We love building friendships with people in the FIRE (financial independence / retire early) community, and we love talking about money with our friends. We have gotten so much out of our money conversations that we decided to start an interview series with our community. No matter what your circumstances are there are other people in the FIRE community that you can relate to, and we are thrilled to share stories from some of our favorite FI community friends.

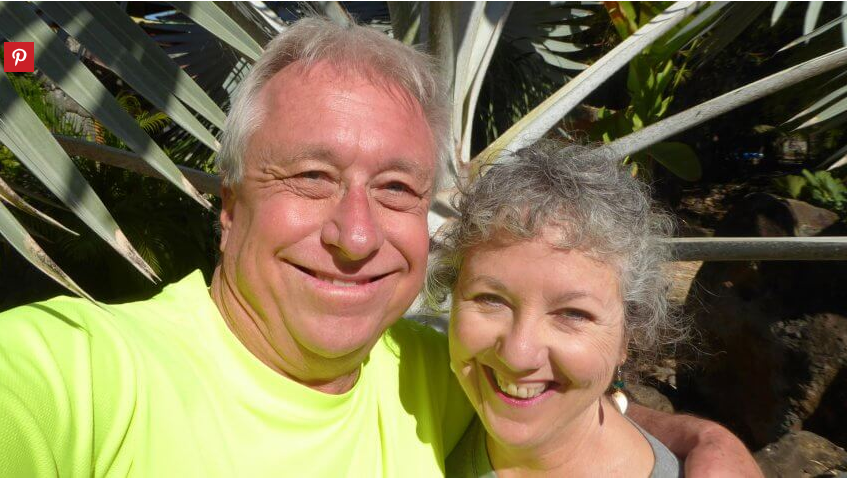

We were excited to interview Billy and Akaisha in our Money Talk series because they inspired us during our own FIRE journey. Their examples made leaping into our early retirement and nomad life easier and more fun, because we knew there were good people out there that we could relate to who were doing many of the things we wanted to do ourselves.

If you already know of Billy and Akaisha we hope you learn something new about them in this interview. And if this is your first introduction to them we are thrilled to introduce you to these longtime FIRE mentors and world travelers!

Your blog has a big following, but introduce yourselves to us!

REL: We met in Santa Cruz, California when we were in our twenties. Billy was a French Chef at the time and had worked in various Michelin Star restaurants. We went to Europe to research fine cuisines and wines, returning after 6 months to open our own (very successful) restaurant a quarter mile from the ocean. Because of our business success, after several years Billy was recruited by Dean Witter Reynolds to become a stock broker, and eventually an office manager. At this point we weren’t seeing enough of each other (trouble in paradise! Billy working days and Akaisha working nights, weekends and holidays running the restaurant) so we sold the restaurant and Akaisha was hired as Executive Assistant and Office Manager to a Civil Engineering firm in a neighboring town. This is when we began discussing selling our stuff, living off our investments and traveling the world. We were 36 at that time.

Now tell us something you love or hate to spend money on!

REL: We hated to spend money and time on home and auto repairs. Once we sold our home and eliminated our car (we’ve been car-free over a decade now) those concerns were over. Billy loves spending time at the beach and body surfing in the ocean but doesn’t want to live full time on the coast. Akaisha thinks the most exciting place on earth is in a library or an anthropological museum. Food is a wide spectrum for us and we will pretty much try anything including crickets with salt and chile. But for Billy liver is out, even though he cooks it well. However, goose liver pate is wonderful! For Akaisha, tripe, goat eyeballs and other Anthony Bourdain choices like this aren’t even on a list to be contemplated.

What have you learned during retirement that you wish you knew when you were still on your FIRE journey?

REL: Neither of us received financial guidance nor training when we were younger. It would have been great to know about compounding interest for instance. Or even how to invest. Our adventure into investing was initiated as a result of an unexpected natural event that closed our little beach town down, and we were left with no cash flow. In terms of what we have learned during our retirement that we wish we would have known sooner… we would say developing personal confidence in our abilities to figure out solutions when confronted with unexpected situations. Or perhaps not to invest so much emotional capital in the judgment of our peers. Or even to have pursued the minimalist philosophy a little more strongly at the beginning. But living life is a process, and we learn as we go. There is something to be said for that.

Your blog and books were a great help for us, what’s it like helping so many people?

REL: We are very humbled at the large and positive response we have received from people all over the world. It’s our number 1 goal to help people become financially independent, because we believe being financially free is the best thing you can do for yourself and for the world. When one is no longer hostage to a job, to the bills they owe, to a physical location where the job is located, or even to an abusive relationship due to financial obligations, one is then free to give back to the world. All of us have talents, abilities and experience that can benefit others. And when we don’t need to be paid for them in order to sustain our living expenses, everyone benefits from this exchange. So we absolutely love it when someone reaches FIRE and begins to live their best life!

You guys reached FIRE more than 30 years ago! Has your budget or withdrawal strategy changed?

REL: We learned the value of tracking our spending since the days of our restaurant. We tracked what we spent on labor, food, utilities and rent, renovations, how many customers came in our door daily, what the average guest check was and so on. So, this is a part of how we manage our businesses and our finances. We still track our spending today as a matter of habit, and it’s not a burden but rather a fascinating accumulation of data. We know how much we spent in each country of our travels, how much housing is at any time, and what our transportation costs are. When we first retired, we simply sold off stocks monthly (at the capital gains rate) to pay for our monthly expenditures. Today, with receiving dividends and Social Security, we don’t need to sell off anything, as this income covers us completely. In fact, we will take the accrued extra cash from time to time and invest it back into the market. We also have several years of living expenses in cash, should we need to wait out a market downturn.

Billy at Caleta de Campos, Mexico

Akaisha in Boracay, Philippines

What was your biggest motivation for retiring early?

REL: We wanted our freedom. This was always our biggest priority… to come and go as we pleased, to spend time on what interested us and personal projects, to have time to ourselves both individually and together. We enjoy having a large stretch of time out in front of us that is unscheduled, free for us to place things in those little calendar boxes or not. We were 36 when we began to track our spending specifically on what we spent on ourselves, not work-related items or high stress release items like expensive vacations and cruises, shopping sprees, buying high-end bottles of wine or lavish gifts. Remember, there were no mentors, no one to encourage us or lead us, so after two years of tracking our expenses and realizing that we could live off our investments, we pulled the plug. We gave our bosses 2 weeks’ notice, sold everything and flew to Nevis, British West Indies. This pretty much took everyone by surprise.

What are your thoughts on the pros and cons of health insurance and medical tourism in various places?

REL: When we first retired, we lived in and out of the States often enough to warrant a US-based health insurance plan. Since we had quit our employment, we had no corporate health coverage. As health care costs rose predictably every year, we found alternate plans with the highest deductible available to service our needs. This kept our health care costs down, but we were still spending thousands of dollars a year to pay for a policy.

About 10 years into our retirement, we found ourselves living more and more time in foreign countries, and as life would have it, we ended up getting medical attention in places other than the US. This care covered the gamut from annual checkups, dental care, emergency treatments, colonoscopies, eye care, x-rays and more. Not only was the health care done with up-to-speed medical equipment, but the doctors themselves were very compassionate and human. Often, they gave us their home cell numbers in case we had a problem or they would visit our apartments at odd hours if we needed attention.

We began discussing what experienced travelers call “Going Naked.” This means going without full bells-and-whistles US-based health care. We decided to take the leap, and we dropped our Stateside healthcare plan, opting for travel insurance when we visited the States. For other needs, we simply paid out of pocket for services. The thousands of dollars we used to spend for our insurance plan in the States more than covered these medical needs and we had money left over for our own designed HSA. This was our health care plan until we qualified for Medicare when we reached 65.

Billy and Akaisha in Chiang Mai, Thailand

Billy and Akaisha in Laos

If you could go back in time is there anything you would do differently?

REL: Yes. We would not have purchased our home and instead, kept our investments. We were in our early 30’s when we purchased our “dream home” – a quarter of a mile from the ocean, lots of sun, a 900 square foot redwood deck, hot tub, French doors, designer tile and a large garden-filled yard. We sold our Exxon stock to purchase this home, which we both loved. But looking back, we saw that:

- The Exxon stock way outperformed the real-estate gain of the house and we would have done better financially had we kept the stock and not purchased the home.

- We realized that we simply were following the programming of what young couples do. At a certain stage, they buy a home. It was expected, it was what all our friends were doing, it was encouraged. We bought new cars, had expensive vacations, and entertained lavishly. There really were no other emotional or financial options in our personal world at that time.

- We were working 80-hour work weeks, and with that many hours away at our careers, we actually spent very little time at our Shangri-La. So looking back… we wish we knew then what we now know.

Where do you see yourselves in five years?

REL: Hopefully still upright. The future is not promised to anyone, and we can be living our lives going along without a care in the world and BAM! A spouse becomes ill, there can be an accident, or something comes in from left field. We cannot control all these things, so we take the idea of living life as fully as we can, here where we are, making the most of opportunities and our time together. As we mentioned, we like having an open calendar with the freedom to move those little day-squares around. We don’t mind if they are full or empty, but we want to be the ones in charge of them.

What do you love most about spending time in other countries?

REL: The personal freedom. We have found in many of the countries we enjoy visiting, there appears to be more openness, and not so many rules, regulations and restrictions. People seem very friendly, open to engagement, and willing to laugh and smile. Cynicism, suspicion, distrust and personal coldness don’t seem to be the first response to strangers. This appeals to us greatly. Of course, since we are foodies and long-term travelers, we enjoy the cuisines of these foreign countries, and their affordable cost of living as well.

Billy and indigenous family in Panajachel, Guatemala

Billy and Petrona in Panajachel, Guatemala

What’s your favorite type of personal giving and why?

REL: We enjoy personal involvement with a project. Our website is probably our #1 volunteer project, but Billy has helped the local community of Chapala, Mexico by importing an electronic basketball scoreboard for the gymnasium and building two more tennis courts at the Cristiania Park. He has raised money to support local businesses, and he has even coached a women’s basketball team to the city finals which they won! Akaisha taught English as a second language, taught Thai Massage to the locals so they had an alternate source of income, and has employed local women for various artistic projects she finds herself doing. We very much enjoy the interaction and seeing the progress.

What does your community of friends and family look like these days?

REL: Since we travel the world, our personal close community is made up of an eclectic group of geniuses, artists, lawyers, doctors, writers, actors, health care workers, accountants, NASA scientists, world-travelers, entrepreneurs, contractors, restaurant owners, ex-Presidentes of Mexican cities, cantina owners, Techies, engineers, military personnel, teachers, plumbers, craftsmen, maids, chefs, gardeners, taxi drivers, boat captains, indigenous and simple folk. Everyone is unique, and many are self-reliant and financially free. We feel very blessed to hobnob with people of such a wide variety of viewpoints.

In Latin America it’s all about relationships. Here in Chapala we have known people for almost thirty years. These are not just acquaintances but friendships. Many times, when we are in need of a doctor, a health specialist, a plumber, a carpenter or an electrician, they are the ones we go to for advice. We hear their personal stories and we tell them ours. It is very refreshing. These days it’s so much easier to maintain relationships with family and friends while living our lifestyle of travel. We utilize Skype, email, social media, and even our website to stay in touch. Once a year we make a 5-week visit to see close family in the States, and people come and visit us wherever we might be in the world, which is always FUN!

Do you feel like you’ve missed out on anything because of FIRE?

REL: Actually, we have thrived in this financially independent lifestyle. We are both out-of-the-box thinkers and we like it that way. Our world has opened up in ways we could never had imagined when we first started our journey on the other side of conventional living. It has been an amazing ride. Everything in life has a trade-off, and we have made the best choice for us and love it!

Akaisha boogie boarding, Kata Beach, Thailand

Billy in the Dominican Republic

Answer this question you asked us: What is exhilarating beyond words, something you would never trade to obtain “security?”

REL: We are both very freedom oriented. Security is an illusion, and it has a price also. There are no guarantees in Life. Loved ones become ill, earthquakes and fires happen, car accidents or plane crashes seem to come out of the blue. Volcano eruptions can take a whole village down the side of the hills (We know, we lived in Guatemala for 7 years!) Friendships change, and what used to bring pleasure sometimes morphs into something new altogether.

We would rather look at Life as an adventure, an interaction of who we are, what we desire and The Unknown. Our lives are an evolution, unfolding in directions we rarely predict and we enjoy the movement forward and the growth it brings. Everyone is different, of course, but we prefer not hanging on too tightly and thereby getting bashed against the rocks in the Stream of Life. We prefer to go with the flow, and “if it doesn’t fit, we don’t force it.”

That’s not to say we are oblivious to the sometimes pain-full results of unexpected change. But we tend to look at things as though they are opportunities. That is what propels us forward. All of that is the long answer. The short answer is that we would not trade the exhilarating freedom of our lifestyle for anything someone would call security.

Lastly, how can people get in contact with you?

REL: The best way to contact us is by email. We answer every serious inquiry, and if we don’t know the answer, hopefully we can refer your question to someone who does.

Email: TheGuide@RetireEarlyLifestyle.com

Website: https://retireearlylifestyle.com/

Facebook: https://www.facebook.com/RetireEarlyLifestyle

We are not certified financial professionals. This post contains affiliate links. For more information please read our Disclaimer.

They are what I want to be when I grow up!

LikeLiked by 2 people

Us too. Theirs was one of the first “FIRE” and nomad blogs we found. Reading through their story helped us realize we could be FIRE nomads too.

LikeLiked by 1 person

Goodness, contemplating FIRE has me struggling, looks wonderful but I love security AND I know it’s an illusion.

LikeLiked by 1 person

Reaching FIRE and changing your life is such an intensely complicated and emotional process! And scary! It was very intimidating for us to take the plunge. But knowing there were people out there like Billy and Akaisha who were having great success with their early retirement finances definitely gave us more confidence!

LikeLiked by 1 person

Thanks for posting this interview and sharing another great site for learning more about FI and nomad life!

LikeLiked by 2 people

So glad you enjoyed the interview! We learned so much from these guys, including money stuff and travel stuff. And they were also a great example for us of how retiring early really can work out well for people which was a big help for us in dealing with fear of retiring and anxiety about not having enough money.

LikeLike

[…] Talking Money with Billy and Akaisha of Retire Early Lifestyle […]

LikeLike