For those of us in the FIRE (financial independence / retire early) community who want to strive for early retirement and who are also lucky enough to make it happen, it’s really important to have a funding plan with accessible money for those early retirement years.

Everyone has their own FIRE strategy. But for most people that starts with saving enough in traditional retirement accounts to fund later retirement years. Perhaps that includes maxing out tax deferred accounts, like a 401k and IRA if you’re in the USA. Maybe that also includes saving to a tax free account like a Roth IRA. In our case we focused on power saving in our employer sponsored 401k’s and our Traditional IRA’s, but we didn’t open our Roth accounts until we were at the end of our career years. If we knew then what we know now we would have started saving to Roth accounts much earlier.

A complete FIRE strategy also needs some puzzle pieces specifically designed to cover early retirement years, from the month of a person’s last paycheck until they reach the age that allows full access to all of the funds in those magical traditional retirement accounts. Some people have rental income or a consistent side hustle to help with that early retirement gap. Other people try less traditional ways of accessing funds in traditional retirement accounts. But there is one more account that doesn’t get as much hype for its use in early retirement — a taxable brokerage account.

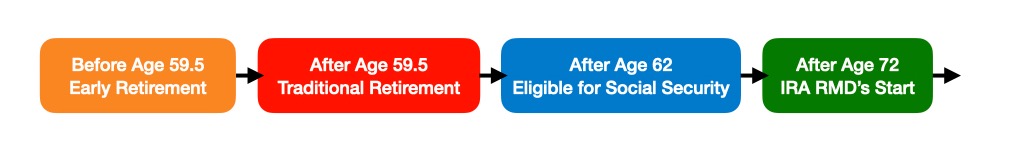

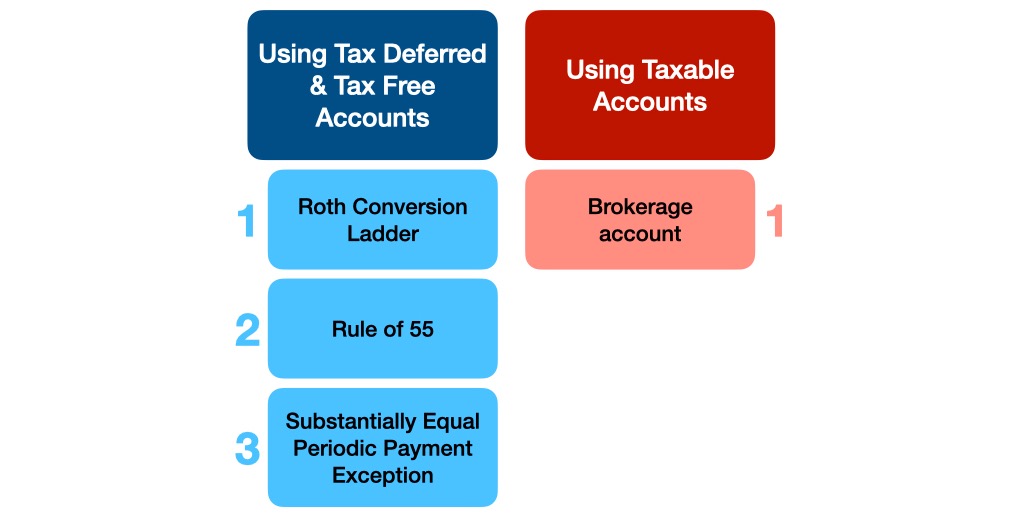

Early Retirement Withdrawal Options

Once we found the FIRE movement in 2014 we started learning more about some popular early retirement withdrawal options for tapping into retirement accounts, including the Roth conversion ladder concept. We absorbed every early retirement blog post and podcast we could find because we wanted to explore all of our options for funding our early retirement years.

In 2016 as we neared our retirement date we were concerned about having enough early retirement funds. We did another round of research and number crunching so we could make our own plan and put it into action. And we promised to stay open to all of the various ways other people were covering their expenses during early retirement in case there was an idea out there that we could roll into our own plan.

The main early retirement withdrawal options we considered were:

First, the Roth IRA 5-Year Rule (Roth Conversion Ladder)

The Roth IRA 5-Year Rule, commonly referred to in the FIRE community as a Roth conversion ladder, allows you to convert money from your tax deferred IRA to your tax free Roth, pay your taxes on the converted amount, wait five years, and then withdraw that same converted amount (the converted principal but no growth). The Roth IRA 5-Year Rule allows you to control the amount and how many times you make conversions, and you can keep converting funds annually and withdrawing the conversions one year at a time after each five year waiting period. The withdrawals are then penalty-free and tax-free since you have to pay taxes in the year of the conversion. And if you’re the type of early retiree who plans way ahead you can start the conversions five years before you retire so you can use the converted funds in your first early retirement year. Knowing all of that we understand the appeal of using a Roth conversion ladder.

The Roth conversion ladder trick didn’t appeal to us. We didn’t like the idea of the five year waiting period because a lot can change in five years, including our income needs. But we also didn’t like the idea of tapping into those IRA funds without letting them bake longterm in Roth accounts. As soon as we retired we each rolled our 401k’s into traditional IRA’s to separate our money from the 401k plan managers and their fees. We also started annual Roth conversions to reduce future required minimum distributions (RMD’s) from our IRAs. But at this point we want to leave those funds to grow tax free in our Roth accounts until our later retirement years.

Second, the 401K/403B Rule of 55

The Rule of 55 allows people who leave or lose a job between age 55 and 59.5 to withdraw funds from their tax deferred 401k or 403b without the usual 10% penalty for early withdrawals. The Rule of 55 only applies to the employer-sponsored retirement account you have when you quit (or get fired or laid off) between age 55 and 59.5. This rule allows you to withdraw funds from that same employer’s 401k or 403b without penalties even if you get another job and open a new 401k or 403b. Best of all, if you’re a public safety worker including firefighters, EMT’s, and police officers, the IRS allows the Rule of 55 to start even earlier for you at age 50. However, if you roll your 401k or 403b into an IRA like I did, the Rule of 55 would no longer be an option for those funds since the Rule of 55 doesn’t apply to IRA’s. And of course the Rule of 55 doesn’t wipe out the requirement to pay your taxes, it just removes the 10% early withdrawal penalty. You just withdraw funds, pay taxes, and enjoy having access to your money. You can control the amount you withdraw and you can keep making withdrawals under this rule until you reach age 59.5 when you have full access to your 401k even without this rule.

The Rule of 55 is a very cool option for people who retire in the age window of 55 to 59.5, but it’s not applicable for people like us who retire even earlier. We had already delayed our early retirement enough by the time we pulled the plug on our careers in 2018, so the idea of waiting any longer just to make this rule applicable for us was not appealing. So we chose to roll our 401k’s into our IRA’s and now we’re doing our best to move those funds to Roth accounts.

Third, the IRA Substantially Equal Periodic Payment Exception (Section 72(t) Distribution)

The Substantially Equal Periodic Payment (SEPP) exemption is a mouth full, and it’s complicated. In order to access funds from your tax deferred IRA using the SEPP exception you first calculate an annual withdrawal amount that will have to remain substantially equal every year for as long as you’re making SEPP withdrawals. The IRS allows three methods for determining your SEPP: the required minimum distribution method, the amortization method, and the annuitization method. The general concept is that you would choose one determination method and stick with those results, though you are allowed a one-time change from either the amortization method or the annuitization method to the required minimum distribution method. The biggest catch is that once you start SEPP withdrawals you’re required to continue them every year for at least five full years or until you reach age 59.5 (whichever is longer), in order to avoid penalties on every distribution. You just calculate your withdrawal amount, check in with your CPA to make sure you’re following the complicated SEPP rules, withdraw your set SEPP amount of funds, pay your taxes, keep withdrawing funds for at least five years, keep paying your taxes, and enjoy having access to your money.

We talked more about the SEPP exemption than the other two options above, and we could imagine committing to five years of SEPP withdrawals from Alison’s IRA since she’s 10 years older than me. But we wouldn’t want to commit to longer term SEPP withdrawals in my case. If I had started taking SEPP withdrawals from my IRA upon retirement I would have had to keep taking that distribution essentially unaltered for at least 5 years, even if our circumstances changed and our income needs changed. But our main concern is that all of those withdrawals during early retirement, some withdrawals surely being made during down markets, could cut an IRA off at the knees and cost us the longterm compounding growth we’re counting on. So we decided the SEPP exemption doesn’t jive with our All Options Considered strategy of having control over the amounts and timing of our withdrawals and the flexibility to change our plans as needed.

Last But Not Least, Taxable Brokerage Account

Brokerage accounts are amazing for longterm investments because anyone can open a brokerage account regardless of the type of job they have/had, they’re accessible at any time regardless of your age, they have no income or contribution limits, withdrawals never have penalties, investments can grow tax free depending on what you invest in, original contributions are never taxed again, gains are only taxed when they are withdrawn/sold, longterm gains are taxed at more favorable capital gains rates rather than ordinary income tax rates, and this is the only one of our accounts that will get a step up in cost basis allowing for tax free inheritance.

So here’s the bottom line – we didn’t try any of the options for taking early withdrawals from traditional retirement accounts. We stuck with saving to our brokerage account to fund our early retirement years.

We opened our brokerage account with Schwab in 2005 to diversify our retirement savings. The original appeal of a brokerage account for us was that we had spent too many years either not having access to a 401k at all or only investing the suggested 15% of our income in a 401k without matching funds from an employer. We weren’t making enough money for 15% of our incomes to make a big splash, and our 401k’s were underwhelming. So the only way we could see to save extra towards retirement was to focus a bit more on our personal IRA’s and a lot more on investing into our brokerage account.

I didn’t have access to 401k’s (let alone matching funds) from my earlier jobs, and in my last job before retiring my employer offered me a very limited 401k with no matching funds. Luckily in the middle of my career, I had one super awesome employer for 13 years that gave me matching funds plus some bonuses in my 401k. Since Alison is 10 years older than me she had a longer career than mine, but for most of her career she wasn’t able to max out her account and didn’t have access to matching funds. In fact, Alison only had employer matching funds in her 401k for the last five years of her 30 year career.

Our brokerage account was a great tool for us while we were learning how to invest and learning how to manage our own portfolio, and it has become the perfect early retirement funding tool for us as well. We had a much bigger variety of investment options and much lower fees in our brokerage account compared to the 401k’s we had at the end of our careers, so our brokerage account was actually a better performer as an investment vehicle.

To a large degree we stuck to the standard advice of saving to our traditional retirement accounts first and our brokerage account last. Looking back we shouldn’t have worried at all about maxing out our 401k’s. In our case we were better off saving our extra dollars to our brokerage account. Ironically, we benefited from the fact that traditional retirement accounts have contribution limits and brokerage accounts do not, and we made more substantial investments in our brokerage account. In 2018 we bumped things up a notch and consolidated our savings, sold our car, sold some of our furniture, and banked all of that money in our brokerage account. Then we sold our condo in Seattle and invested half of those proceeds into our brokerage account. We set the other half of our condo money aside separately in case we decided to buy a rental property or personal home in a lower cost of living area (and we made that home purchase about six months ago). By the end of 2018 our brokerage account had about 15 years of living expenses in it, as both invested funds and cash, and that’s what made us feel ready to schedule our resignations and retire early.

We love that our brokerage account comes with a huge amount of flexibility. We get to manage our own investments with very low fees, and we can access that money at any time, in any amount we choose, for any reason. Our brokerage account turned out to be the perfect investment vehicle for our FIRE plan because it gives us the ability to access our money without penalties, at more favorable long term capital gains tax rates, and without depleting our traditional retirement accounts during our early retirement years.

Our Plan (for now)

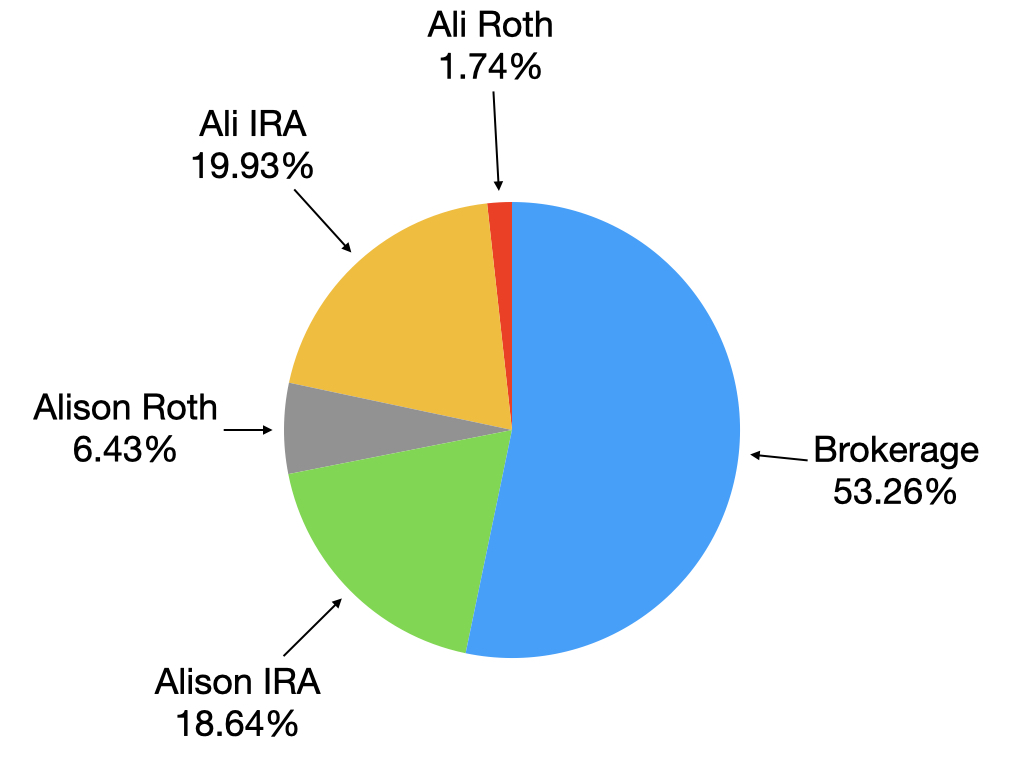

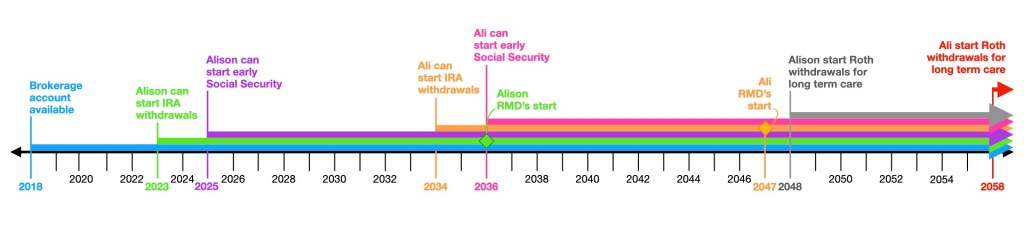

Our five account portfolio includes our two traditional IRA accounts (combined with our old employer sponsored 401k’s), our two Roth IRA accounts, and our taxable brokerage account. With our 10 year age difference our traditional retirement accounts become accessible at different times giving us a staggered waterfall system to withdraw from. Each year our plan evolves a bit more so we can see what kinds of jobs each of our accounts will be responsible for over time.

Brokerage account. When we retired in 2018 our brokerage account had about 15 years of living expenses in it as both invested funds and cash. After withdrawing a couple of years of living expenses and enough money for a nice new-to-us used SUV, our brokerage account still has more than 15 years of living expenses in it because the account’s growth rate is higher than our withdrawal rate and the account is generating income on its own. Originally we planned to live 100% off of our brokerage account until it was empty, only switching to our IRA’s after that. Our latest plan is to start tapping additional retirement account income streams as they become available to us, allowing our brokerage account to recover from our early retirement withdrawals so it can keep growing and continue producing income at lower capital gains tax rates.

Dividend Income. Our portfolio of low cost index fund ETF’s is geared more towards passively managed broad market growth rather than on funds that generate the most dividends. Why? Because we’re longterm index investors and a growth focused portfolio will more closely match the index and perform better than a yield focused portfolio. During our first two years of retirement our portfolio generated about $40k in dividends each year, with about $22k in dividends from our brokerage account alone. Our brokerage account dividends are not high enough to fully cover our annual living expenses but when we combine our dividends with capital gains and cost basis from our brokerage account our living expenses are fully covered. At this point we can’t/won’t withdraw the dividends being generated in our IRA’s and Roth’s since we’re too young to withdraw those funds without penalties, and instead of automatically reinvesting them we use those dividends for rebalancing.

IRA withdrawals. We’ll definitely consider starting distributions from Alison’s IRA when she’s 60 years old, and then 10 years later we can start taking withdrawals from my IRA when I’m 60 years old. We’ll be especially open to starting Alison’s IRA withdrawals when she’s 60, even if our brokerage account can still cover our living expenses, if we aren’t able to make large enough Roth conversions before then. If we start taking some money out of our IRA’s when we each turn 60 that will help us lower our future RMDs. The key is being able to choose which account we pull money from and what size of withdrawals we make, which will depend on our needs in any given year. Our IRA withdrawals will also be wet to stay within the 12% tax bracket because we want to avoid having to increase our budget just to pay more taxes.

Social Security. Our main plan for Social Security is NOT to rely on it, which is why we didn’t calculate any Social Security into our FIRE numbers. If we do end up with Social Security benefits we plan to consider taking them early when we each reach age 62. This is another one of those ideas that seems to shock people but it makes sense to us. Taking Social Security early will allow us to decrease the size of withdrawals from our investment accounts, which will allow our portfolio to continue growing. Taking Social Security early could also be a good hedge against sequence of returns risk, reducing our need to sell investments in a down market.

Charitable Giving. Financial gifts are a substantial part of our annual budget and giving is one of the elements of our retirement that gives us the most joy. We’ve increased our giving budget every year so far, and also moved all of our stimulus money into our giving budget. If things go according to plan our account balances will start to seem excessive compared to our spending needs by the time I turn 60. And at that point we plan to give even larger financial gifts so we can see our money doing more good while we’re alive. That includes gifts to our nieces, nephews, and chosen family, donations to charitable organizations, and donations to political causes and candidates as well.

Insurance. We’re all about having good health insurance since we live in the USA where health care costs are unreasonably high compared to other countries. We had global health insurance during our first two years of retirement since we were living as international nomads, but now in our third year of retirement we’re using ACA health insurance because we’re in the USA full time and health insurance is wealth insurance in this country. We also have good home owner’s insurance since we recently bought a house and we have good car insurance since we bought a car three months ago. But that’s it. We do not see life insurance as a rational or reasonable purchase for our circumstances, and the same goes for long term care insurance in our case. We are self insuring for our individual “life care” and death related needs using our investment portfolio and our Roth accounts specifically.

Roth conversions. Our goal is to move as much of our IRA money as possible to Roth accounts where it can grow tax free. We plan to keep making annual Roth conversions until we’re each 72 years old and RMD’s begin. We made large Roth conversions in our first two years of early retirement, $62k in 2019 and $58k in 2020, but our plan changed this year in 2021 since we’re now using ACA health insurance with a large subsidy. We set our income for 2021 to include a small $6k Roth conversion, low enough to allow us to benefit from a $1,536/month ACA subsidy. Thanks to the American Rescue Plan’s ACA provisions we’ll have a little more wiggle room for slightly higher Roth conversions in 2021 and 2022 and we’re excited to boost our conversion amount beyond the $6k we had originally estimated. We won’t know until December exactly what our Roth conversion amount will be for this year because we need to see our final income numbers first including dividends, capital gains, and cost basis. Each year we’ll set our Roth conversion amount based on our annual income needs and ACA subsidy levels, while also trying to stay within the 12% tax bracket (or the equivalent as the tax brackets change).

Roth withdrawals/life care. According to the U.S. Department of Health & Human Services, 70% of adults in the USA who live past age 65 develop severe long term care needs before they die. We’ve learned from what our parents and grandparents experienced and we want to be ready to self insure for anything we might need to deal with when we’re old and can’t pretend we’re 25 any longer. And that’s why we’re so focused on annual Roth conversions. Our plan is to start tapping into our Roth accounts when we really need it, after Alison’s hair finally turns gray (if it ever does). For now we’re estimating that by age 85 we’ll each be depending on our Roth account funds to cover our health and medical costs when we’re elderly. Our life care needs when we’re elderly could include anything from assisted living in our own home, to skilled nursing in an assisted living facility, to buying in at a retirement community with a full range of senior care health services.

We Can’t Control the Future, But…

We can’t accurately predict how things will go in the future, but we are planners at heart so we’ll do our best to put plans in place. We know whatever plans we do make will probably have to change and we’re ok with that. If we don’t make any plans at all we definitely won’t be ready for what comes our way. So we’ll keep charting our course and we’ll try to be ready to change direction as needed.

That’s Our Plan (for now)

We’re in our third year of retirement as I write this post. In fact today is the three year anniversary of Alison’s retirement date!! In our second retirement year there was a black swan event and we bought a house. Three months ago we also bought a car. We had access to the cash we needed in our brokerage account for our major one time purchases and all of our regular daily living expenses, and we didn’t need to touch our traditional retirement accounts. After all of our early retirement cash needs so far, and because the stock market is crazy, our portfolio is still just as healthy and growing strong. For us that’s a sign that even though our plans keep changing and we went from being nomads to homeowners in our first years of early retirement, so far things are going according to plan.

We’re grateful to have our brokerage account for our early retirement years. And to be able to preserve our traditional retirement account funds during early retirement. In Alison’s words, “Pulling contributions out of our retirement accounts too early would be like drinking weak tea.” We’d rather let our tea steep so it’s strong like our favorite Scotch Whisky and we can really enjoy it. Come to think of it, our withdrawal plan is like a fun cocktail. Three parts brokerage, two parts IRA, one part Roth, and a dash of Social Security. Hold the olives since Alison really hates olives!

What’s Your Retirement Withdrawal Plan?

We are not certified financial professionals. For more information please read our Disclaimer.

Really enjoyed the read. So inspiring to follow your journey and see how you’re thinking through your withdrawals.

LikeLiked by 1 person

Thank you Linda! Hope your personal finance journey is going well!

LikeLike

This was a great post. I feel like I’m good at saving money/investing, but not as good knowing how to access the accounts. I’m fortunate to have retired 2 years ago at age 54 and have a pension that I can easily live on. At age 60 I may start withdrawing from my 403b and brokerage account. I plan to not touch my Roth IRA or HSA and consider it my long-term care insurance. If not needed it can go to my nieces.

About 10 years ago I had a financial advisor say I needed more bonds in my portfolio. That’s when I started doing more research and discovered what I needed was gap money (age 54-60). That stated a beautiful relationship with Vanguard.

Sounds like you have a great plan. It’s exciting to follow along on your journey.

LikeLiked by 1 person

Congrats on your retirement two years ago! I can totally relate to what you’re saying. It took time for us to figure out the details about how to access different kinds of accounts and what that all meant for our own personal finance journey.

And good plan with your Roth and HSA, we have a similar plan for our nieces and nephews. Though we’re starting to think our brokerage account funds might be a better option for them since that’s the account that will get a step up in cost basis allowing for tax free inheritance. We still have some planning to do on those topics.

Also – hooray for you! You took some generic financial advice and figured out what you really needed to do for your personal finances. Bravo!

LikeLike

The bit about early social security withdrawals is a hidden gem in this post! I hadn’t even thought about that but it makes a lot of sense.

I think most FIRE folks use taxable accounts but they don’t get much ink. One other area I push against on conventional FIRE wisdom is maxing out 401ks. Since most FIRE bloggers are software engineers at high income levels, maxing out makes sense since it’s still a small portion of savings (since the amount you can contribute is capped). But at lower incomes levels, it eliminates flexibility. A good example is this March – during the shutdown I was furloughed with reduced hours and pay. Had I been maxing out my 401k things would have been very tight. Because I had a lower contribution, I had the flexibility to invest a little less. One of the benefits of FIRE is having extra income potential for those rainy day events, and maxing out at my income level would have eliminated that ability.

Good post!

LikeLiked by 1 person

Thank you. Gotta love those hidden gems! People typically think the idea of early Social Security is irrational. But in our case having a fear of leaving money on the table and planning to wait until age 70 would be irrational.

We did a poll on Twitter about brokerage accounts and 80% of responders said they have one. But after more in depth conversations it sounds like most people in the FIRE community are more focused on maxing out 401k’s and IRA’s rather than really power saving to their brokerage accounts. There are certainly way more posts out there about the Roth conversion ladder than there are about using a brokerage account to fund early retirement.

As for high and low income levels, we were not high income earners ourselves. We have learned so much about why that old mindset of being hyper focused on maxing out 401k’s was not just unrealistic for us, but it actually slowed us down. Not to mention just being a source of disappointment for us. Sounds like you had the right plan while you were furloughed. That must have been a challenge! But you figured out a good solution and put control over your situation and flexibility with your finances first. Good job!

LikeLike

Super helpful! So glad to hear you both say you’re going to begin SS withdrawals at 62. I’ve done my own calcs and had been planning the same thing but glad to have that corroborated by your plan. Great to hear your reasoning on taking from your IRA’s when you can begin instead of continuing to pull from brokerage. I will be 59.5 in June, and after reading this post I can see it makes more sense for me to switch to pulling from my IRA at that point instead of continuing to draw from my brokerage.

I haven’t jumped in yet with Roth conversions (have some Roth investments) but know I need to get going on this. I think especially before 65 and medicare calculations affect me. Would love to hear if you two have factored medicare into your planning and, if so, what your thoughts are on that. Thanks for everything!

LikeLiked by 1 person

Thanks! So glad we can corroborate your plan for early Social Security and switching from your brokerage to your IRA at age 59.5. Alison only has to wait two more years until we can start withdrawing from her IRA and we have modeled how much that will change both our RMD’s and the health of our brokerage account over time. It’s pretty exciting.

As for Roth conversions these are especially important for us since we have around 40% of our portfolio in IRA’s at this point. If only we had been maxing out our Roth accounts instead of our IRA’s while we were still working! We have been doing our medicare research and starting to run the calculations. Our initial thoughts are… wow medicare is expensive! If you’d like to chat more on the medicare topic please feel free to send us an email!

LikeLike

This is what I ended up concluding too, since I haven’t had a 401k in years. We’ll have a 401K, 2 rollover IRAs, a tiny Roth IRA, and our taxable brokerage account. In three years, I’ll have plowed as much in contributions in the brokerage as I have in my IRA because yay no contribution limits!

I am still trying to figure out when it makes the most sense for us to do Roth conversions if any.

Taking early SS as a supplement to your income in your situation make senses to me now. Once I would have thought it was foolish to leave any money on the table but with more perspective now I realize it’s good for two reasons: There’s no guarantee of how long we each have so holding out when you don’t truly need that increased later payment can be unnecessarily conservative, and taking it earlier preserves your brokerage accounts which is great! As we formulate our plans, I’m incorporating this new perspective.

LikeLiked by 1 person

Sounds like you guys are doing a great job of loading up your brokerage account! If you only have a “tiny” Roth perhaps you won’t need to do conversions.

So glad you enjoyed the early Social Security topics in this post. There are definitely no guarantees with Social Security at this point. Many of the arguments I’ve heard around the FIRE community for waiting until age 70 to take full Social Security benefits sound a bit like fomo. Though of course waiting for full Social Security is the right thing to do for some people. From my perspective there are a million reasons why taking Social Security early at 62 makes perfect sense for us. Most importantly there’s the benefit of relieving the withdrawal pressure on our investments and allowing all of our accounts to continue growing!

LikeLike

Love the helpful graphics! Like the idea of earmarking Roth accounts as long term care. FI seems very far away, but hoping to learn the ropes along the way to have a solid plan when the time comes.

LikeLiked by 1 person

Thank you! I had lots of fun building graphics for this post. And we are feeling really good about our long term care plan with our Roth accounts.

The fact that you’re doing so much research and working so hard on figuring out your plan early in the process is fabulous. Having a solid plan early in your FI journey will definitely help you!!

LikeLike

Terrific post! I really appreciate how you explain your different thought processes, including the details on why you decided *against* other options. And being a visual person the graphics always help me see the big picture.

I have only a small portion of my investments in retirement accounts, due to the types of jobs I’ve had over the years. 8% are in two IRAs (one is a traditional, the other was my 401k that I rolled over). Another 8% is in a Roth IRA, and the remaining 84%(!) is in my taxable brokerage account. I’m 47, and so the retirement accounts are currently 100% S&P index (Vanguard and Fidelity). And my taxable account is 80/20 indexed equities and bonds (all Vanguard).

I’ve been spending time learning more about Roth conversions, and trying to decide if it’s a path I should pursue. I have a lot of researching to do and your post is extremely helpful. Thank you!

LikeLiked by 1 person

To put my percentages in perspective, I’m around 24x right now, no debt, own my house outright. I don’t include my house in my net worth, otherwise I’d be around 37-39x. I plan to live here for at least 10+ more years and have a teen, so “home base” is a quality of life issue that I value now.

Getting close to my 30-33x goal!

LikeLiked by 1 person

Sounds like you have a solid plan in place! And the home base makes perfect sense, especially while you’re creating stability for your kid. Congrats on getting so close to your goal!

LikeLike

Wow your portfolio allocations are exciting to hear about! 84% in your brokerage account! Woohoo!

It would be interesting to hear more about your thoughts on Roth conversions. Our IRA’s are basically 40% of our portfolio so our estimated RMD’s are quite high. Perhaps your IRA balance is more reasonable at 8% and your RMD’s may not cause any tax or other issues for you? Especially if you start tapping that account in 12-ish years when you turn 59.5?

LikeLike

I do think the Roth conversion for myself may be somewhat moot, like you said since my IRAs are relatively small, at perhaps 1.5-2x.

The other tax strategy I am beginning to research is capitol gain harvesting, especially as I’m in Oregon where paying a bit of tax earlier to reset my cost basis, may pay off later after those funds have had more time to appreciate in my taxable account? It’s on my mind as I’ll be switching from Head of Household to Single in (perhaps) 7-8 years as my 10th grader grows up.

LikeLiked by 1 person

If you don’t need to “play with” Roth conversions it sounds like you might instead get to play with some tax gain harvesting instead. We have been talking about that option ourselves just because it’s interesting to understand how it works, but so far we haven’t needed to do any tax gain harvesting since we’re maxing out our 0%/12% tax brackets with Roth conversions and we haven’t realized any capital losses. YET.

Sounds like you have about 7 years to do research and plan ahead while your kid is still growing up. Ideally you would be able to strategically harvest gains in some years to both limit tax liability and keep your portfolio balanced.

LikeLike

Thank you so much for this post! When I see early retirees talk about their 25x (or so) investments, I always wonder how much of that is in tax advantaged retirement accounts and how much is brokerage accounts/cash. That has always been the hard part for me to figure out, so I love how you walk through your planning.

PS – I’m with Alison on the olive-hating.

LikeLiked by 1 person

I always wonder the same! People often talk about the size of their portfolio but rarely talk about the relative size of different types of accounts. I think it’s incredibly helpful to learn more about how various accounts are used/withdrawn from and how they all fit together like puzzle pieces. 🙂

LikeLiked by 1 person

Yes – this exactly!

LikeLiked by 1 person

This is SUCH a great post, and I really appreciate the pictures! They help me really make sense of all the information you’re laying out here.

I’ve been making changes to my retirement saving plan based on a lot of your thoughts – as soon as I replace my furnace (sigh) I’m going to start really adding money to my brokerage account. My retirement savings are healthy enough as it is, I need to focus on that bridge funding.

LikeLiked by 1 person

Thanks Beth! So glad you enjoyed the post and the pictures. Sounds like your retirement savings plan is really coming together. That moment when you can really shift your saving focus to your brokerage account is pretty exciting!

And hey we can relate with the furnace, we have to replace ours this summer as well. Oy house maintenance! 😝

LikeLike

Reading this post made me go update my percentages. I am sitting at 40.62% in my taxable, 41.6% in tax deferred, and 17.78% in tax free. I have to say that I’m please to see that first percentage is really close to overtaking my 401k in the deferred category.

I changed my 401k deductions from 15% which maxed me out every year to only 4.5% which is just enough to get my full company match. I take the remaining 10.5% and put it into my taxable brokerage account each month. I’m thinking my brokerage account will overtake the 401k sometime this year. Tack on my next 5 years of continuing this practice until I retire, and I think I will be ok to cover my gap of 53 to 59.5.

I really liked the pictures as well.

LikeLiked by 1 person

Thanks for sharing your percentages, sounds like you have a really good portfolio balance and know how much money you need for your early retirement gap. And how exciting to have only 5 more years until retirement! Good for you Rex. 🙂

LikeLike

Ali,

Just found your blog via link from allstarmoney.com and found this helpful. I have been going through the same process.

Have you considered the HSA account (triple tax free) to fund your LTC? You get an above the line deduction for current year contributions, all future earnings are tax free, and all withdrawals for med expenses are tax free! The above the line adjustment (up to $$4,600 per person over 55) can also increase your Roth conversion limit.

By taking your SS at 62, you are reducing your Roth IRA conversions while staying in the 12% bracket (unless you income is low and SS is not considered income). Roth conversions are VALUABLE. No taxes on ALL future earnings.

Wish I had found you earlier. Your writing is easy to understand and your graphics are great illustrating the concepts.

LikeLiked by 1 person

Hey there. Thanks for your comment. And yes that’s exactly right on early Social Security. And yes we are trying every trick we can to essentially increase our Roth conversions and similar tax maneuvers.

To answer your HSA question, we didn’t save funds in HSA accounts while we were working so there were no HSA’s in our portfolio during our careers. This is another account type that isn’t open to everyone unfortunately. Since we started our new ACA health insurance plan in January of 2021 we did open HSA’s and we’ll max them out each year, which is enough to take the edge off of any medical costs now but not enough to fund our long term savings needs at this point. No need to do anything too heroic on LTC though since we have more than enough and a good plan in place already. We have a post about our new HSA’s and our health care plan from Jan 3 if you want to know more. Best part about our brand new HSA’s was learning we can make QHFD’s to our HSA accounts. That is a very cool tax trick!

LikeLike

OK, I didn’t read the article, but I’m subscribed to your blog, so I have it in my Email box. I hope you’re going to keep your blog going for a long time. Don’t delete it ;-)… some good FIRE’d people did (of course I don’t blame them doing that).

When I make up my mind to retire (aka OMY syndrome or overcoming fear), I’ll come back to refresh my memory of all these options.

I’m glad I discovered your blog because I find quite a few similarities despite the fact that I have a conventional family including two young teens.

The ages are quite similar and the age difference between the partners isn’t that far off.

Your expenses sound very similar to ours (ours somewhat lower). Over 8 years of expense tracking we crossed $60k one year due to overpaying for our flight tickets to Europe.

Of course what’s not clear is how our health insurance situation would change if we both quit working, and we’re a family of 4 instead of 2.

Oh, yeah, and how can I forget: College education is looming starting in 3 years for #1 and then in 6 for #2:-). Just this week I changed umbrella insurance from $1M to $2M as the #1 child wants to start driving ed. Insurance requires an underwriting procedure (whatever that is) to increase to $3M or $5M. I need to explore if we should go through it and get $3M now or wait a couple of years until our taxable accounts get close to $2M. As far as I understand, house, IRA’s, and 401k’s are protected, but not taxable savings/CD’s, I-bonds, or brokerage accounts.

Now I just need to figure out how to cure my OMY syndrome.

BTW, what AA percentages have you been maintaining? I’m curious if we are similar. Last year we changed to 65/35, but I’m OK if it has drifted or is drifting towards 70/30 since then.

LikeLiked by 1 person

Sounds like it would help a lot to start really focusing on that “one more year” syndrome! We totally struggled with that ourselves and it was really hard to break that habit as it was really the fear of not having enough. At the time it seemed like working more was the only solution to battling our fear. But we seriously could have focused much more attention on the fear element and maybe dealt with that more intentionally. Hindsight!

As for our asset allocation, we retired with our portfolio at 75/25 and we keep moving it tack to 75/25 when we rebalance. That’s just our equity to bond allocation since we still don’t include our home equity in our portfolio. We have talked about changing our allocation to 80/20 but so far we’re sticking with 75/25.

LikeLike

Hi Ali,

Thanks for your response!

Have you or Allison written a post about the ‘fear element’ of reluctance to retire much earlier? If not, do you have any advice you could share or direct/recommend me some book/website on that?

Here is the thing with me personally… I always find something to anchor to in order to justify my fear or excitement in that particular moment.

When I read stories of people who’ve retired on much less when we have, their courage inspires me and I feel I should be just fine to retire now too. OTOH, I am even more susceptible to ‘bad’ stories especially where medical issues (and insurance) are involved and also thoughts of gloom and doom coming from the stock market and economy. So, my mood keeps switching like on a roller-coaster and continue padding those accounts. It’s nice to feel the comfort of having a nice portfolio, but then I also think “What owns whom? Do I own the money or does the money own me?!” I’m afraid it’s the latter in my case.

How did you two work through your fear or what was the catalyst to break free from your OMY syndrome?

Do you remember the feelings you went through when the money for your living expenses came not from your paycheck but from investments? Do you still feel them occasionally?

I used to read in the past about people having a difficult time of saying goodbye to their salaries and I thought at the time that it shouldn’t be THAT bad for me. The joke is on me now…

LikeLiked by 1 person

Hi Sana,

We haven’t focused a whole post on the fear element exactly but we have talked about it a bit in a few posts. It’s amazing how difficult it is to feel emotionally ready to stop working, walk away from paychecks, and just trust in your investments. But I’ll tell you – even more shocking for us was retiring and then almost immediately having all of that anxiety melt away. We kept talking about how great we were feeling even when the stock market was struggling or whatever else was going on, we didn’t have any fear or money anxiety after we retired. It was great to look around and realize that 3 months later, 6 months later, 1 year later, etc. We both wrote posts about how we we were feeling 1 year after retirement. And we still talk a lot about how intense that fear was before we quit work and how fascinating it was to start taking withdrawals from our portfolio and not be afraid at all anymore.

For us to let go of our own fear we needed a plan to work on and a schedule to meet. We talked through our emotions and fear a million times. And then we needed a distraction to pull us out of that fear cycle because it’s like falling in a pit of mud. At some point we just needed to get up and get out of it. Our plan was basically to quit, sell the condo, and take a really long trip and that gave us a ton of details to focus on and we were able to commit to a timeline. We had a series of conversations like this with a few others and it does seem like that type of planning and scheduling is a great option for dealing with that kind of fear and figuring out how to change your focus. One couple scheduled a 3 month language learning session to start immediately after retiring which motivated them to set dates and milestones of their own. Another couple made a plan to quit their jobs and immediately leave and take a long road trip to visit family.

In our case though, that fear went away once we left our jobs and took the retirement plunge. We have a plan and a schedule for when we take withdrawals or rebalance our portfolio and that plan makes us feel organized and unafraid. Every time we check in on our plan or even when we change our plan we get a sense of safety and reassurance from that process. We don’t fret about the stock market ups and downs and we don’t worry about money anymore!

Also, if you haven’t read the Psychology of Money you should check that out! We have a very short review of that book in our Resources tab under Book Reviews. There is so much emotion tied to money!! We both really enjoyed that book and it might be useful for you to check that out.

LikeLike

Hey Ali,

Thanks for your helpful reply. I’m going to read your review on the Psychology of Money and see if maybe my library has it.

Sana

LikeLiked by 1 person

Great! We really loved that book so hopefully it will be useful for you as well. It’s eye opening and also very reassuring to explore the intense relationship between money and emotion.

LikeLike

Hi Ali,

I gotta tell ya…Your recommendation of reading the book rejiggled my memory. I have read articles of Morgan Housel here and there and he’s very good at what he does. So now I reserved his book at my library. I’m #45 in line, so I should get it next month or in June. But it’s not a problem for me! After waiting a couple of months in line, I’m getting a book about how to pay for college which is supposedly insightful and I’m curious to read it.

Re Morgan Housel, he wrote an article (last year I think) about one experience that shaped him for life. If you never read it, it’s a very sad story, but very moving at the same time and it’s worth reading. I cannot recall the name, but it deals with a snow avalanche. I teared up just to remember it.

LikeLiked by 1 person

Wow that avalanche story – I hadn’t read it before so thanks for the tip. Now I know you are going to love this book and hopefully you’ll get it by May or June at the latest. Let us know what you think!

LikeLike

I understand the focus for this post is on the value of having a flush brokerage account for early retirement, but honestly, it’s a pretty great starting point for figuring out your own early retirement withdrawal strategy!

You did a great job of hitting the pros/cons on the different types of accounts and then tying it all together in a consumable way. Neat!

I popped open our own accounts and eyeballing it we have a fairly equal balance between our two 401(k) accounts and our two brokerage accounts. This wasn’t necessarily an intentional strategy during our saving years, rather, just kind of how it worked out. For the most part, Jenni and I maxed our 401(k)s whenever possible, then Roth IRAs, then HSAs, then put the balance into brokerage accounts.

But of course, this is what happens with two fairly high incomes (relative to a modest ~40k/year annual spend). I can understand it’s necessary to make a more intentional decision when the range between saving and spending is closer.

Like you all, our intention is to subsist on our brokerage accounts until reaching age-related limits for 401(k) and IRA/HSAs. Conversion ladders and the 72(t) are our backup plans, but that really shouldn’t come to fruition.

One point I’d like to add in the positive column for brokerage accounts is just how easy it is to roll over investments to a donor-advised-fund (DAF) to supercharge your giving and take the tax advantages of giving *today*. I know a lot of folks (us included) have a desire to give “in the future” once reaching FI is firmly established. But, when you have lower income in those years, the tax advantages are less valuable when you start giving. If you know you’re going to set aside money to give, later, it might make sense to do that now and reap the tax benefits when you’re in a higher bracket.

What you do with those savings is up to you, but I like to think of it as a way to give *even more* through the tax savings.

Cheers!

LikeLiked by 1 person

Thanks for the great comment Chris! Really appreciate your feedback.

Sounds like you and Jenni have a nice balance in your accounts and your saving strategy came together well. Good for you guys!

It’s fascinating for us to look back at how our FIRE journey went with all of the successes and challenges we came up with along the way. Now we have all of the wisdom of hindsight and acknowledge where we were truly intentional and where we were just really lucky. That’s a whole other cocktail blending intention and luck!

And yes DAF’s work really well with brokerage accounts. We aren’t using DAF’s so far since they don’t offer us any tax advantages at this point. Our giving plan involves more individuals and other countries and only about half of our donations go to 501(c)(3) organizations in the USA these days. But anyway DAF’s work great for lots of people and they are really useful accounts.

Cheers back to ya!

LikeLike

[…] accounts while you’re still young. We retired with half of our net worth saved in our brokerage account to provide us with completely accessible funds to withdraw during our early retirement years, along with a five year emergency fund (which is now […]

LikeLike

[…] Why we LOVE our brokerage account for early retirement funding All Options […]

LikeLiked by 1 person

THIS RIGHT HERE! This is why I love this blog so much – real, digestable FIRE best practices – especially for those of us who do not see real estate, side hustling, or geo-arbitrage in our FIRE plans. Thank you so much for always providing clear, concise, and creative ways to make what can become a “blackhole” of FIRE content online so relevant and tangible for us.

LikeLiked by 1 person

Wow thanks for your comment Christina. I know what you mean about the blackhole. We were really hoping that sharing our stories would be useful for others so thank you for this feedback! 🙌

LikeLike

Brilliant! This post brings together all of the concepts I’ve read over the years concerning withdrawal strategies from other bloggers. Very easy to read and follow. It also helps to confirm many of my own plans concerning withdrawal strategies, as much of it is similar. I am planning to take SS early because the calculators told me to do so, but your thoughts on how it impacts RMD’s is brilliant. It’s like…. why didn’t I think of that? I may be picking your wonderful brains in the near future.

LikeLiked by 3 people

Hey, thanks for the feedback. We had a great time writing this post. Our draw down strategy evolves along with what we learn, changes in tax codes, and our long term objectives. We would be happy to chat more with you about all of this down the road. Cheers!

LikeLiked by 1 person

[…] other option you have for your Retirement Savings Money Jobs is a brokerage account. We love our brokerage account because it’s so easy to use. There’s no limit to how much you can save, no limit to […]

LikeLike

[…] Since we retired at 44 and 54 years old our bucket strategy taps our savings and brokerage accounts first since they are 100% accessible now and always. We also did our best to make sure we had enough money in the brokerage and savings accounts to cover us at least until I’m 60, knowing at that point we will be able to also tap into my IRA. Without enough funds in our savings and brokerage accounts to cover those early retirement years we could have looked at one of several ways to access a 401k or IRA early. […]

LikeLike

[…] our early retirement years and we don’t have access to our IRA’s yet, we’re using our brokerage account to fund our current lifestyle. Because of this, we have to pay taxes on any gains and dividends NOW […]

LikeLike

[…] those to IRAs as soon as they retire as they don’t anticipate needing or wanting to access those accounts during early retirement. Sue and Joan also have a healthy joint brokerage account and they each have one modest Roth […]

LikeLike