the bucket (or runs off with a vampire)?

- RMDs: How do the account balances shift depending on when and how RMDs are taken?

- Taxes: What would the overall drag on the portfolio be from taxes, depending on when RMDs are taken?

- Legacy: Which account is the best one to use for charitable donations and gifts to our nieces and nephews after our death?

Test 1: No Roth Conversions

In this first test of our portfolio I wanted a more detailed explanation of what would happen to our ordinary income and capital gains tax brackets if we don’t do any Roth conversions. The responses to the test questions are listed below.

- Portfolio Ending Balance: The ending balance in this first test serves as our baseline for comparison. We are confident that we will not run out of money before death across our total portfolio by the time I’m age 95 and Ali is 100 (unless she finds her vampire), given our current real return rates and expected inflation adjusted expense projections.

- RMDs: Our IRA balances start to dive dramatically after RMDs start when we each turn 70 years old. The RMDs are taxable as ordinary income and it’s required that you take the minimum that the IRS calculates or pay an additional penalty.

- Taxes: With out making any adjustments to the IRA balances, the eventual forced RMDs over time along with social security will push us into higher ordinary and capital gains brackets resulting in an ever increasing tax obligation. Yuck.

- Legacy: This graphic shows us ending with a relatively high balance in our taxable account, which isn’t bad since we’d love to leave a legacy for our nieces and nephews. Depending on how we arrange things, this account could also get a step up in cost basis when we die.

Basic Portfolio Distribution, No Roth Conversions

The graphic below represents our current total portfolio with all 5 accounts funding our expenses during retirement. Look at all of those purple bars — with no Roth conversions, 88% of our portfolio’s final balance will fall in the taxable account. In this case the types of income we depend on will start to land in higher tax brackets soon and will stay there until we die! We intend to live off our taxable brokerage account for the immediate future to allow the tax-deferred IRA accounts and tax-free Roth accounts to grow for as long as possible. I’m 10 years older than Ali and I have estimated my death in this graphic at 95 years old, so the graphic shows my IRA and Roth disappearing when I hit 95 years old as those balances transfer to Ali’s IRA and Roth respectively. Since Ali wants to live forever and is always looking for a vampire to help with that, I padded her life expectancy to 100 years old.

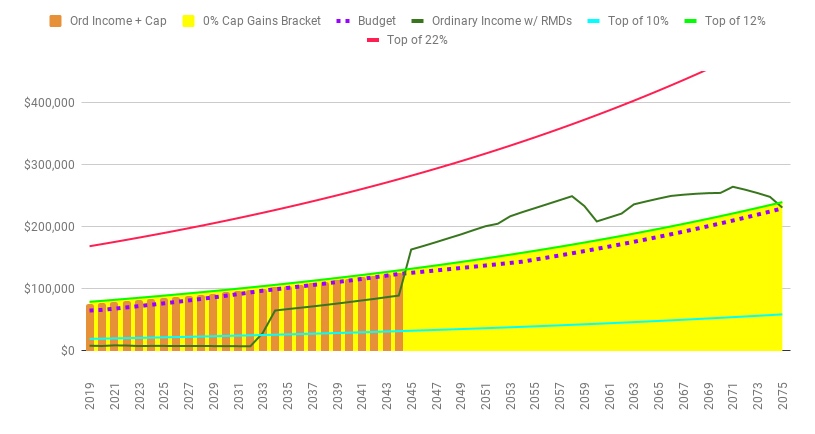

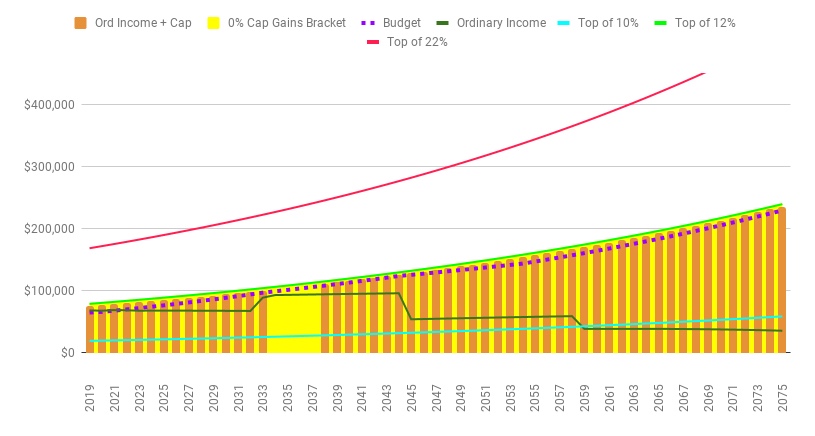

Ordinary Income + Capital Gains, No Roth Conversions

This yellow graphic below shows our ordinary income plus capital gains, and it also shows the RMD tax cliff when our ordinary income line in dark green jumps up out of the yellow field. In the scenario illustrated below with no Roth conversions, I would be forced to take RMDs when I turn 70.5 in 2033. I also anticipate taking social security at that time. When Ali turns 70.5 in 2045, she would also be forced to take RMDs and social security. If we are both taking RMDs and social security, that income combined with dividends from our growing taxable account would push us into the 22% ordinary income tax bracket and the 15% capital gains bracket. We would prefer to avoid paying those high taxes during retirement.

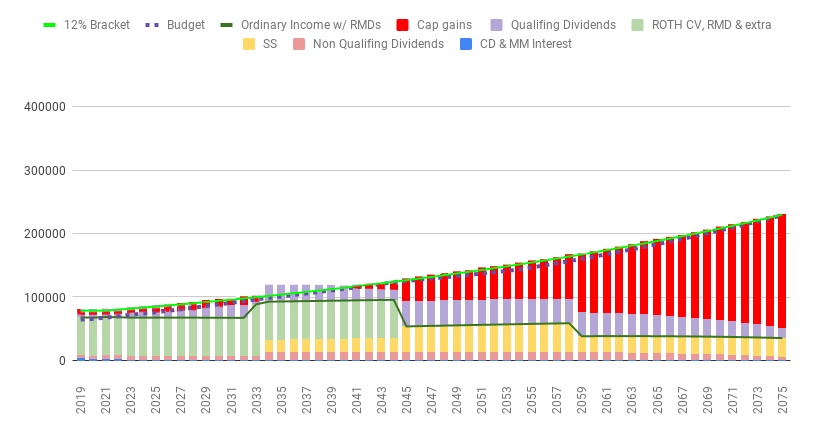

Changes Across Our Complete Portfolio, No Roth Conversions

The following graphic goes into greater detail showing all of our various income types, and how and when they are affected if no early Roth conversions are made. This colorful illustration really dramatizes the RMD cliff and how our total portfolio taxes could jump after RMDs hit us in 2045.

Test 2: With Roth Conversions

In this test, we start making $60k Roth conversions combined every year starting now, in 2019. We are looking at $60k for annual conversions because that is the amount needed to zero out each of our two IRA accounts (which hold our old 401k money) and prevent forced RMDs. The responses to the original test questions are listed below.

- Portfolio Ending Balance: As compared to the Test 1 baseline, the ending balance in Test 2 is relatively similar. With regard to total portfolio return alone, doing a Roth conversion would not be detrimental to our final portfolio balance.

- RMDs: Roth conversions shared between our IRAs make the Roth’s jump in value. And since I’m 10 years older than Ali, my IRA depletes quickly since the majority of the early conversions would go to my account in order to empty it before I turn 70. Once my IRA is empty we shift all of the $60k conversions to Ali’s IRA to make sure she has a zero IRA balance by the time she turns 70.

- Taxes: By making combined strategic $60k Roth conversions across our two IRAs now, we can avoid forced RMDs completely and control our ordinary income down the road. We will take up most of the 12% tax bracket with $60k conversions between 2019 and 2044. After that both IRAs will be empty and we avoid any RMDs, and all withdrawals from the Roths would be tax-free.

- Legacy: Based on current tax law, shifting our account balances from IRAs to Roths will allow us to pass the remaining balances to our beneficiaries tax free. If you transfer your Roth to your spouse when you die, that money is available tax-free as long as your spouse is over age 59.5 and has met the 5 year Roth holding requirement. If the Roth is inherited by a non-spouse beneficiary, tax-free RMDs would start based on the beneficiary’s life expectancy. Please do your own research to get up today IRS rules and guidelines to help prevent additional taxes or penalties.

Note: At the time of this writing, the non-spouse inheritance rules are in flux so please check the current rules for this kind of account with the IRS.

Basic Portfolio Distribution, With Roth Conversions

The graphic below represents our current total portfolio with all 5 accounts funding our expenses during retirement. This time, look at how those green bars take over! With Roth conversions, 99% of our portfolio’s final balance will fall in our tax-free accounts. By the time the remaining balances of my IRA and Roth transfer to Ali’s IRA and Roth respectively, there’s a fabulous store of tax-free money to fund Ali’s vampire lifestyle (or be passed on to our beneficiaries after we die).

Ordinary Income + Capital Gains, With Roth Conversions

Roth conversions are taxable. However, we do not plan to use the conversions to live on anytime soon since we plan to live on dividends, capital gains, and original cost basis from our taxable account for the immediate future. The Roth conversions are a way to avoid having the IRS control what money we withdraw from our portfolio and the timing and amounts of our withdrawals. Most of all, we want to avoid letting the IRS force us into a high tax bracket.

Changes Across Our Complete Portfolio, With Roth Conversions

The following graphic goes into greater detail showing how all of our various income types are affected by making annual Roth conversions of $60k. This is a well managed portfolio that doesn’t get hit by any dramatic cliffs and maintains our preferred tax brackets. And in this scenario there’s nothing imposed to limit our income stream options.

Side-by-Side Comparisons

With No Roth Conversions — this is not appealing!

- Portfolio Ending Balance: 88% of our total portfolio eventually lands in our taxable account.

- RMDs: Large RMDs when we are 70.5 years old push our total taxable income into higher tax brackets.

- Taxes: Our ordinary income rates will most likely be 22% along with 15% taxes on capital gains.

- Legacy: Taxable accounts get a step-up in cost basis for beneficiaries.

With Annual $60K Roth Conversions — yes, that’s much better!

- Portfolio Ending Balance: 99% of our total portfolio ends in our tax-free accounts.

- RMDs: Early Roth conversions prevent all RMDs.

- Taxes: Ordinary income rates stay within the 12% tax bracket, maintaining access to 0% capital gains. Additionally, if we need to harvest equities with higher gains we will be harvesting and paying taxes in the 15% capital gains bracket instead of the 22% ordinary income tax bracket.

- Legacy: Roths can be inherited tax-free by our beneficiaries.

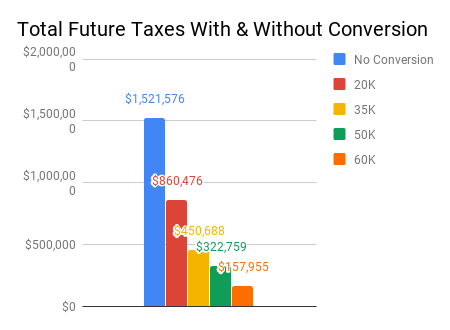

Bonus for Our Lifetime Taxes

Probably the most surprising result of this research was realizing how different our taxes would be because of Roth conversions. My Test 1 example with zero Roth conversions resulted in the highest overall tax obligations between now and Ali’s death at age 100 (yes the vampire thing is still an option), at over $1.5 million paid in taxes! That’s painful, especially since the majority of tax obligations would occur in our later elderly years with RMDs and social security on top of our qualified dividends. That’s clearly the way to create a perfectly-horrible-tax storm! No thank you!

My Test 2 example with $60k in annual Roth conversions starting now in 2019 yielded the best result for total taxes due. By making these really big Roth conversions we shift the long term growth of our portfolio over to our tax-free Roth accounts. And with a lower overall tax obligation of just under $157k, it’s easy to see that starting early Roth conversions of $60k annually will produce the lowest tax drag on our portfolio. This option is clearly the winner in terms of controlling our destiny and saving on taxes!

Besides the 2 examples I included in this post, I did an additional round of tests on 3 other dollar amounts for our annual Roth conversions to see how that would change our tax obligations. The graphic below shows all 5 of the Roth conversion calculations I tested with their tax obligations.

In Conclusion – hell yes we are starting Roth conversions immediately

Clearly I picked the two biggest extremes to test. In reality we will start with a $60k Roth conversion this year, with 75% of that going from my IRA to my Roth, and 25% going from Ali’s IRA to her Roth. And every year instead of blindly sticking to a routine I will enjoy recalculating the level of Roth conversion to make depending on our current tax year needs and opportunities. For instance, we might make a lower conversion if there is any capital gain harvesting we want to do when selling equities to pay for a following years expenses. Or we might choose to max out the 12% bracket if the market is down and convert over more shares, at lower per share prices, as we will be transferring equity positions when making the conversion not cash.

But the bottom line is, we are beginning Roth conversions now and intend to keep them going at higher amounts until our IRAs are completely emptied, prior to when we hit age 70.5. In the end, we will have more control over our tax brackets and income streams if we avoid RMDs and start paying attention now to the timing of when we dip into our various income streams as well as social security.

PS – here are a couple of links to fun tools if you want to play with tax brackets yourself:

We are not certified professionals. For more information about us please read our Disclaimer.

As per usual another excellent, highly detailed, quality blog post which full of actionable content. Great stuff !!

LikeLike

Thanks! This one took a little longer to write as we wanted to be as accurate as we could knowing all tax laws could change and the market is unpredictable. We learned a ton both regarding Roth conversions and how to program Google Sheets. We feel so much more informed now.

LikeLiked by 1 person

Wow! Great post. This is very detailed. Thanks for sharing your experience and research with us

LikeLiked by 2 people

Thanks! I was really shocked at my test results. But now I can start to see where we’re going to get cornered by taxes in the future.

LikeLike

This is a fantastic post! Thank you for the research and great information. Looks like you have your course mapped out– Congrats!

LikeLiked by 1 person

Thanks! We had a ton of fun doing all the research and the results were so interesting.

LikeLike

Forgive my lack of knowledge, but aren’t there costs associated with conversions? Don’t you have to pay taxes on the $60k in the year it converts? Or is that already considered in the 12% bracket?

LikeLike

That is correct. As I mentioned in the post you must pay taxes on the amount you convert each year you convert. See Test 2, under Taxes. “We will take up most of the 12% tax bracket with $60k conversions”. The idea is that the portfolio will not have grown as much earlier on so by doing big conversions now, we can stay away from even higher tax brackets, 22% plus, on a lower portfolio balance. We will have to pay taxes on moneys coming from those IRAs at some point, but I would rather pay 12% in taxes now than 22% and/or higher in the future. And we will have in our current year’s budget enough to pay those taxes without any real hardship.

LikeLike

It’s tax-deferred, not tax-differed.

LikeLike

Noted. Now let’s see if this 55 year old Dyslexic can remember. Cheers.

LikeLike

[…] A&A: We fund our nomad lifestyle through dividends and capital gains across our portfolio. We each have a 401k rollover IRA, and we each have a Roth IRA, and we also have a joint brokerage account. Our investments are in index fund ETFs and we follow a simplified allocation using a five-fund portfolio format that we derived from the Bogleheads three-fund portfolio. For more information about our portfolio you can check out our blog: Visualizing Your Money, and Avoiding The RMD Cliff. […]

LikeLiked by 1 person

Thank you!

I have been trying to figure this out. I converted most of my husband’s IRA over the last five years. He turns 70.5 next year. I haven’t converted any of mine(62). I considered converting mine within the 12% tax bracket for the next four year(hoping it stays at the same tax level). Your graphs and work confirm my gut feeling.

My next question is where to get the money to pay the 12% tax on the conversion. I am thinking of taking it from my taxable account, but mine is not near as large as yours. I have until April to figure that out.

Do you realize that finding this information is almost impossible?

Good thing GetRichSlowly posted a link to your blog or I never would have found you! Your blog is enlightening and well written.

LikeLiked by 2 people

Thank you so much for your comment. I wanted to take a deep dive into this topic because I was not finding satisfactory information on the RMD cliff either. And I wanted to see if I could really show in a measurable way the ramifications of The Cliff. I am by no way an expert in this so do talk to your CPA or find one who really understands what you’re doing. But good for you to be tackling this while you can.

You are correct, we will be paying all our taxes out of funds from our taxable account at this point. And depending on if we will be settling in the US in the near term, we will have to reduce or even stop conversions to qualify for lower ACA premiums. So its bit of a moving target down the road.

I’m glad you’re found us and are enjoying the blog. We’re having a lot of fun and learning a ton. Cheers!

LikeLike

[…] actually do not plan to use our rollover IRA accounts for our living expenses. We plan to consolidate our rollover IRAs into our Roth accounts. We started making Roth conversions in 2019, and at this point we intend to make additional […]

LikeLike

[…] Roth Conversions: The amount of taxes we pay on Roth conversions is actually something we can control. In any given year I can choose to convert $1k or $10k or $60k from our IRAs to our Roths. And I […]

LikeLike

[…] Related post: Avoiding the RMD Cliff […]

LikeLike

Like!! Great article post.Really thank you! Really Cool.

LikeLiked by 1 person

Thank you very much.

LikeLike

This level of awesome and useful analysis gets the wheels turning! I’m excited now to run my own calculations and projections! Thank you so much for sharing the information 🙂

LikeLiked by 1 person

This part of our finances is an obsession for us. I like challenging the cookie cutter answers to questions like this. And then just have fun with it all.

LikeLike

Dear ali and Alison, that is a great post and I am really impressed with your calculation and anticipation, I must admit that you lost me a bit in the middle but I got an good understanding overall. 2 questions though: only the IRA can be transfer to Roth or you could as well transfer some revenue from your regular brokerage account to you Roth. as well when you are retrieving Can you still send some of you active income to you IRA to defer tax later?

thank you very much for your postes

LikeLiked by 1 person

The Roth conversion that we are talking about in this post is one thats done after you finish work and no longer have any earned income. You can only add to a 401k, IRA or Roth if you have earned income. This Roth conversion can be done after you stop working but you do have to pay income tax on it as these funds are added pre tax. And you can convert as much or as little as you want. It all depends on how much you want to pay in taxes.

But prior to leaving work, you can contribute to a 401k, IRA and or Roth each year. It depends on when you want to apply the tax deductions or reductions. Contributions to 401k’s and sometimes IRAs lower your taxable income in the year you make the contribution. But Roth contributions are only made with taxed money so are not tax deductible. But 401k’s and IRA distributions do become taxable down the road whereas Roth distributions are not taxable.

Which accounts you have access to during your working years will dictate what you can contribute to over time. It just so happens we had access to 401k’s and put the lion share of our retirement contributions in those accounts. Which means we might have very high Required Minimum Distributions by the time we are each 72. Roth conversions should help with that in our case if we can do them early enough, but they aren’t necessary for everyone. Again, it all depends on which account types you have access to and how much disposable income you have over time to save to those accounts.

Cheers, Alison

LikeLike

[…] early Social Security at 62 in order to preserve our investment portfolio. We also want to make annual Roth conversions to move funds from our traditional IRAs to our Roth accounts, which increases our taxable income today but will also reduce future required minimum […]

LikeLike

What a great detailed post! I love it. My husband and I are just starting on our FI journey, and we have considerable amounts in our traditional IRAs. I would like to run the same simulation you did. Would you mind sharing your spreadsheet for running the simulation? Thanks a bunch!

LikeLiked by 1 person

Hi Rosana, Have you actually retired yet?? Depending on your timing, you might consider stopping your contributions to your 401k or IRAs and invest that money in a brokerage account to reduce your future RMDs and have more cash available for when you do retire. But each persons situation is very different and has a lot of factors to consider first. We ended up with 50% of our net worth in brokerage and 50% in tax deferred accounts. Unfortunately, we don’t share our BIG spread sheet with folks. Do go have a look at our coaching section for other resources that we do share as well as other calculators. Then drop us an email if you have more questions. Cheers!

LikeLike

Thank you for your reply, Alison. I became a stay at home mom last year and my husband would like to retire in 10 years. We have already agreed to stop our 401k and IRA contributions, and put those funds towards a brokerage account. We are so excited. I will definitely check out the coaching section.

LikeLiked by 2 people

Sounds like you all have a lot to be excited about. For us once we set a timeline that seemed to really change things for us both in terms of our plans and also in terms of our progress. We look forward to chatting with you more!

LikeLike

[…] our early retirement years while we are hopefully in a lower tax bracket. In our case, making annual Roth conversions and paying taxes on those funds now helps us moderate our lifetime tax obligations by reducing our […]

LikeLike

Found out about fire, then subsequently quit my job to retire early all in the same month, and I’ve been so vary confused about taxes and roth conversion ladders and Why to Do it. Your graphs and straight forward way of explaining and comparing doing vs not and how ordinary income vs cap gains all stack is priceless. I feel like I understand this all so much better now. (also as a complete ungoal of the article but an amusing aside I now understand inflation better when I compare those numbers to the new 2024 brackets, made it really concrete that inflation is real!)

LikeLiked by 1 person