(When to start taking Social Security)

We are not certified professionals. For more information about us please read our Disclaimer.

Since our FIRE journey helped us retire early in 2018 we have been able to talk to a lot of amazing people about our money and travels, and theirs as well. In this post I’m sharing some of the lovely messages we’ve received from folks we’ve interacted with this year. These messages spur us on to keep talking to everyone we meet about our individual choices and dreams surrounding money, financial independence, and early retirement.

These types of conversations help our community share ideas and find new ways to put money tools to work to achieve our hopes and dreams. In some cases we’ve worked one-on-one in depth with people, and in other cases our paths have crossed and allowed us to meet in person to share stories. In each case these interactions have helped us make each other’s lives a little better, and anyone having success inspires me to keep learning and sharing.

To be clear, we would never tell someone else what they can or can’t do but we are happy to listen and talk about what we might do ourselves in case that is useful for them.

Below are just a few notes we’ve gotten recently with most names changed for anonymity.

Aloha Pearl: “You guys are so inspiring! I’ve been more conscious about saving even more since I’ve been following your journey.”

RunWild: “Thank you for all of the input on getting out of debt! Also, I have really enjoyed bouncing ideas around with you and getting your input on all of my wild thoughts about different jobs and new business ideas I could get into.”

Girl Without Boarders: “You have inspired me to start focusing on saving and investing and planning for retirement, and I’m grateful for your input on investment options. I’m also grateful for the inspiration and advice about following my own hopes and dreams.”

Rainbow Mom: “Since I last saw you a year ago, I’ve paid off all of the 85k I had in debt and am now at a point where I can save 60%+ of my income. I’ve been getting acquainted with the blogs, books, podcasts, etc in the FI community. If I hadn’t met you, I may have never discovered FIRE. I cannot thank you enough. You helped me discover a path that gives me not only a sense of strength and security, but also joy about the future I’m thoughtfully creating.”

Two Moms & Two Kids: “My 401k Rate of Return is currently over 17% this year! It’s been fun to watch that gradually get a bit higher since you helped me reallocate funds earlier in the year. We really appreciated chatting with you guys. We’ve somewhat felt lost the past several months with trying to figure out what to do, but it helps talking it out with others. Moving to a new home is what makes the most sense right now, just have to get my heart there. We appreciate all of your advice and help!”

Mom: “I’m so grateful for all you do to help me and our family.”

(This one is not anonymous. Yup, thats my mom!)

Case Study: The Wannabe Retiree

One note we got was from someone in the US who selected their own code name, the Wannabe Retiree. I thought the Wannabe Retiree’s circumstances were an interesting puzzle so I agreed to take a deeper look at their numbers.

Here’s some info from the Wannabe Retiree:

Dear All Options Considered,

I have several questions that I’m trying to figure out relating to quitting my current job and taking Social Security. I would really appreciate your input.

1. When should I retire?

2. Do I have “enough” money to quit my job?

3. When should I take social security?

4. Should I pay off my home and stay there? Or should I sell and either buy a lower cost home or rent?

Here are my details… I am 63 years old and will hit full retirement age 66 years + 4 months in January of 2023. I’m in good health. Based on other family members, I assume my lifetime expectancy is around 82 years old (meaning I would die by 2039). I’m single with no kids and I don’t plan to leave any money to anyone when I die. My full Social Security benefits would be about $2,200 a month. I’m currently still working full time. I don’t have access to a 401K but I do put $7,000 in a Roth IRA every year. I have $19,000 in a rollover IRA and $131,000 saved in my Roth IRA. I own my home worth about $240,000 with only $32,000 left to payoff the mortgage. My plan was to payoff my home and stay there “forever” but I am willing to consider other options, including selling my home and moving to a different location. My total expenses for 2019 are $30,000. Once I stop working I could probably lower my expenses a bit more as I come from a naturally frugal family. My current salary is about $40,000 a year and my employer pays 100% of my high deductible health insurance premiums. I have no credit card debt and I own my car outright.

Although there are some good things about my job, there are a lot of bad things I have to put up with in my workplace regarding politics and discrimination, so I want to leave this job forever in another year or two at the most. At this point I have to admit I’m getting burned out and would really like to consider being done with my job at the start of 2023 at the very latest. But I am also willing to work part time in retirement as long as it’s not continuing to work for my current company.

I would appreciate any thoughts you might have.

~The Wannabe Retiree

Break it Down and Build a New Plan

I was impressed with all the detail the Wannabe Retiree provided and I can tell they are really motivated to make a plan that works for them so I was excited to get involved and get to know them a little better.

Before we move on, let’s look at other information out there to see how similar or different the Wannabe Retiree might be within their own age bracket nationwide.

According to research by the Federal Reserve as quoted in a very recent post on SmartAsset, the median balance in retirement accounts for folks in the 55-64 age bracket is $104,000. This SmartAsset post also quotes average monthly Social Security benefits for the 55-64 age range as $1,354.04.

The Motley Fool has a post updated in 2018 quoting US Census Bureau data that shows homeowners in the US who are between 55 and 64 years old have a median home equity of $97,000.

2016 data from the Bureau of Labor and Statistics as quoted in an article by USA Today, shows the average US household run by someone over 65 spends about $45,756 a year to cover expenses.

Assuming no debt other than mortgages, which could skew these numbers, the data in these various posts gives us a baseline to work with. Our baseline for the Wannabe Retiree’s age bracket has a target net worth of $201,000, a monthly Social Security benefit of $1,354.04, and household expenses around $45,756. This baseline also makes me feel better “calibrated” and ready to work on the Wannabe Retiree’s project!

DISCLAIMER: Remember, the All Options Considered blog and our posts are shared for entertainment purposes only and to generate conversations. AOC is really just Ali and Alison Walker. We do not have professional credentials in the areas of personal finance, and nothing we share on our website or our social media is intended as professional advice or guidance. Please seek professional advice as appropriate.

The Wannabe Retiree’s Numbers

Consumer Debt

Car loan: Zero!

Credit card debt: Zero!

Net Worth

Rollover IRA: $19,000

Roth IRA: $131,000 (+ $7,000 per year worked until retirement)

Home Equity: $240,000 – $32,000 (mortgage) – $15,000 (sales commission) = $193,000

Total: $343,000

Annual Expenses, inflated by 2% each year

2020: $30,600

2021: $31,212

2022: $31,836

2023: $32,473

Social Security data from the IRS

Early Social Security at age 62 (2019): $1,571/month or $18,852/year

Full Social Security at age 66+4 months (2023): $2,131/month or $25,572/year

Delayed Social Security at age 70 (2027): $2,806/month or $33,672/year

The 4% Safe Withdrawal Rate

and 25x Living Expense Rules

There are two well known formulas in the FIRE community used when considering the “do I have enough” question. The 4% Rule looks at what you’ve saved and multiplies it by 4%, theorizing that if you can live on only 4% of your savings each year you have enough money to retire. The 25x Living Expenses Rule looks again at how much money you’ve saved and compares that to your estimated living expenses, theorizing that if your savings holds 25x your living expenses you have enough money to retire. These two concepts are trusted by many but not by everyone (and not by us). Still they are something to start with.

For more reading on these and other FIRE concepts check out the posts below. This Mr. Money Mustache blog post supports these concepts, while this post from Our Next Life challenges the idea that these concepts are infallible.

And for the real money rats out there, of which I am one, if you haven’t already reviewed the Trinity Study that started it all you might want to check that out.

I will also add that personally Ali and I do not see these 4% and 25x living expenses concepts as foolproof and we do not believe they are a good fit for everyone in every circumstance. We were not comfortable with 4% and 25x for our FIRE number. We were comfortable with 33x living expenses for our own retirement portfolio.

Playing Money Crush

As a first step in playing Money Crush with the Wannabe Retiree, I ran three tests with their numbers using the 4% and 25x living expense rules. Throughout this process I wished I could sit down together in person with the Wannabe Retiree to talk through everything. But we actually did just fine using video chats, messaging, and sharing files on Google Drive.

Test 1: Investments Alone

The first thing I did was add up the Wannabe Retiree’s net worth, not including home equity. Then I looked at living expenses for their full retirement age in 2023. Then I calculated the baseline 25x annual living expenses.

| Rollover IRA + Roth IRA | $150,000 |

| Annual Living Expenses (2023) | / $32,473 |

| Compared to 25x Living Expenses Rule | = 4.6x |

Test 2: Investments + Home Equity

Once I had the investment only numbers in front of me it was clear there’s not enough money to retire and live off of the investments alone for the next 20 years or more. And there was no need to get worried since there was still a lot more digging to do. The next thing I did was run their numbers again including home equity in hopes that it’s possible to make this all work by unlocking the illiquid money in their home. I know from my own retirement planning process that liquidating a home and putting the proceeds to work in someone’s investments can generate accessible passive income to help cover annual living expenses. I ran this calculation using a $193,000 net for the Wannabe Retiree’s home after paying off the mortgage and covering realtor fees.

| Rollover IRA + Roth IRA + Home Equity | $343,000 |

| Annual Living Expenses (2023) | / $32,473 |

| Compared to 25x Living Expenses Rule | = 10.6x |

Test 3: Investments + Home Equity + Social Security

The third test was adding other anticipated income streams like Social Security into the equation. I started with their estimated full retirement number to find the gap number that Social Security won’t cover.

| Annual Living Expenses (2023) | $32,473 |

| Annual Full Social Security (2023) | — $25,572 |

| Gap Number | = $6,901 |

| Rollover IRA + Roth IRA + Home Equity | $343,000 |

| Revised Gap Number | / $6,901 |

| Compared to 25x Living Expenses Rule | = 50x |

That’s what we are looking for! Let’s Party!

The Wannabe Retiree’s Manageable Gap Number Means There’s Enough to Retire in 2023!

I can imagine this as some fabulous back-of-the-napkin math at a little diner where me and the Wannabe Retiree might be having a chat over a yummy brunch. And I also imagine us whooping it up at this point because with these calculations the Wannabe Retiree has enough to retire in 2023!

What About Common Assumptions?

Hang on now! After whooping it up I reigned myself in and got back to work. There are some big assumptions in those calculations. What if the Wannabe Retiree doesn’t want to sell their house? And doesn’t everyone say it’s better to wait to take social security until you turn 70 years old? Won’t the Wannabe Retiree be missing out on an 8% increase in Social Security if they take Social Security before age 70?

A lot of the information about retirement and Social Security I have found online is “average” advice. That doesn’t take into consideration an individual’s specific and unique circumstances and what it took for them to get to where they are now. Instead of using that generic advice it’s helpful to look at the real numbers a person has to work with, which reminds me of the Apollo 13 team trying to get back from their trip to the moon. NASA built an incredible plan but when things went sideways the team brainstormed using anything and everything in the space capsule while they were hurtling through space and they came up with a creative solution that landed the crew safely back on earth. They may not have landed on the moon but they overcame intense challenges and made it back home. I would say that was a successful mission.

We all take different paths through life, but we have common goals to find some happiness and be fulfilled. And from what I see the Wannabe Retiree has been able to build, save, and maintain enough wealth to retire and they are going to be OK.

But that’s not the end of the story! Once I had this first run of numbers I started testing them against some of the common assumptions and a unique plan started to evolve.

1. Do you want to leave money for anyone when you die?

As a single person with no kids, the Wannabe Retiree is telling us they don’t have a burning desire to leave a legacy to anyone in particular at this point. So their whole net worth will be accessible for their needs between now and “you know when.”

Side note: In my family we use “you know when” to indicate when someone will likely die. That’s how my Mom and Granny used to talk when they were doing life planning together, that’s how my Mom and I talk today, and that’s also how Ali and I talk with each other as well. It’s just a little more fun for us to say, “you know when” and wink in these kinds of conversations. So we’re going to adopt that here because if you let me run your numbers, you’re family!

The Wannabe Retiree says most of the older generations in their family have lived to be between 82 and 85 years old. That’s the perfect assumption to work with in our calculations because according to the IRS Uniform Lifetime Table, the life expectancy for the Wannabe Retiree is 85 years old. Since the Wannabe Retiree prefers to use 82 for themselves I decided to test the health and growth of the Wannabe Retiree’s portfolio when they are age 82 in 2039 as an anchor point. Since this is just an assumption I also decided to run the numbers on their portfolio through age 95 to see if they will run out of money before that age, because “you know when” might happen much later than they assume.

2. Should home ownership be included in the calculation?

In the Wannabe Retiree’s situation accessing their home equity is key to the success of their retirement plan. They have built and maintained some healthy equity in their home over time. Moving their home equity into passive index funds could produce enough income through price appreciation and dividends to more than cover their gap number. My calculations using their home equity moved them from only 10.7x their living expenses to an impressive 50x their living expenses gap number. Additionally, if they aren’t locked into their current home they will have more flexibility to move as their needs change over time. After all, a person’s home is more than just housing.

The Wannabe Retiree initially said they had assumed they would pay off their home and live there after retirement. Though when I asked more questions it became clear that if all options are on the table, they are open to moving to a new location. Right now the Wannabe Retiree lives in a state that collects a state income tax. If they move to a location with no state income tax that would give them a slight raise in net disposable income.

3. When should you take Social Security?

I do not automatically follow standard generic advice when it comes to money, or anything else for that matter. Since the Wannabe Retiree asked how long they should wait to take Social Security, I decided in order to answer that question I should build a complicated spreadsheet with their real numbers and a series of different potential ages for taking Social Security. Building spreadsheets makes me VERY HAPPY!

Each of the three options detailed below for when the Wannabe Retiree might take Social Security includes a 1% COLA increase to the associated Social Security payments. These estimates assume that the Wannabe Retiree will get 100% of their Social Security payments until “you know when.” I have also run an option (not shown in this post) that includes one of the scenarios most feared, which is a 25% drop in Social Security payments in the year 2035 to further stress this test. This article is worth reading to learn more about COLA and the penalties of working and taking SS before your full retirement age.

4. How do we calculate growth and inflation?

The portfolio performance in my spreadsheet estimates a 6% nominal equity growth rate for investments with 1.8% dividends and a 2% inflation rate. That growth rate is decreased by the inflation rate to a 4% real rate in all calculations. Annual living expenses are set to increase by a 2% inflation rate over time in the following examples. Also, this is a great post on the difference between nominal and real returns.

5. What’s the best drawdown order?

At this point the Wannabe Retiree has two retirement accounts, a rollover IRA from a previous job with a balance of $20,000, and a Roth IRA with a balance of $131,000. Their retirement plan really comes together if they create a third income source by selling their house and investing the proceeds (which we have estimated at $193,000) in passive index funds in a broker account. Selling the house would be a tax-free event since this is their personal home and not a rental property. Here’s another take on deciding which assets to spend first in retirement.

If these were my accounts, I would go with this as the drawdown order:

- Rollover IRA: Distributions from this account are taxable events. However, if withdrawals are only up to their personal deduction which is $12,200 + $1,300 since the Wannabe Retiree will be over 65 years old by 2023, that would be tax-free money. The Wannabe Retiree only needs about $6,901 in the first year for gap money. These withdrawals can continue for about 2.5 years until the IRA is empty.

- Taxable broker account: After the rollover IRA is empty the taxable broker account can be tapped. Withdrawals from this account can continue until these funds run out, which I estimate lasting to cover the gap number until 2045. That estimate is based on a perfect world for things like the market and the Wannabe Retiree’s health so we are taking that estimate with a grain of salt. My goal would be to pull from this account for as long as possible to allow the Roth to grow and percolate in the background.

- Roth IRA: I wouldn’t tap this account until the rollover IRA and broker account are both empty. Any growth or dividends in this account are not taxed in the year they occur or even when withdrawn. The longer we can let these funds bake the better. The best part is that withdrawals will be tax-free when the Wannabe Retiree dips into this account for living expenses or to cover a larger one-time expense.

Let’s Take a Deep Dive into the Spreadsheet

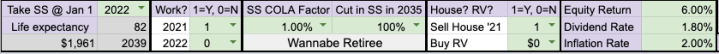

My spreadsheet for the Wannabe Retiree identifies all of their existing and projected taxable, tax-deferred, and tax-free accounts. It assigns equity to bond ratios and calculations in the accounts based on the Wannabe Retiree’s risk tolerance and retirement timeline. It recalculates based on the timing of Social Security benefits. It also examines safe withdrawal rates with all of the variables mentioned above. The big question for the Wannabe Retiree to answer next is their timing for taking Social Security. I have included three of the options we worked through in depth within my spreadsheet to illustrate the way their portfolio and retirement timing tested out.

Option 1: Start Social Security in 2023

In this first option the Wannabe Retiree would sell their home in 2021 and invest the net proceeds immediately. They would continue working through 2022 and start taking Social Security in 2023.

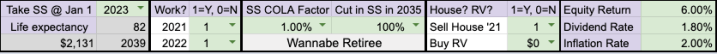

Social Security Lifetime Max vs Overall Portfolio Health

My spreadsheet for the Wannabe Retiree includes the following graph which compares the lifetime Social Security payment total to total portfolio value when the Wannabe Retiree is 82 years old, to test the overall performance of the portfolio as different levels of Social Security are introduced. Running the test for age 82 also corresponds to the early part of the range the Wannabe Retiree estimates for “you know when.” We have to keep considering the timing of their death since we’re trying to keep it real here.

In this example we are assuming the Wannabe Retiree will work in 2021 and 2022, then retire and take Social Security in 2023. This combination yields the highest portfolio balance in 2039 when the Wannabe Retiree is 82 years old.

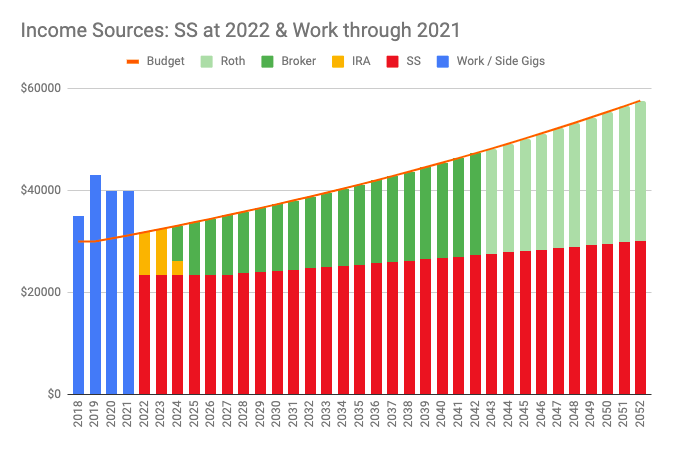

Income Sources

This next graph below illustrates each of the income sources available to the Wannabe Retiree if they work through 2022 and start taking Social Security in 2023. The IRA gets tapped to cover the gap number from 2023 to 2025. After that they tap a minimal amount from the broker account. The Roth IRA is not tapped until the broker account is empty. The majority of living expenses are covered by Social Security leaving as much as possible of the broker and Roth accounts to keep growing for a few years. Ideally, according to current tax laws, this combination of income streams will not be taxed which would result in a small additional raise in the Wannabe Retiree’s disposable income.

One of the best ways to avoid sequence of return risk is to spend non-market assets like cash, CDs, rental income, annuities, pensions, or even Social Security first.

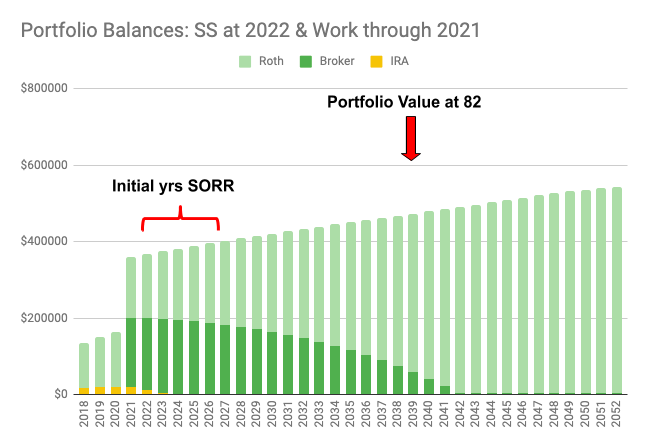

Avoiding Sequence of Return Risk

It’s important to pay attention to every plan’s vulnerability to sequence of return risk (SORR) in a situation where securities or stocks need to be sold in a down market thereby locking in losses. If this occurs for too many years in a row, it would be difficult for many portfolios to recover. SORR is most worrying at the beginning of retirement around the first 5-7 years. If these kinds of withdrawals happen later in retirement most portfolios will have grown sufficiently to overcome the need to sell any down securities to cover living expenses. One of the best ways to avoid SORR is to spend non-market assets like cash, CDs, rental income, annuities, pensions, or even Social Security before touching market assets. From my perspective, one of the best arguments for taking Social Security before you turn 70 is to help smaller portfolios avoid too much exposure to SORR.

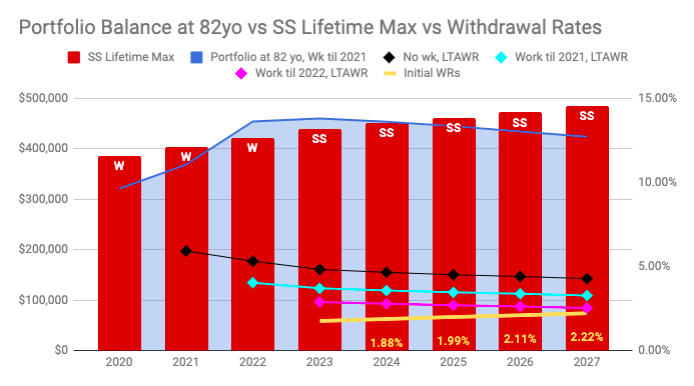

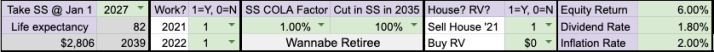

Option 2: Start Social Security in 2027

In this second option the Wannabe Retiree would sell their home in 2021 and invest the net proceeds immediately. They would continue working through 2022, but wait to start taking Social Security until 2027.

Social Security Lifetime Max vs Overall Portfolio Health

As in the previous option we are comparing the Social Security lifetime max premium total to the value of the portfolio in 2039 when the Wannabe Retiree is 82 years old. If they stick to the plan to retire in 2023 but wait to take Social Security until 2027, the total value of the portfolio will take a hit because they would be covering their living expenses by selling equities in their initial retirement years. The graph below shows the withdrawal rate jumping up to 11.11% by 2026! Once they start taking Social Security in 2027 the withdrawal drops to a much more reasonable 0.46% with a very respectable lifetime average withdrawal rate of 2.54%, which is well below the 4% Rule.

Income Sources

The graph below illustrates the four year gap between work years and the start of Social Security. In this example, much less of the portfolio has to be used to cover annual living expenses once Social Security kicks in because waiting to 70 years old creates the biggest lifetime max Social Security amount reducing the gap number at 70 years old.

Avoiding SORR

In this second option the portfolio continues to grow in the first two years after the house was sold and moved to a broker account while the Wannabe Retiree continues to work through 2022. But once the broker account starts getting tapped to cover living expenses, there is a dramatic downturn in the portfolio as the outflow of capital occurs. The Wannabe Retiree would have to be really careful about SORR in this situation. They can take a “watch and see” approach and delay Social Security as long as possible, or start taking Social Security if a prolonged down market occurs.

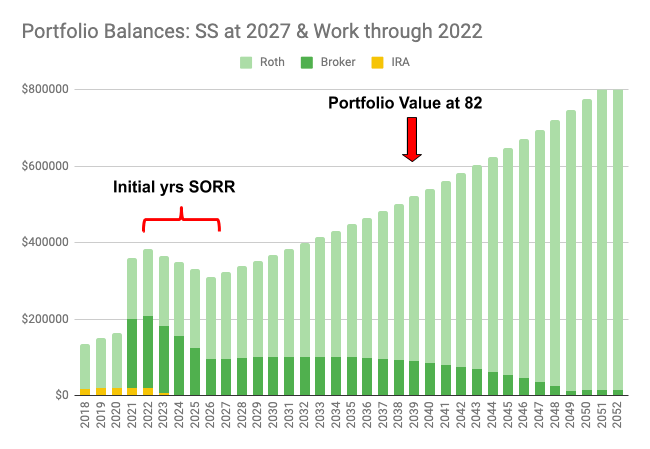

Option 3: Start Social Security in 2022

In this third option the Wannabe Retiree would sell their home in 2021 and invest the net proceeds immediately. They would continue working only through 2021, and start taking Social Security earlier in 2022.

Social Security Lifetime Max vs Overall Portfolio Health

With this third option we focus on the fact that the Wannabe Retiree said they were getting burned out at work and are ready to make a change in order to preserve their sense of wellbeing. So in this option we look at having the Wannabe Retiree retire from their current job and any full time work at the end of 2021, which is the same year their house should be sold and the proceeds invested in a broker account. This option also has them starting Social Security earlier in 2022. At that point the initial withdrawal rate or gap number is 2.26% with a lifetime withdrawal rate averaging around 4.04%. This combination in 2022 is right on the 4% Rule. This option also gives the greatest potential overall portfolio balance because of early Social Security and later withdrawals from their investments, creating more room in their portfolio to weather early market fluctuations.

Income Sources

Since this option doesn’t create a gap between retirement and the start of Social Security, there will be much less stress on the rest of the portfolio in the beginning of retirement. However, 2022 is too early to capitalize on full retirement benefits. So we need to keep that in mind to avoid any COLA surprises down the line.

Portfolio Balances

This third option protects the portfolio and allows it to grow much more than option 2 during the SORR window. However, it does not have the large growth curve shown in option 2 due to the reduced lifetime Social Security premium. But in this situation the portfolio is allowed to keep growing early on, creating a healthier portfolio should unexpected expenses or a down market arise before 2039, and I assume a down market will occur before then. Even though Social Security is taken much earlier in this example, the portfolio hits the $400k mark five years ahead of option 2.

Have we considered ALL the options?

There are other scenarios that I have run as options for the Wannabe Retiree to test their numbers, but I think I have pummeled you with enough bar charts for one post. What I have seen in the other options is that taking Social Security at full retirement in 2023 or even one year early in 2022 are both viable scenarios. And since the Wannabe Retiree indicated they would be willing to add some part time work in retirement for a couple of years, as long as it’s in a different job environment, that would go a long way to bolster the success of their retirement plan.

Next steps

In order to get the ball rolling immediately on their retirement plan, there are a number of actions I would take now if this was my situation so I am encouraging the Wannabe Retiree to get moving on the following steps in 2020.

- In the rollover IRA account, move all funds as soon as possible to safe short-term investments such as CDs or money market funds in preparation for these funds to be accessed in the next 2-3 years. The balance in this account is relatively small so moving to these types of investments now shouldn’t be detrimental to the overall growth of the portfolio.

- Sell the house by the end of 2021 at the very latest. If the Wannabe Retiree had to move into an apartment in their current location for a while after the house sold, they would probably be paying slightly more in rent than they are now with their low mortgage payments. But I don’t think the potential increased rent for a year or two would hurt their plan. I would invest the house proceeds as soon as possible in a brokerage account at 60/40 or even 50/50 equity to bond allocation.

- Right now the Roth IRA is invested at 70/30 equity to bonds. After the house is sold and the proceeds are invested in a broker account, I would quickly change the allocation in the Roth account to 80/20 or even 90/10 equity to bonds for a super charged 10 to 20 year tax-free growth horizon. I would be waiting to do this until we are sure they have sold the house just in case these funds are needed before the house is sold for any reason.

- Have a plan in case SORR hits your portfolio in your initial retirement years. The bond portion of the broker account can be tapped first. And depending on how long the down market lasts as well as the amount of funds left in bond investments, the Wannabe Retiree might use some of their bonds to buy lower priced equities to participate in the recovery of the market. With a 50/50 equity to bond allocation in the broker account, any drop in the market won’t hit that account as hard. Conversely, the Roth account at 80/20 will get kicked around in a down market but it will also have a longer time to recover before any securities need to be sold. Additionally, the Wannabe Retiree could pick up some part time work to help cover some or all of their gap number for a year or two in a really down market.

- Work on a plan for the timing of Medicare so you are informed and prepared to sign up for each part. It’s important not to miss the Part A signup window because that could cause a permanent increase in future premiums. Also consider adding a Medicare gap insurance plan. Additionally, Medicare drug plans also have a coverage gap that’s also important to understand. Medicare will for sure change your annual budget and I’ll be available to help you rework the numbers with this new information.

- Understand how social security is taxed along with your other streams of income.

- Understand how COLA increases are affected if you are taking Social Security early instead of waiting for full retirement age.

- Consider moving to a location with no state income tax.

This isn’t the end, it’s the Home Stretch!

I’m grateful to the Wannabe Retiree for sending me their numbers and trusting me with their questions. I’m happy to say I think they have some really good options they can tailor to fit what they decide is best for their retirement and portfolio. The Wannabe Retiree can definitely build a retirement plan that will meet their hopes and dreams sooner than they think.

Remember – run more than one test! When you run your own data to plan for retirement, always run more than one kind of test so you can see how it will fare under consistent growth, historical growth, or even Monte Carlo growth. Always remember to consider all the options or variables. And now it’s time for me to find other curveballs to further stress the Wannabe Retiree’s numbers, cause All Options Considered does not stop here. Cheers!

Bonus – FireCalc

All the calculations I’ve done on the Wannabe Retiree’s numbers have assumed fixed rates of portfolio growth, inflation, and spending. And we all know that’s not how the world works. To further test the numbers we can either use a Monte Carlo simulation calculator or a historical data calculator. One of the best, free, historical data calculators I’ve found is FireCalc. I entered all the data I’ve collected from the Wannabe Retiree and tested their numbers in FireCalc which works with 119 historical market cycles. The result is illustrated in the cool graph below.

Here’s the case study for the Wannabe Retiree within FireCalc.

FireCalc also gave the following summary.

Your spending in every year after the first year will be adjusted for inflation, so the spending power is preserved. Because you indicated a future retirement date (2023), the withdrawals won’t start until that year. Your contributions will continue until then. The tested period is 4 years of preretirement plus 26 years of retirement, or 30 years. FIRECalc looked at the 119 possible 30 year periods in the available data, starting with a portfolio of $350,000 and spending your specified amounts each year thereafter. Here is how your portfolio would have fared in each of the 119 cycles. The lowest and highest portfolio balance at the end of your retirement was $350,000 to $3,104,109, with an average at the end of $1,554,925. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.) For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 0 cycles failed, for a success rate of 100.0%.

Holy smokes that’s a lot to absorb! I’m going to have to break this up into chunks over some time so I may have a series of comments.

The one comment I want to start with is around the cost/benefit of selling her home. Yes, she gets perhaps 200k to invest – great! – but don’t her monthly expenses jump enough that it could be a wash or even a detriment to her plan?

I can’t articulate it well but it seems like this is a calculator/spreadsheet waiting to be built – $x cashed out vs $y change in monthly housing and expense over $z years.

LikeLiked by 1 person

Great question! It’s true that Wannabe Retiree has a low mortgage payment right now. But their house is also aging and they’ve noticed an up tic in maintenance costs. And home repairs would require adding to their debt or emptying their savings. But since their gap number is 50x living expenses after adding in the home equity, there is room to absorb an increase in rent and expenses once they sell.

Looking forward to your next comment! Thx.

LikeLike

Alison the number cruncher!! Want to run an analysis for us….??!? 😉 No seriously lol, amazing job!!

Incredible work and I appreciate all the numbers and visuals along with the depth you provided on this. Very interesting how taking SS early seems to be one of the “safer” options. I don’t think most people would have intuitively thought that but makes sense with SORR. We too are fiscally conservative and do not use the 4% Rule as our Safe Withdrawal Rate. Anything to preserve SORR is a win in our books.

My only 2 comments for Wannabee Retiree are:

1.) Beware that SS is not tax-free money so I would recalcuate using what you will NET from SS after taxes. As Alison mentions on part 6 of Next Steps – I would get a clear picture on how taxes will adjust your earnings. I am no where near SS age and do not understand the complexities completely, but my mom is a low income earner and still owes taxes on her SS payments.

2.) I would also try to calculate how your current housing costs will compare to your future housing costs if you decide to sell your home. Maybe they net will be the same and all of these calcs work out but if you have a low mortgage and instead decide to rent, you may end up paying more per month (or less as you now wouldn’t have property taxes, property insurance, HOAs, etc.). Again, I have no clue about your current housing set up vs your future housing but make sure you hash out that math too and reassess the calcs.

LikeLiked by 2 people

1.) I ran Wannabee’s numbers through Big ERN’s nifty google sheet found in a post he did on taxation of social security and it always came up with zero. And I admit I have lots more to learn regarding SS and taxes. https://earlyretirementnow.com/2019/11/13/taxation-of-social-security-tax-torpedo-roth-conversion-tightrope/

2.) I think the big concern with housing is, all though there is a lower mortgage, the house is starting to need some significant repair and up keep. So regardless, there will be some increased housing costs in the future. And with a gap number thats only 50x living expenses, there is room in the plan to absorb increased housing costs.

And sure I’ll run your numbers……… 😉

LikeLike

This sentence is blowing my mind: one of the best arguments for taking Social Security before you turn 70 is to help smaller portfolios avoid too much exposure to SORR

!! I never thought of it like that and had always planned to hold out til 70.

Can you think of some way to roughly estimate when it makes sense to pull SS to preserve retirement capital? As I think it over I’m realizing there are a lot of factors and it may not be possible to make a simple calculation. I’m ages away still but this is a really interesting idea.

I really like the way you broke down the numbers here, so much to ponder. I hope you do more posts like this.

Happy almost 2020!

LikeLiked by 1 person

One of the reasons I was tracking Wannabee’s portfolio value at 82 yo was so I had a way to “test” the future growth if they took SS at each year between 66 and 70 yo. In this case, the portfoiio always hit $400K at 82yo earlier when taking SS at 2023 because less was being taken out of the portfolio early on. And waiting to take SS at 2027 meant more was being with drawn from the portfolio so there was less capital to grow early on. I’ve not found a calculator online that shows this kind of model but it seams to be a reasonable way to test this question.

Glad you enjoyed the post. I had a great time working on it.

Happy New year!

LikeLike

This blew my mind in the best possible way. I’m so impressed! Fascinating stuff, and what a great result for Wannabe Retiree.

LikeLiked by 1 person

Thanks Sarah. It was so nice to see, when finding the Gap number, they had lots more flexibility. There are still lots of unknowns, health care being one. But I think they have lots to be excited about. Cheers!

LikeLike

[…] Considered (remember them from FIRE Community Guest Interview Series #2?) published this awesome Case Study post that I really enjoyed so I reached out to them to see if they’d be interested in doing […]

LikeLiked by 1 person

[…] In 2019 we had an equity to bond allocation of 75/25, and that’s about where our allocation is still. We were comfortable with that allocation since we had cash to cover our living expenses last year, and there was a continued bull market in 2019. The bond portion of our portfolio is important because it holds bonds as well as cash and CDs that we will draw from over the next few years as a way to protect ourselves from sequence of return risk (SORR). […]

LikeLike

I know I’m late to the game with this (and you’ve basically given this person a free financial plan, so kudos), but for what it’s worth, another wrinkle to consider for Wannabe Retiree is looking at a reverse mortgage and/or DIIA combo. See Dr. Wade Pfau, CFA’s analysis here: https://www.thinkadvisor.com/2016/04/06/wade-pfau-retirees-should-consider-reverse-mortgag/ and https://advisorperspectives.com/newsletters13/Why_Retirees_Should_Choose_DIAs_over_SPIAs.php

LikeLike

I hear you about a reverse mortgage. But, this person really wants to move from this very conservative town were they live for their personal wellbeing. The importance of which can not be over emphasized. But I will make sure this info gets passed along. Thanks!

LikeLiked by 1 person

[…] Below the main worksheet area are two more mini calculators. The first one helps you calculate how much of your expenses really have to be covered by this portfolio. Simply add all of your expenses, including any taxes and healthcare costs as well as your daily living costs. Then subtract any expected pensions, social security, or rental income. Boom, that’s your Gap Number. Now, enter in the Gap in the expense line and see how your numbers change. You might find you are 100% on track as we found in our case study for the Wannabe Retiree. […]

LikeLike

[…] find you’re closer to your goal than you originally thought. We found this to be true in our case study for the Wannabe Retiree. Thankfully, V3 of this calculator will do this automatically after you enter in all your […]

LikeLike