We are not certified professionals. For more information about us please read our Disclaimer.

I’m excited that our first year of retirement and also our first year of full-time travels is in the books! This will sound very cliche, but wow 2019 just flew by! When we left January 3, 2019 from San Francisco to Singapore it felt like an overwhelming adventure had begun. Getting through the first few weeks of constantly switching to new environments was difficult. I definitely had moments where I was thinking, “What the hell are we doing?” And now a year later we are in San Miguel de Allende in Mexico and our lifestyle feels familiar and so much easier than anything else I’ve experienced as an adult. We’re having a blast being Home Free.

What Was 2019 Like for Us?

We did a lot of traveling in 2019, and it felt slow and methodical just as I had hoped it would. We traveled to Asia, Europe, the Americas, and ended the year in Mexico City. We visited both our families in the US twice. We traveled with a friend in both Vietnam and Japan. We met up with other dear friends in London. We made new friends through one of my old coworkers in Vietnam. We met our first FIRE community friends in Chiang Mai and then saw them again in Glasgow. We took cooking classes in Chiang Mai and Quito. We attended a Chautauqua retreat and made a ton of new friends in our FIRE community. We had more picnics than I can count in France. We traveled with my mom in France and Scotland, and also had a visit with one of my sisters and one of our nephews on that trip. We marched my Mom to the top of Le Mont-Saint-Michel and then basked in the instantaneous weather changes on the Isle of Skye. We also housesat for 5 Dogs and 11 cats in 3 countries, accounting for 68 free nights staying in those places.

Our 2019 Budget

We started 2019 with a budget that I have to admit I totally made up. Really. When we decided we wanted to retire it was my job to find a way to build a budget. After doing some life planning at our Seabrook Summit we decided to stick with a budget that represented an average of what we had spent living in our condo in downtown Seattle between 2016 and 2017. We needed to cover ALL of our expenses: food, housing, travel, healthcare, taxes, and anything else within this magical budget.

The plan I came up with was to start 2019 with $65K cash in a savings account. That was the money we could spend for everything that year including all of our expenses listed above, things like birthday and holiday gifts and graduation gifts for our six nieces and nephews, other charitable gifts and donations, and any unplanned wild ideas like attending a Chautauqua retreat in Ecuador. And we were serious about sticking to our budget and our plan to live on cash – we were absolutely NOT going to pull money from any other account. Period. The plan was to be our normal frugal selves but not go overboard in restricting ourselves. Using our Seattle budget as a baseline for our early retirement budget would allow us to build upon and refine that for all of our other calculations as early retirees and full-time travelers. It was our stake in the ground.

When we decided to travel full time we had done a ton of reading to find other budgets from full-time travelers. There were some examples out there, though they tended not to include things like healthcare costs and other costs beyond just daily living expenses. In the end we felt comfortable with what I had built as a starting point for an all-in complete budget for our lives, and then we added some new cost savings goals relating to housesitting and travel hacking. We were confident we could make it work.

We Are Not Uber Frugal

To be clear, we are NOT uber frugal. We are frugal in that we rarely spend money on clothes, we don’t usually buy anything we can’t eat or drink, we don’t eat out in restaurants very often, and we don’t like to waste anything. Here’s how we’re not frugal: We like to be generous and we love to give tips. We don’t look at shared housing such as hostel dorms, we usually choose housing options where we will be comfortable in full apartments or homes with room to work on projects and cook full meals in the kitchen. And when our options are either a 17 hour bus ride or a 90 minute flight, we also choose the flight option. Though we do enjoy using regional busses for rides that are 5 hours or less.

Having a $65k spending budget, or $32.5k per person, will sound very high to some people and very low to lots of other people. We know there are lots of full-time travelers who can do the same type of thing we are doing, on a much smaller budget than we are using. We also know there are a lot of full-time travelers out there who have a much larger budget than ours. That’s fine – we are not in a competition.

We also are not backpackers, though we did try traveling only with backpacks for the first half of 2019. But again, that wasn’t our style. We were very happy to switch to roller bags after traveling as backpackers for 5 months. We have figured out like our friends the Senior Nomads with their pillows, that we need to bring a few items with us to every place we land in order to feel at home. For us, those things are mostly for the kitchen including our AreoPress coffee maker, some light-weight mugs and bowls, a half dozen spices, a cutting board, and a couple of good knives. The point is, after a year of full-time travel we’ve come up with a lifestyle that works for us. And everyone who enjoys traveling full-time has to find the specific budget, packing list, and unique routine that works for them. Practice makes perfect!!

Spoiler alert! Turns out we killed our budget in 2019, and even had a little surplus left at the end of the year!

The Numbers

And now for the juicy part of this post. The numbers.

Expenses Covered By Cash

We break our main spending into two major categories – Fixed and Variable expenses. Our fixed expenses are things outside of our daily travel costs, and include things like healthcare premiums, our little storage unit in Seattle, audio book and TV/movie streaming subscriptions, our one cell phone plan, plus our annual income taxes. We also include a generous budget for “giving expenses” in our fixed expense budget, with gifts for our six nieces and nephews, political and charitable giving, plus we cover some monthly bills for Ali’s mom. Our variable expenses are basically just our travel expenses, and include our housing costs, transportation costs, food, and fun extras like admission prices.

Expenses Covered By Points

We also try to use our credit card rewards, hotel points, airline miles, and other travel hacks to cover costs for flights, rental cars, and housing as often as possible. We track anything we have gotten for free with various types of travel hacks in a third category, as Points. To track the dollar value of any housesits we book I use a generic nightly value of $50 since that’s our average budget for housing per night across the year. And when we book flights using miles I note what the same flight would cost in cash on Sky Scanner or Google Flights.

2019 All-In Expenses

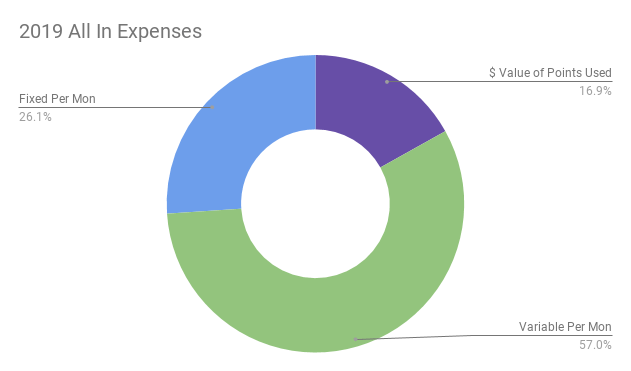

When we combined our fixed and variable expenses and factored in any Points we spent as well, we ended up with a combined All-In Budget. It includes $65K spent in cash, along with $13K in points redeemed (which is like cash saved from using points and house sitting) for a grand total of $78K as the value for our year in 2019.

With this all-in 2019 lifestyle number in the books we can see where our actual spending was directed in 2019. And 57% of our actual spending went to variable expenses, which are basically our daily living expenses, with only 26% going to our fixed expenses. And of course I’m thrilled that we used travel hacks to cover the equivalent of almost 17% of our travel expenses with points.

since that includes all of our housing and food costs, and other daily expenses.

2019 Expenses By Month

The chart below shows our individual expenses for each month. It’s quite thrilling to see all of the purple showing costs covered with travel hacking. On the flip side, the amount of green during our time spent staying with family and friends in June and September was surprising. We assumed time spent staying with family and friends would result in lower spending since we save on housing costs, but the net result tends to be higher spending due to much higher than average food and restaurant costs. For example, in June we spent 25 nights as guests with family and another 16 nights staying with them in September, but our variable expenses were still higher than average for those months.

Digging Deeper in Variable Expenses

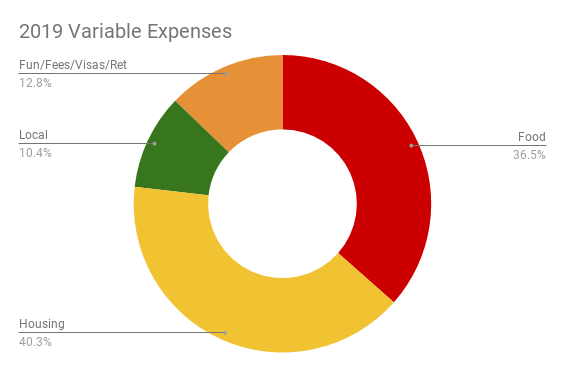

Our variable expenses totaled around $44k in 2019. The graphic below shows the four major categories we track within our variable expenses. We track exactly how much we spend every day on food, housing, fun, and local transportation. Housing is our biggest expense, though our housing and food costs are actually relatively similar expenditures. The bottom line is that we feel really good about our spending levels in these areas as they average out over the year.

that number goes way down when evaluated within our total all-in budget).

Variable Expenses by Month

Looking at variable spending for individual months tells a different story. Our spending was definitely impacted by the location we were in, and by whether we were on our own or visiting with others. The first four months of the year we were in Southeast Asia in lower cost of living areas. We were in Japan in May. We spent most of June staying with family in the US, and then at the end of the month we picked up my Mom for our three-month extravaganza together in France and Scotland. We had an amazing summer and enjoyed every minute and location we visited with non-stop family time, and before the summer was over we had already started planning our next summer in 2020. After we dropped Mom back in the US, Ali and I headed to Ecuador for 6 weeks. We were in Quito during the protests in October, and stuck it out in Ecuador as our ultimate destination was the November 2019 FIRE Chautauqua where we made a lot of new friends. From there we went to Panama for our first month-long housesit, and ended the year in Mexico City.

Bringing it All Together – Did We Hit Our Goals?

To be clear, we aren’t trying to win any awards for extreme frugality with our spending. When we were living in Seattle we were pretty frugal, and in 2019 we were basically living on the same budget max we had in Seattle in 2016, with the added expense of things covering our healthcare and dental costs without employers. We have a budget that works for us and we think it’s important to be honest with ourselves as well as our friends and family about that budget. And we enjoy making sure we keep our spending within that budget, even if it means turning down some fun opportunities like that trip to the Galapagos after the Chautauqua retreat.

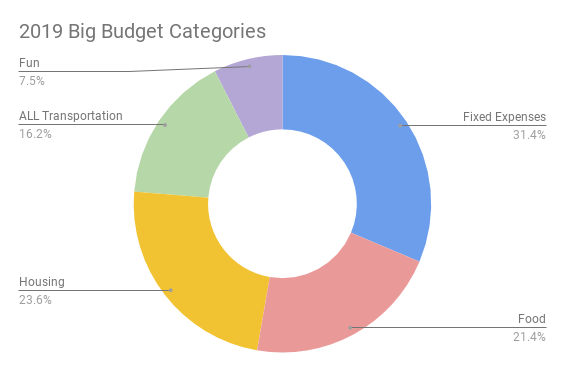

Once all of the numbers were recorded for 2019 I scrutinized our spending in two really basic ways. The first thing I looked at was our biggest single expense type, which is housing. The second thing I was anxious to see was our overall spending total compared to our original $65K cash budget max for the year.

Our goal for housing was simple, to keep our housing costs below 25% of our total cash budget. I was thrilled to see in the following graphic in my budgeting spreadsheet showing our housing costs at 23.6% of our total cash budget. I’m calling that a big success.

come in at 23.6% of our total all-in budget for 2019.

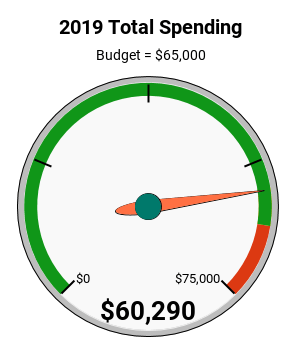

The second and most important question, was did we stay at or below our original stated cash budget for the whole year? Our goal was to keep our total spending for every single penny at or below $65K in 2019. I added up everything we spent money on, and I mean everything: transportation, Visas, housing, ice cream, clothes, luggage, deodorant, shoes, street food, my seven-course fancy birthday dinner, flying back to the US to take my Mom home from Scotland instead of flying straight to Ecuador, one-way rental car fees, Chautauqua fees, movie theater tickets and popcorn, Ubers all over Paris, cooking classes, a new porcelain crown for Ali (I don’t mean a tiara), an emergency room visit for me, gifts for our six nieces and nephews, some charitable giving, international medical insurance, and our US income taxes. In the end we only spent $60,290. I’m definitely calling that a big success!

Budgeting for the Unexpected

We expected to have some unexpected surprises in 2019, and in a way I feel like we got lucky. The biggest surprise was my emergency room visit and the series of medical visits that followed. I will write a separate post about the blood pressure issues I had in November, but the point was that I had to spend a day in the emergency room in Panama, then see a cardiologist, then have a few visits with a general practitioner, and I had quite a lot of medical tests between those visits. We also purchased a few months of one medication, and then gave them away to a small clinic when a doctor told me to switch to another medication and we had to stock up again.

Those were all unexpected medical expenses, and some stressful and uncomfortable days for sure. I guess it qualifies as bad news that all of those expenses didn’t even put a dent in our high deductible for our international medical insurance, so we paid for them all out of pocket. But really that was good news of course, and it’s also good news that we were in Panama instead of the US, so the costs were very reasonable. And of course I have a line item in our budget for out of pocket medical costs, so we had the cash on hand to deal with all of that.

Bringing Back My Favorite Budgeting Chart

We set aside cash for our 2019 expenses at the start of the year, so it was ready to spend or not as the year unfolded. The chart I used all year to track our spending during our travels is included below. The bars representing Fun, All Transportation, Housing, and Food show money we actually spent during each month. But the blue bars represent money we had set aside to cover all Fixed expenses. Amazingly, at the end of 2019, we ended up with a small surplus of unspent funds.

Welcome to 2020

I started working on this post at the end of January after getting our taxes done for 2019. Our taxes turned out to be a little more complicated than expected, but I’ll save those details for another post on our 2019 portfolio performance.

At the end of our 2019 travels what sticks out most to me is the fact that we stayed within our budget. We had some amazing travels on our own, we added the Chautauqua in Ecuador, spent lots of time back in the US with family and friends, plus we spent three months traveling with my mom in Europe! Looking back on all of our amazing experiences in 2019, knowing we did not use up all the funds we had set aside for the year was the best news of all. We were not pinching pennies, and we still ended up with $4,710 remaining from our 2019 budget. I actually did a little dance about that! What happens to that money? Well we’re not going on a shopping spree. That surplus immediately became starter cash for this year’s living expenses, so when I sat down to update our budget for 2020 and set aside our living expense cash for this year, I didn’t need to move as much cash over as anticipated. Now that’s something to celebrate.

While I was writing this post Ali was working on our travel plans for 2020 and we have a lot to look forward to. We have decided to stay in Mexico through the end of April, mostly within San Miguel, Puerto Vallarta, Merida, plus probably one other side trip somewhere we haven’t picked yet. After Mexico we are excited to spend time with some family and friends back in the US in May and June, with a couple of college graduations and other festivities to attend. Then we will start our summer travels with my Mom in Ireland, England, and Scotland, which I’m sure will be amazing. After that we have a second quick trip back to the US again to take Mom home, spend more time with family, and then we are attending FinCon in Long Beach (yay!). We’re planning to finish out 2020 in the EU using our 90 day stay allowance in the Schengen Area, most likely in Croatia, Portugal, and Spain. So much to look forward to! I will be tracking all of our spending to the penny along the way.

Happy one year anniversary to you both!!

LikeLiked by 1 person

Thank you!!

LikeLike

Great to hear you’ve done so well for 2019!

How are you liking San Miguel de Allende? Derrick and I have never been there yet, but everyone I know who has been there, loved the place.

LikeLiked by 1 person

Its fun. You can get really caught up in the Expat community if you are staying right in the heart of it all. We have been moving more and more away from the Expat areas so we can have a slower, more cultural experience. But we love the weather. Cheers!

LikeLike

Congrats on spending less than budgeted, that’s quite an amazing accomplishment, especially in your first full year of travel! Great job and best wishes on continued success in 2020!

LikeLiked by 1 person

Thanks Kelly! I know 2020 will be different in a lot of ways. Paying estimated taxes will be a big change, but continuing summer travels with my mom will be a wonderful thing to repeat. We are spending more time in the US this year compared to last year partly because we have a few graduations to attend, but our base plan will stay the same. I can already see we have a little challenge ahead in the tax department this year, but I will make it a game and learn as much as I can!

LikeLike

Super impressive and inspiring!!!!!

LikeLiked by 1 person

Thanks for that. I’m very happy that my original budget was padded a bit. Nice to be lucky in the positive side instead of the negative side for 2019. Stay tuned for how 2020 rolls out…….

LikeLike

This is great! I have always thought of housing as fixed expenses and never thought about it being variable for travelers. Also, yay fincon!

Roxanne

LikeLiked by 1 person

Lots of things we were looking at in our budget in last year have gone through massive changes. Like, we always include not just our travel budget but our base fixed expenses as well. This year I want to do a better job of tracking how much we are saving with points, and if we stopped travel hacking it would be a very different story. For us these kinds of things are similar to disclosing money you also make money on your blog. We don’t currently make money on our blog and we don’t want to at this point, though we could change our minds of course. So from here on out, we will include more detail on Points value “spent” and what that has saved us.

Cheers and see you at FinCon!

LikeLike

I look forward to reading about your travels in 2020.

LikeLiked by 1 person

Its going to be a very different year as we are not just that much more experienced…..but for sure have lots to learn. Cheers!

LikeLike

[…] insurance, utility bills and that sort of thing. We do have a budget and we need to stick to it. We do have a separate Spending Report for 2019, if you want to know more about what our travels cost and what our overall complete budget is like […]

LikeLike

Thank you for this. We are hoping to go full time by the end of this year and our budget goal is similar.

LikeLike

One of our dreams is to do some full time RV’n at some point. But not quite sure when. Will you have also FIRE’d or will you will be working? We have a dream of seeing all the National Parks some day. Maybe even renting an RV for a month and taking my mom around a bit before thats not as easy for her. Cheers!

LikeLiked by 1 person

We’re headed to an RV show tonight! Depending on how the market does, we’re hoping to RV 5-6 months/year. We don’t plan to start that for 4-5 years though. We want to see other parts of the world first!

LikeLike

Sounds perfect!

LikeLike

We will be working while our son is in college to help with expenses and to hit our fire goal.

LikeLiked by 1 person

Hmmm, you’re making me consider tracking our point spending! Husband RE’s in early April (I’m already done working) and we’ll head to Japan and Taiwan for 37 days. 21 days + direct flights from MN are all paid for with points (damn, I love credit cards). You’re right that while that will help my budget overall, I should track it in terms of dollars as well. Very interesting idea – thanks!

If our two every want to housesit an adorable dog in MN, let me know! I’m assuming it would not be in Jan through Mar. Hahaha 😉

LikeLike

It was eye opening to look at how much we “spent” in points during the year. If we had to do that all in cash we might be making some other choices. Its fun that its free and all but if we didn’t have those points would we be traveling like we do?

Enjoy Japan. We just loved it. And regarding house sitting in MN…..you never know. We just signed up for a Christmas sit on the southern cost of England were the weather can be crazy!!! Cheers!

LikeLike

[…] we had a great year of travel in 2019. And even with surprise medical costs, our 2019 spending proved that our budget was a good fit. We also learned how to be very happy and grounded being Home […]

LikeLike

What an amazing year and it sounds like 2020 is shaping up to be just as wonderful!! Enjoy all the slow travel and I like seeing how you’re plans are semi-similar year over year. Low cost warm area to start, States to visit fam, Europe over the summer, back to the States. I definitely see the trend there 🙂 enjoy ladies!!!

LikeLiked by 1 person

Spectacular! We’ve been following you And been inspired all year. Your writing is wonderful, and the way you share your challenges and learning experiences is unique. We’re happy to follow your adventures, thank you very much for sharing. Jay & Margaret, two years behind you and hoping to catch up then

LikeLiked by 2 people

So glad you are enjoying our posts. We learn a lot about ourselves and our FIRE process along the way. We’d love to hear more about your plans.

Best, Alison & Ali

LikeLike

[…] and Ali of All Options Considered flew Alison’s mom to France and Scotland to stay with them for three mo…. They also tend to get back to the U.S. occasionally, and seem to be able to see family and friends […]

LikeLike

super helpful information about what it’s actually costing you to travel full-time as I’m interested in doing a year around Australia soon!

LikeLiked by 1 person

Hey glad you enjoyed that post. Budgets are so personal that everyone seems to have wildly different numbers but it’s still interesting to see what other peoples are spending. A year around Australia sounds amazing. We were hoping to see Australia this year but it’s looking like we might need to wait a couple years with this Covid stuff. So maybe 2022! Hope you are doing well as we start to get close to the end of 2020!

~Ali

LikeLike

[…] and Ali of All Options Considered flew Alison’s mom to France and Scotland to stay with them for three months. They also tend to get back to the U.S. occasionally, and seem to be able to see family and friends […]

LikeLike